Adani Wilmar Ltd.'s shares rose after the company signed an agreement with GD Foods Manufacturing India on Tuesday to acquire the owner of household cooking brand Tops.

The acquisition will take place in parts, with 80% of the shares set to be acquired in the first tranche and the rest to be acquired over the next three years. The deal will be funded using internal funds or proceeds from an initial public offering, according to the exchange filing.

The acquisition is in line with Adani Wilmar's vision to cater to the demands of household kitchens and offer a strategic advantage by expanding its portfolio with a broad range of "value-added" food products, it said.

GD Foods is known for products like tomato ketchup, snack sauce, specialty and culinary sauces, jams, pickles, instant mixes and corn; and cooking essentials like vinegar, baking powder, cake mix and corn flour which have been sold under the brand name for over 40 years.

The acquisition is subject to customary closing conditions and is expected to close in two phases, with the first part completing within 60 days.

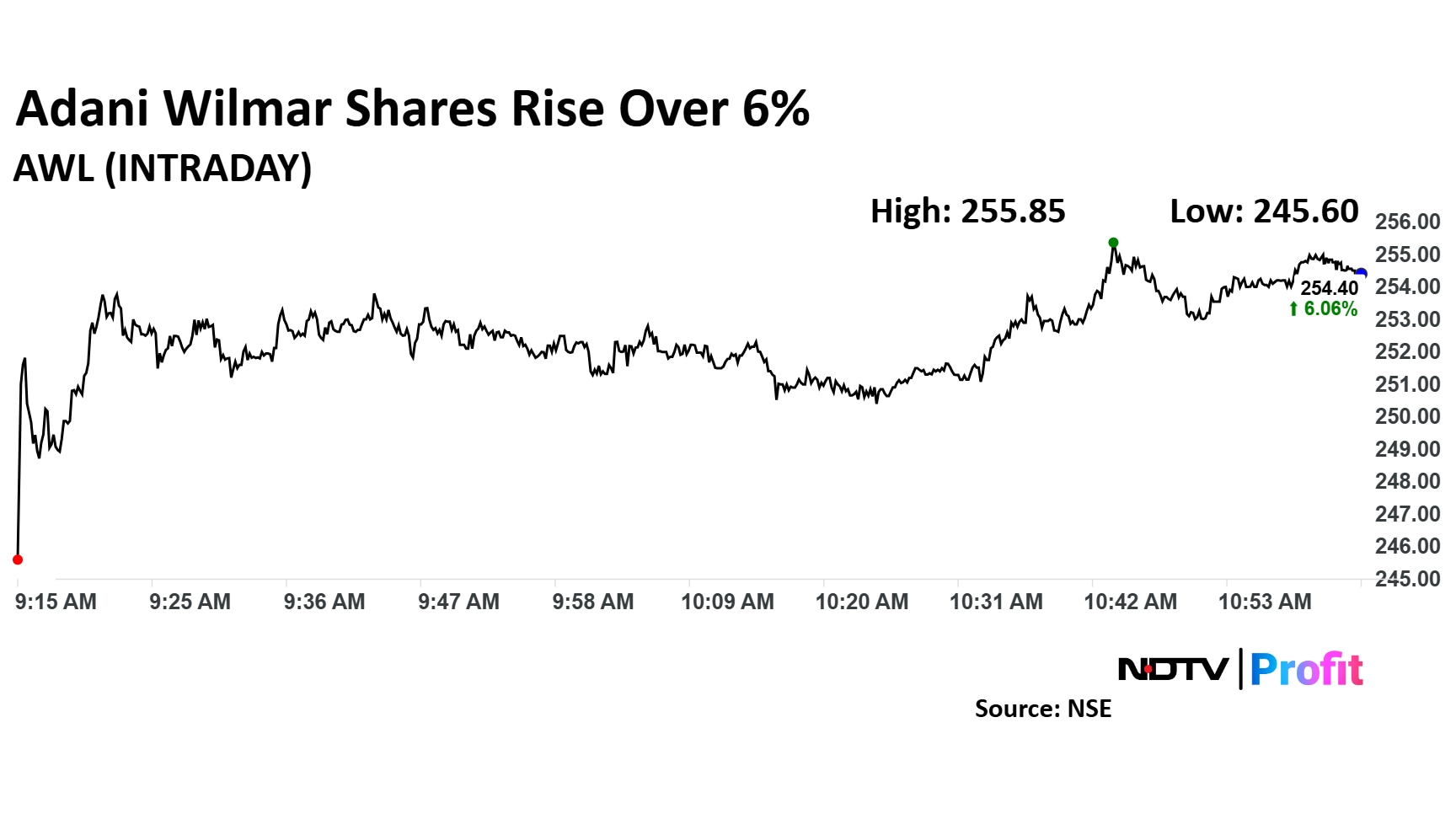

Adani Wilmar Share Price

Adani Wilmar shares rose as much as 6.66% during the day to Rs 255.8 apiece on the NSE. It was trading 4.77% higher at Rs 251.3 apiece, compared to a 0.94% advance in the benchmark Nifty 50 as of 11:01 a.m.

It is down 30.37% in the last 12 months. The total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 61.44.

Four out of the six analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and one suggests a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 334.1, implying an upside of 31.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.