Shares of Adani Wilmar Ltd. recovered from Tuesday's plunge after the billionaire Gautam Adani's flagship announced a $2 billion exit from the joint venture by divesting its entire 44% stake.

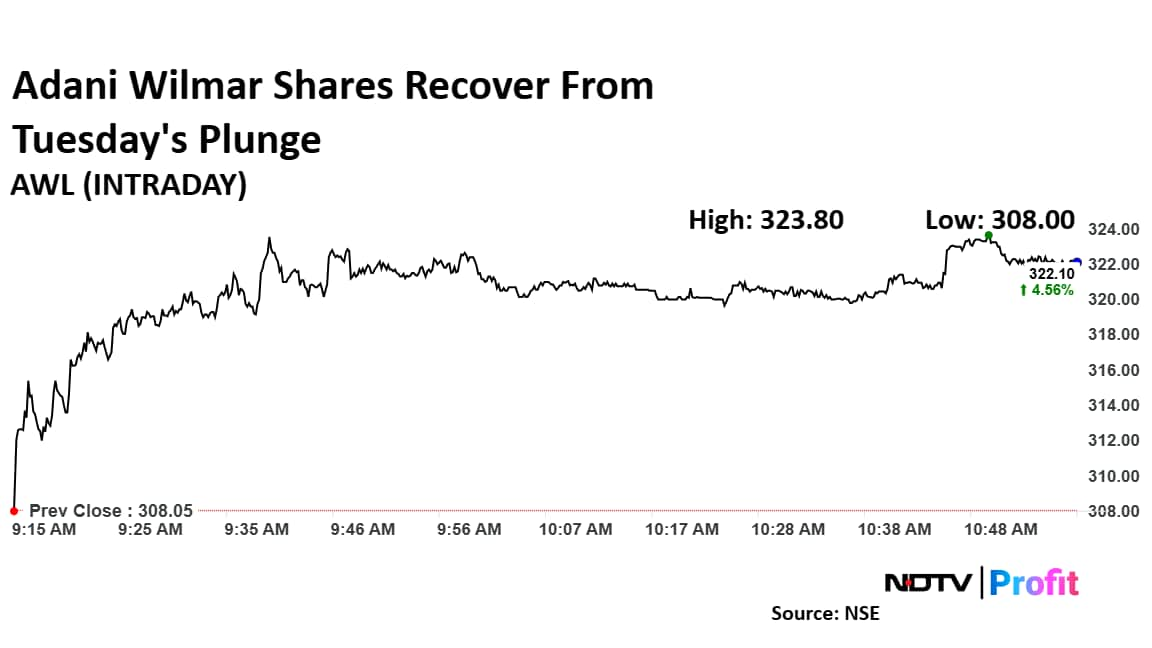

The counter of the Fortune cooking oil maker closed 6.3% lower in the previous session but surged over 5% to recoup most of the losses on Wednesday.

Adani Enterprises Ltd. will divest 13% of its shares in Adani Wilmar to achieve compliance with minimum public shareholding requirements via an offer for sale. In addition, Wilmar International Ltd. has agreed to acquire the 31% stake held by the Adani flagship in the edible oil maker.

The proceeds shall be utilised to turbocharge the growth of the Adani Group flagship in the core infrastructure businesses—energy and utility, transport and logistics, along with primary industry-adjacent businesses, the company said in a press release.

The shares will be sold to Lence at a price that is mutually agreed upon by the parties, provided that such price per share shall not exceed Rs 305, the filing said.

Adani Wilmar's stock rose as much as 5.11% during the day to Rs 323.8 apiece on the NSE. It was trading 4.5% higher at Rs 321.9 apiece, compared to a 0.41% advance in the benchmark Nifty 50 as of 10:56 a.m.

The company's shares have declined 12.3% during the last 12 months. The total traded volume so far in the day stood at two times its 30-day average. The relative strength index was at 54.

Two out of the five analysts tracking the company have a 'buy' rating on the stock, two suggest a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 13.2%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.