ABG Shipyard Ltd.'s shareholders rejected its lenders' attempt to initiate strategic debt restructuring process.

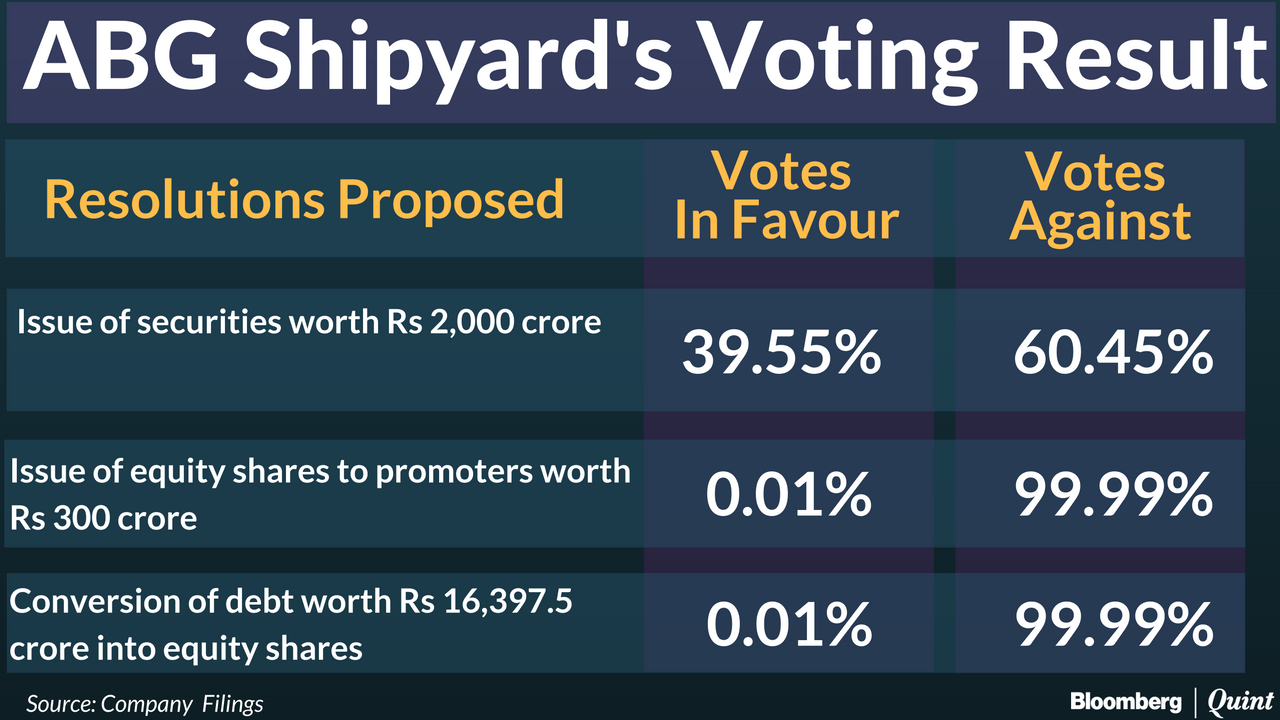

Public shareholders voted against the proposal to convert debt into equity under the strategic debt restructuring scheme, the company said in an exchange filing. Shareholders also voted against two more resolutions which were related to capital infusion by the promoter and through issue of securities.

The lenders had proposed the conversion of all or part of the Rs 16,397.5 crore outstanding debt. The conversion of the entire outstanding debt would have taken lenders' stake in the company to more than 51 percent, giving them a controlling stake.

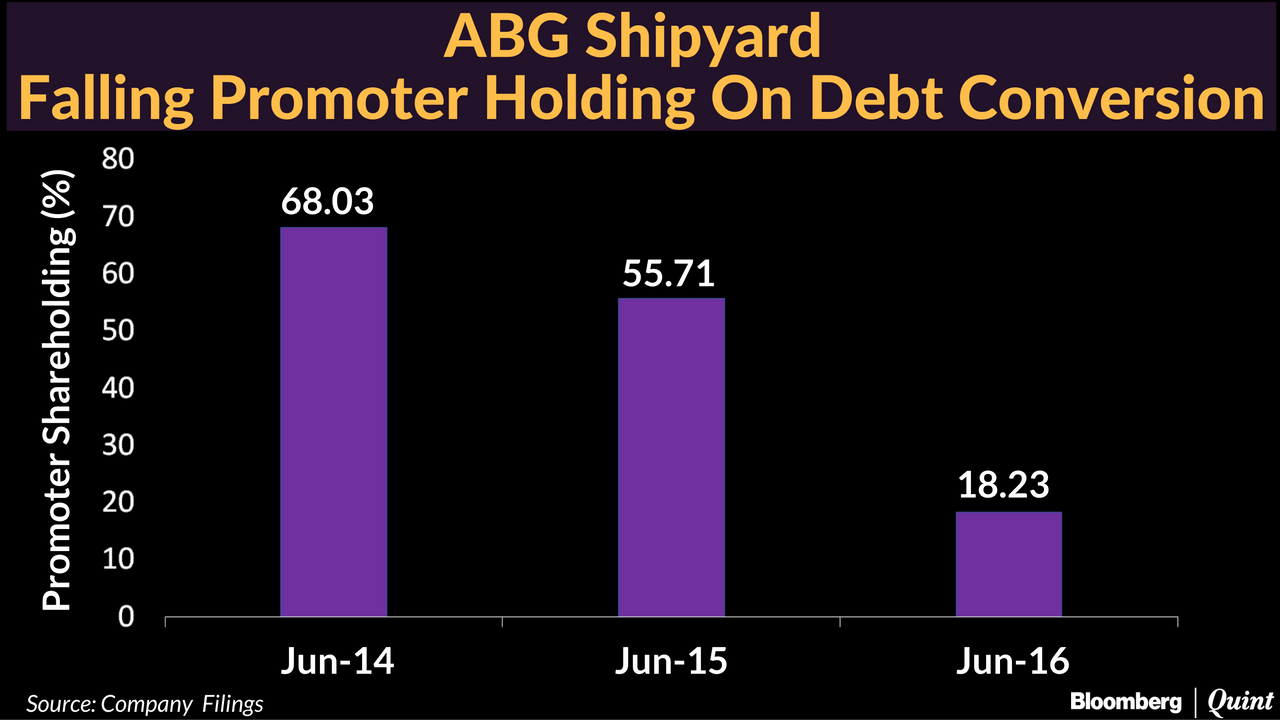

The corporate debt restructuring scheme invoked by 22 lenders led by ICICI Bank Ltd. was approved in March 2014. Since then, promoter shareholding has dwindled from 68.03 percent to 18.23 percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.