.png?downsize=773:435)

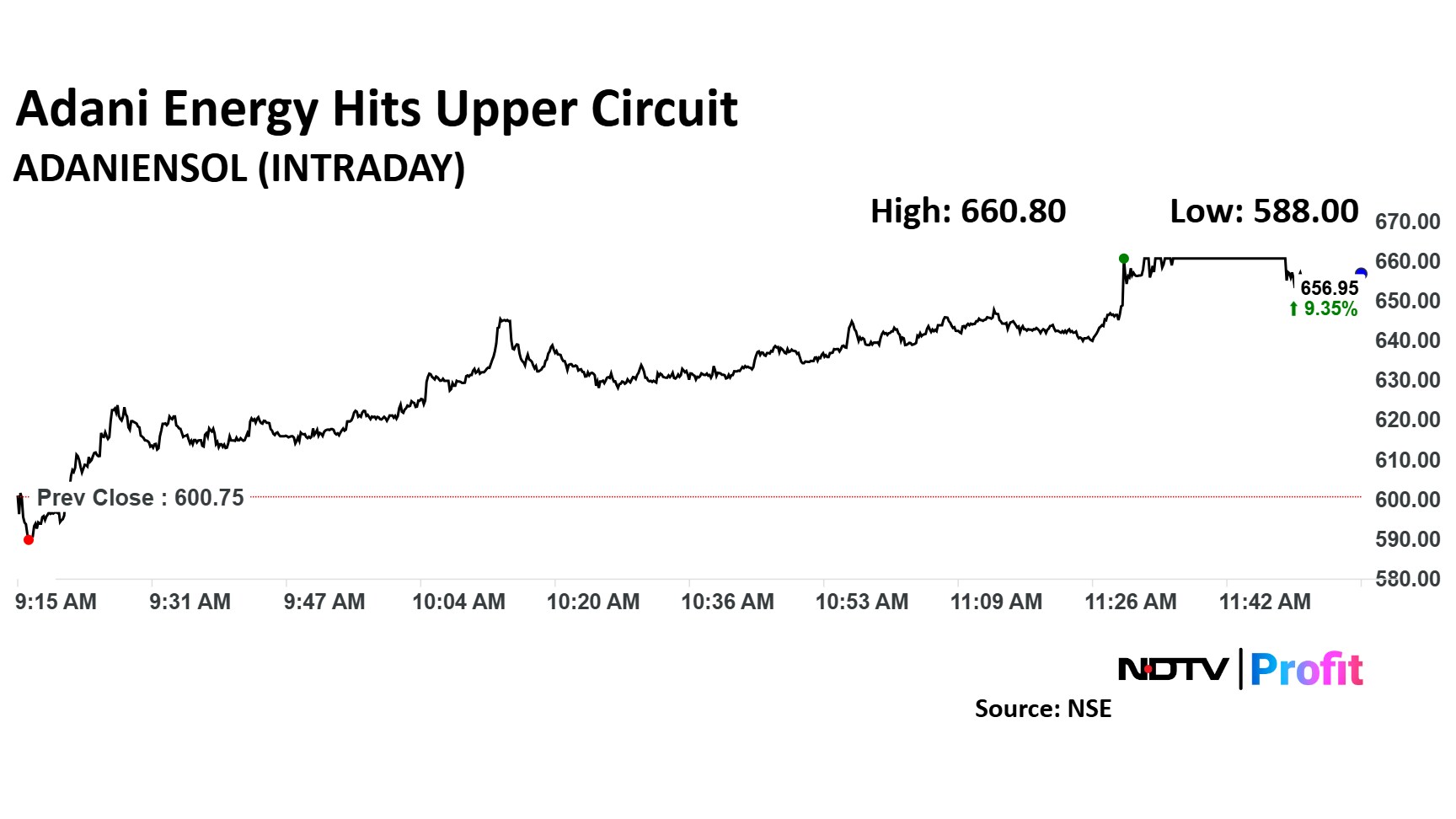

Adani Energy Solutions Ltd. share price surged by 10%, hitting its upper circuit limit by midday on Wednesday. The rally followed a clarification by the company denying media reports that its directors were named in bribery charges in the US under Foreign Corrupt Practices Act.

The clarification, which addressed allegations from the United States Department of Justice and the Securities and Exchange Commission, stated that the charges against Adani Green Energy directors Gautam Adani, Sagar Adani, and Vneet Jaain did not include any FCPA violations.

The clarification has been seen as a significant move to clear the air regarding the allegations, which had raised concerns in the market.

Adani Green's statement reassured investors, emphasising that the directors named in the US legal proceedings were not involved in the charges related to the FCPA, thus removing a major concern that had been swirling in the media. The denial of FCPA violations helped to restore confidence among investors, driving a strong upward movement in the stock of Adani Energy Solutions, a key entity in the Adani Group's energy and infrastructure portfolio.

The scrip rose as much as 10% to Rs 660 apiece. It pared gains to trade 9.13% higher at Rs 655 apiece, as of 12:09 p.m. This compares to a 0.05% advance in the NSE Nifty 50 Index.

It has fallen 24.22% in the last 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 29.5.

Out of 6 analysts tracking the company, all maintain a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 128.4%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.