Aarti Industries witnessed a significant decline in its share price following the release of its third-quarter earnings report. The company's share price dropped by 6.78% in early trade on Monday, reflecting investor concerns over the disappointing financial performance.

For the third quarter of the fiscal year, Aarti Industries reported a revenue of Rs 1,840 crore, marking a 6.2% increase compared to Rs 1,732 crore in the same period last year. The company's earnings before interest, tax, depreciation, and amortisation saw a 11.2% increase, reaching Rs 231 crore, up from Rs 260 crore in the previous year. However, the Ebitda margin contracted to 12.6% from 15.01%.

The company reported a sharp decline in the net profit, which plummeted by 62.9% to Rs 46 crore, compared to Rs 124 crore in the corresponding quarter of the previous year.

Earlier in the second quarter, Aarti Industries reported a 43% drop in its consolidated net profit, falling short of analysts' expectations. The specialty chemical manufacturer saw its profit decrease to Rs 52 crore in the September quarter, down from Rs 91 crore in the same period last year.

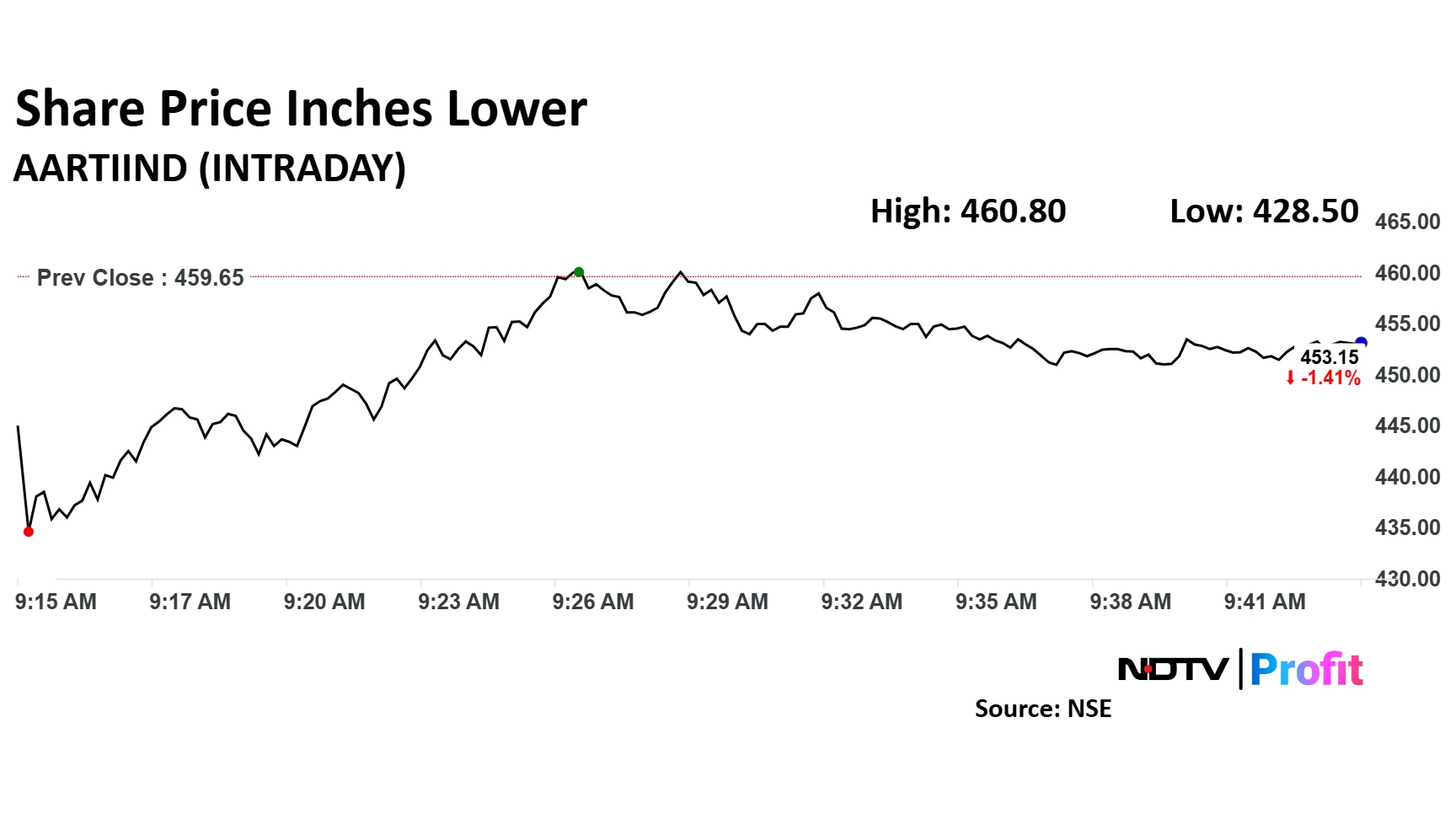

The scrip fell as much as 6.78% to Rs 428.50 apiece. It pared losses to trade 1.65% lower at Rs 459.65 apiece, as of 09:39 a.m. This compares to a 1.02% decline in the NSE Nifty.

It has fallen 29.68% in the last 12 months. Total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 57.

Out of 24 analysts tracking the company, nine maintain a 'buy' rating, three recommend a 'hold,' and 12 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.