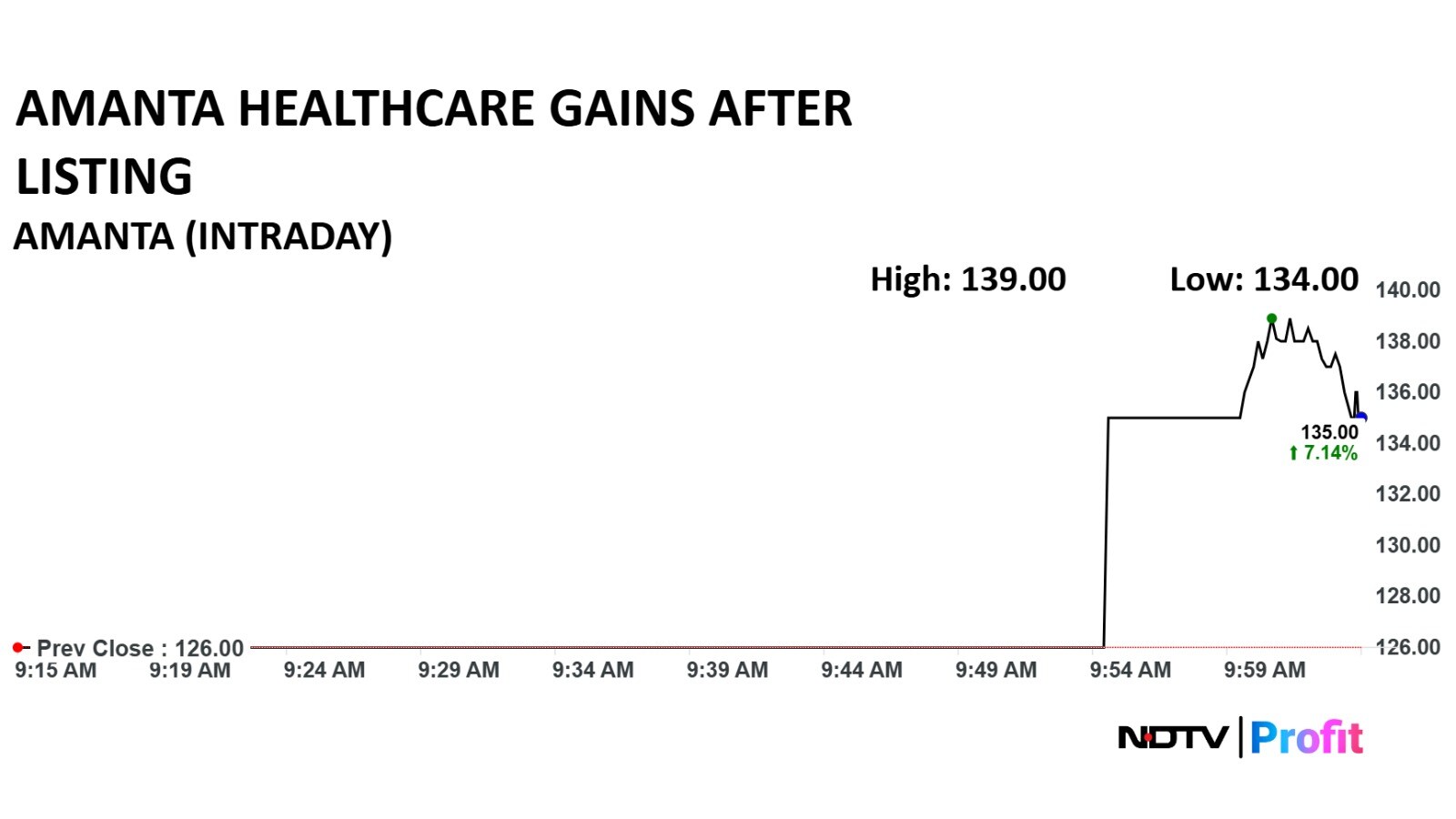

- Amanta Healthcare shares opened at Rs 135 on NSE and Rs 134 on BSE against Rs 126 IPO price

- The IPO was subscribed 86 times overall, with retail investors subscribing 54.98 times

- Rs 70 crore from IPO proceeds will fund new manufacturing line at Hariyala, Kheda, Gujarat

Amanta Healthcare Ltd. shares saw single-digit gains in their stock market debut on Tuesday. Shares of the pharmaceutical company opened at Rs 135 apiece on the NSE and Rs 134 on the BSE. The IPO price was Rs 126.

The initial pubic offering was a book-built issue worth Rs 126 crore, comprising entirely a fresh issuance of 1 crore shares. The mainboard IPO was open for subscription from Sept 1 to Sept 3.

The IPO was subscribed 86 times on the final day. Retail investors subscribed the issue 54.98 times. The Qualified Institutional Buyers (QIBs) subscribed their category 35.86 times, while the Non-Institutional Investors' (NIIs) segment was booked 209.42 times.

Overall, Amanta Healthcare IPO received bids for 57.81 crore shares against 70 lakh shares on offer.

The proceeds from the IPO will be primarily used for funding capital expenditure. An estimated Rs 70 crore will be allocated for civil construction and purchase of equipment, plant and machinery for establishing a new manufacturing line of SteriPort at Hariyala, Kheda, Gujarat.

Additionally, around Rs 30 crore will be used for setting up a new SVP manufacturing line at the same location. The remaining funds will be utilised for general corporate purposes.

Amanta Healthcare IPO GMP

Ahead of the listing, the grey market premium (GMP) for the Amanta Healthcare IPO was Rs 9 apiece as of 7:00 a.m. on Sept. 9. Compared to the upper end of the IPO price band of Rs 126 per share, the latest GMP indicated a potential listing gain of 7.14%.

Note: GMP is not an official source of data and is based on speculation. GMP data sourced from InvestorGain.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.