The Rupee has remained largely stable at Rs 65.17 against the U.S. dollar on Thursday, despite better macroeconomic data, amid growing concerns of faster Fed rate hikes this year. The weekly change was much starker though with the Indian currency depreciating by 44 paise against the greenback. It has weakened by 160 paise last month.

The country's foreign exchange reserves fell $1.13 billion to $420.6 billion in the week to Feb. 23, according to data released by the RBI. The reserves had touched a life-time high of $421.9 billion on Feb. 9.

On the global front, the dollar fell against most currencies on Friday, dropping to its lowest in more than two years against the Japanese Yen. The U.S. President Donald Trump's proposal to impose higher import duty on steel and aluminium imports raised prospects of a trade war.

Friday's sell-off came just as the dollar had risen to multi-week highs amid strong data and an upbeat view on the economy from Federal Reserve Chairman Jerome Powell, which reinforced expectations of three or more interest rate hikes this year.

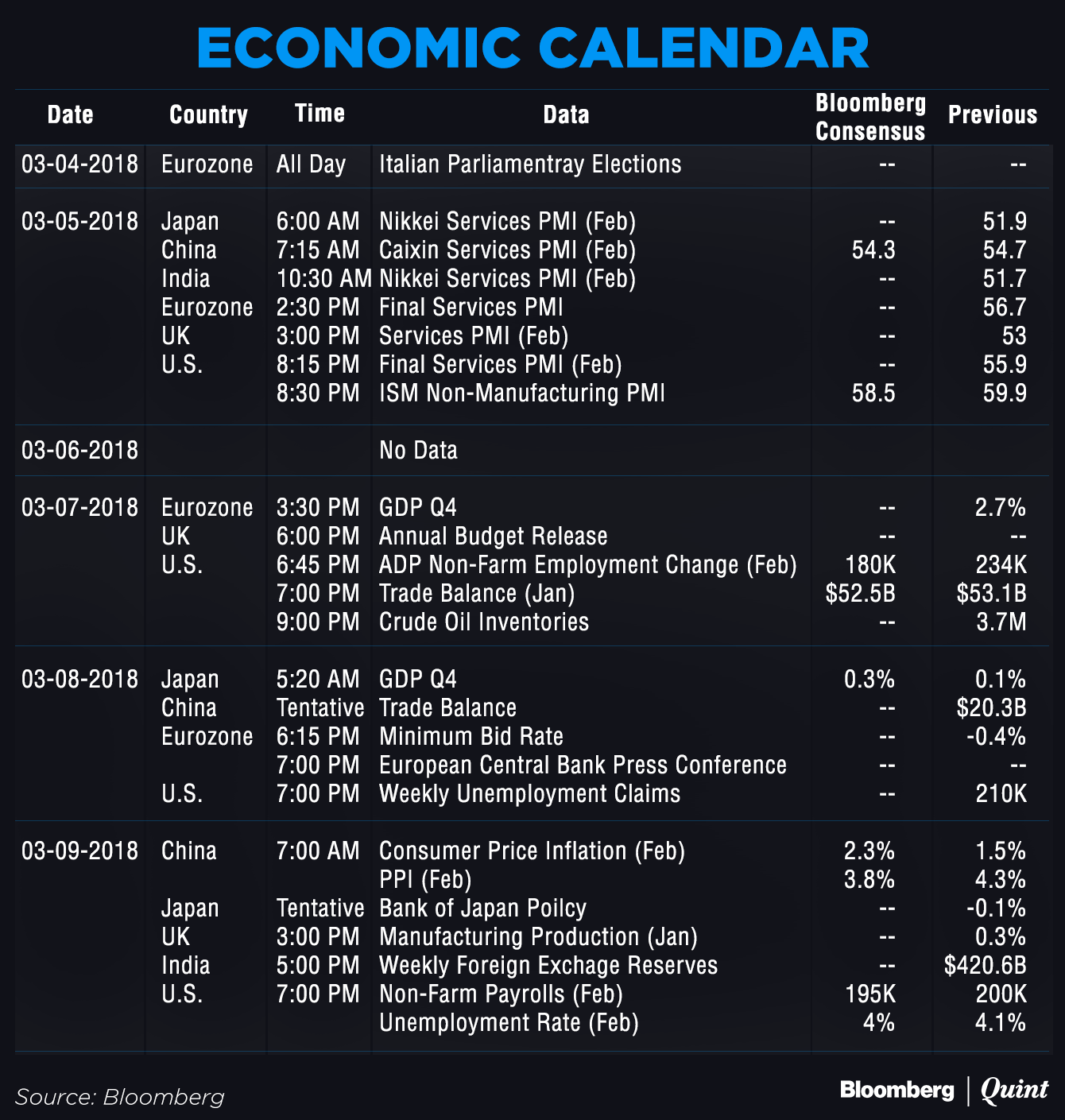

In the week ahead, traders will turn their attention to a slew of central bank policies along with key Services PMI data to gauge the level of activity in the major economies. A reading above 50 indicates expansion, while a reading below 50 indicates contraction in the economy. Investors will also focus on the U.S. jobs report for February due next week.

Following events are likely to affect the currencies markets:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.