Shares of Adani Ports and Special Economic Zone Ltd. rose over 4% on Monday to hit nearly six-month high after the company reported a strong performance for April, with cargo volume increasing 4% year-over-year to 37.5 million metric tons.

Container volume grew 21%, while liquids and gas volume rose 8%, according to an exchange filing on Friday.

The company's logistics rail volume saw a 17% increase to 57,751 TEUs (twenty-foot equivalent unit). Additionally, GPWIS (General Purpose Wagon Investment Scheme) volume grew 4% to 1.8 MMT.

Adani Ports earlier posted a 48% rise in its consolidated net profit to Rs 3,014 crore for the January-March quarter of fiscal 2025, as compared to Rs 2,039 crore in the year-ago period.

The revenue of the Adani Group company was up 23.1% year-on-year to Rs 8,488.44 crore in the January-March period, compared to Rs 6,896.5 crore in the year-ago period.

The company reported a 7% growth of cargo volume in fiscal 2025 at 450 MMT, driven by containers (+20% YoY) and liquids and gas (+9% YoY). All-India cargo market share for the last financial year increased to 27% as compared to 26.5% in financial year 2024. Meanwhile, the container market share for fiscal 2025 increased to 45.5% as compared to 44% in financial year 2024.

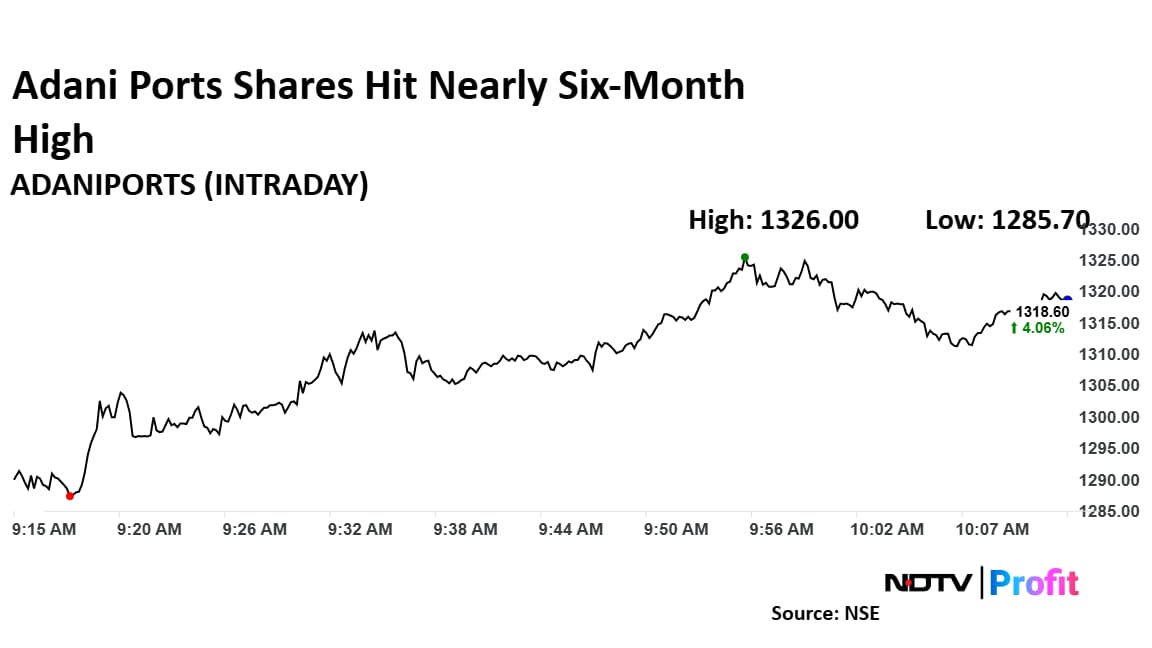

Adani Ports Share Price Rise

The shares of Adani Ports rose as much as 4.65% to Rs 1,326 apiece, the highest level since Nov. 13. The stock pared gains to trade 3.61% higher at Rs 1,312.90 apiece, as of 10:11 a.m. This compares to a 0.52% advance in the NSE Nifty 50 Index.

It has risen 1.79% in the last 12 months and 7.82% year-to-date. Total traded volume so far in the day stood at 4.6 times its 30-day average.

All 19 analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.8%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.