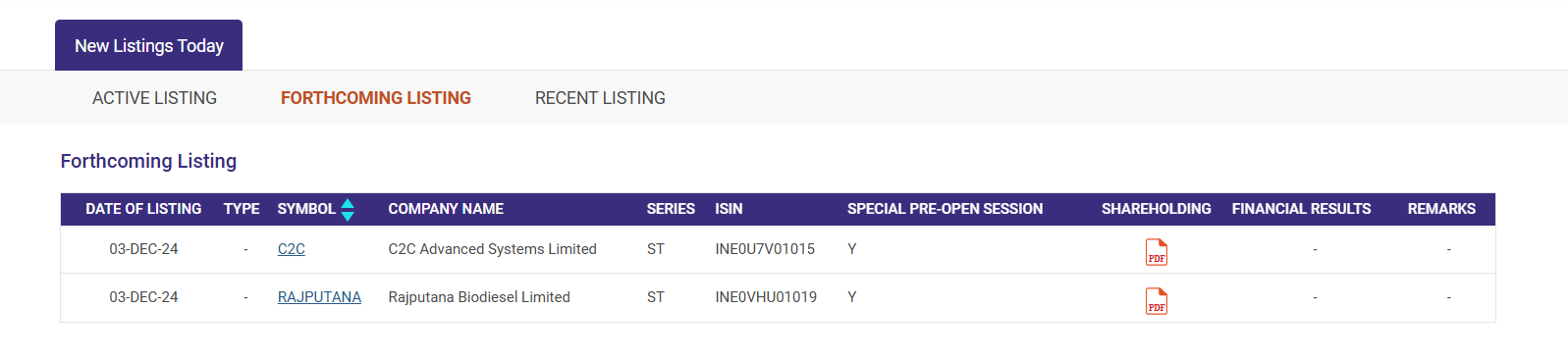

The shares of C2C Advanced Systems will list on NSE Emerge SME platform on Tuesday, Dec. 3.

The allotment for C2C Advanced Systems IPO was finalised on Monday, December 2. This came after multiple delays due to a directive from SEBI asking the company to appoint an independent auditor and file an independent report on its financials.

Additionally, the regulator asked the National Stock Exchange (NSE) to set up a monitoring agency to oversee the utilisation of funds raised through the IPO. C2C Advanced Systems provided IPO investors, including from the anchor portion, the option to withdraw their bids for shares before the allocation.

The SEBI action led to a massive withdrawal of applications, with over 3.72 lakh applications withdrawn. Retail investors accounted for the bulk of the exits, with 3.57 lakh applications. The withdrawal window, originally scheduled to close on Nov. 28, was extended by a day.

Image: nseindia.com

C2C Advanced Systems IPO GMP Today

The GMP (grey market premium) of C2C Advanced Systems IPO was Rs 240 per share on Tuesdday, indicating a strong listing over the upper limit of the price band. The GMP suggests a listing price of Rs 466 per share compared to the IPO price of Rs 226 per share, as per the InvestorGain website.

With a listing gain of around 106%, the GMP reached close to an all-time of Rs 245 which was seen during the first few days when the issue opened for bidding. The GMP of C2C Advanced Systems IPO had seen a sharp fall (to Rs 120) after the SEBI action. However, after the conclusion of the bidding process, the GMP has shown an upward trend.

Note: GMP or grey market price is not an official price quote for the stock and is based on speculation.

C2C Advanced Systems: Investor Interest

The IPO was subscribed 125.42 times on the final day of bidding, with investors applying for 36,56,00,400 shares against the 29,14,800 shares on offer. The Qualified Institutional Buyers (QIBs) subscribed their quota 31.61 times by applying for 2,63,25,000 shares as compared to 8,32,800 shares on offer. The Non-Institutional Investors (NIIs) submitted bids for 14,58,30,600 shares against the 6,24,600 shares on offer, subscribing their quota by 233.48 times.

The retail portion of the IPO was subscribed 132.73 times. The retail investors applied for 19,34,44,800 shares as compared to 14,57,400 on offer.

About C2C Advanced Systems

The company aims to raise Rs 99.1 crore through its initial public offering, which comprises only a fresh issuance of 43.8 lakh shares. C2C Advanced Systems IPO price band was fixed at Rs 214 to Rs 226 per share.

New Delhi-based C2C Advanced Systems Ltd., is a vertically integrated defence electronics solutions provider catering to the indigenously developed defence products industry in India. Formerly known as C2C – DB Systems Private Limited, the company was incorporated in 2018

Disclaimer: Investments in initial public offerings are subject to market risks. Please consult with financial advisors and read red herring prospectus thoroughly before placing bids.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.