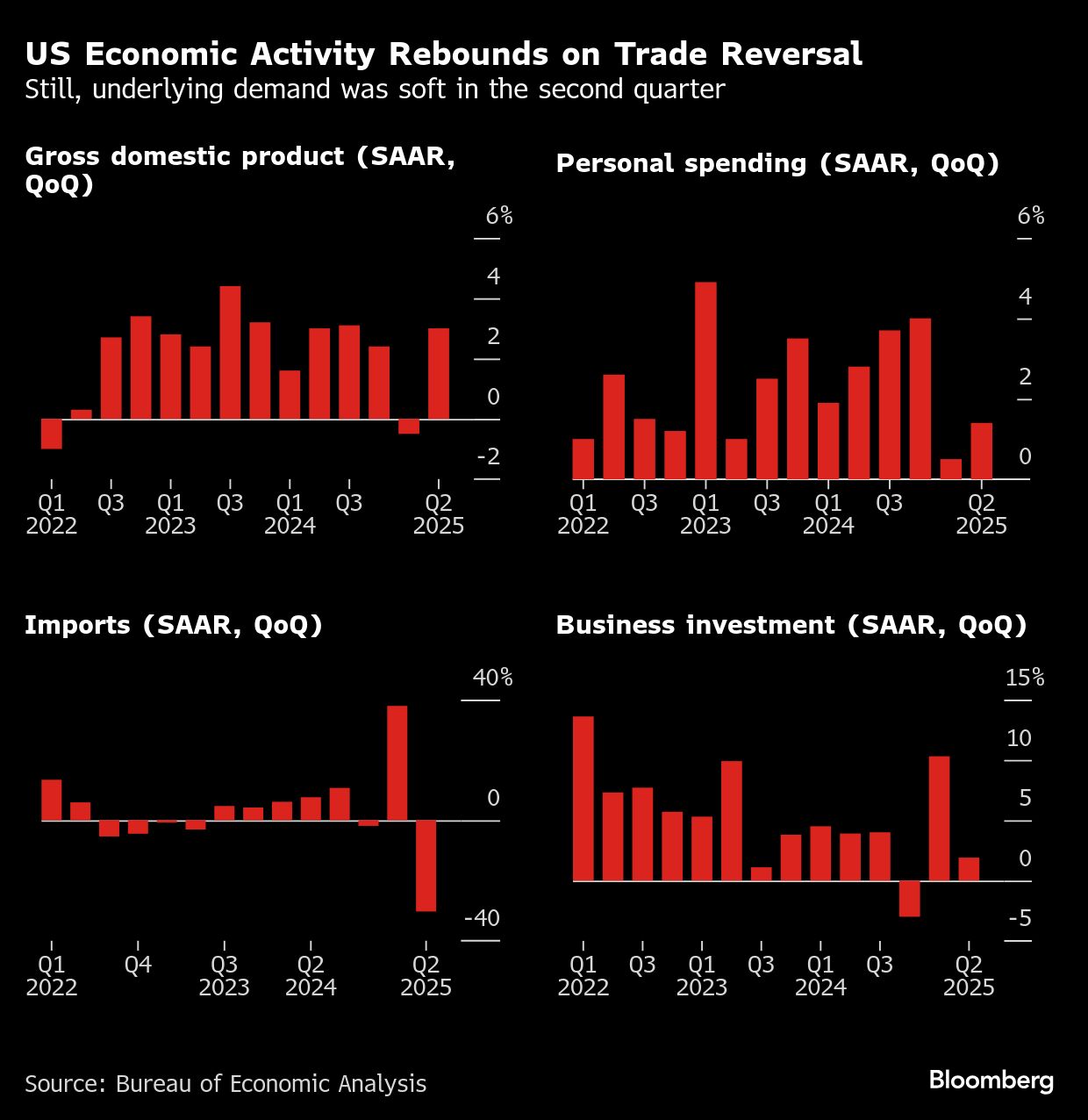

US economic activity rebounded in the second quarter on a modest pickup in consumer spending and a marked drop in imports after a scramble to secure foreign goods earlier in the year.

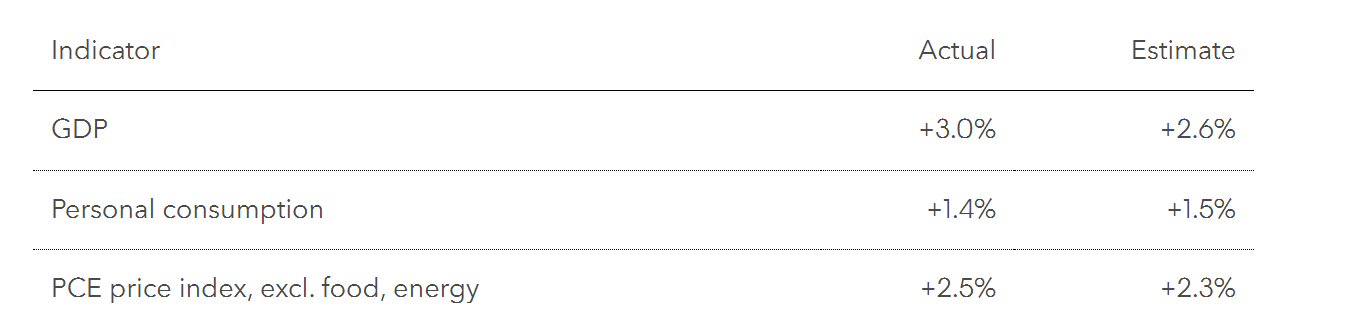

Inflation-adjusted gross domestic product, which measures the value of goods and services produced in the US, increased an annualized 3% after shrinking at a 0.5% rate in the previous period, according to preliminary government data out Wednesday.

Net exports added 5 percentage points to GDP after subtracting the most on record in the first three months of the year, the Bureau of Economic Analysis report showed. Goods and services that aren't produced in the US are subtracted from the GDP calculation but counted when consumed.

Beyond the recent tariff-related swings, second-quarter economic activity was more moderate. Consumer spending — which accounts for two-thirds of GDP — advanced 1.4%, marking the tamest growth in consecutive quarters since the pandemic. Business investment growth cooled.

The government's initial snapshot of second-quarter economic activity is the first of three high-profile data releases this week that include monthly updates on consumer spending, inflation and the job market. As Federal Reserve policymakers wrap up their two-day meeting this afternoon, the GDP report suggests underlying demand is softening.

Because swings in trade and inventories have been distorting overall GDP this year, economists have been paying even more attention to final sales to private domestic purchasers, a narrower metric of demand. This measure rose at a 1.2% pace in the second quarter, the slowest since the end of 2022.

Stocks opened little changed, while Treasury yields and the dollar rose. Just before the report, President Donald Trump announced the US would impose 25% tariffs on India.

Trump hailed the GDP number in a social media post as “WAY BETTER THAN EXPECTED” and renewed his call for Fed Chair Jerome Powell and his colleagues to lower interest rates. Officials are widely expected to keep borrowing costs unchanged for now.

There are signs the policy uncertainty is starting to lift, which has given a boost to the stock market and helped support consumer sentiment. The administration has managed to strike trade deals with key partners including the European Union and Japan, even as others face a Friday deadline to reach trade agreements with the US or risk bigger increases in import duties.

Consumer spending was driven by a rebound in purchases of durable goods, namely cars. Demand for services also picked up somewhat. Widespread uncertainty contributed to the weakest advance in spending since 2020 at the start of the year.

What Bloomberg Economics Says...

“The reading obscures a slowdown in components that provide a cleaner signal of demand. Final sales to private domestic purchasers cooled — signaling economic activity was softening even without tariff costs being fully passed through to consumers.”

— Eliza Winger, economist

To read the full note, click here

As investors look beyond the machinations in trade policy, some companies are hopeful consumers will also adjust and underpin demand. Chipotle Mexican Grill Inc. and United Airlines Holdings Inc. noted on earnings calls that they have seen spending improve alongside consumer sentiment.

“While tariffs are not yet certain, I think the market and most businesses have a much better read on how they'll manage in a narrower range of outcomes,” United Chief Executive Officer Scott Kirby said during the company's earnings call on July 17. “And encouragingly, that higher level of certainty has translated into a meaningful inflection point in demand.”

Meanwhile, the GDP report showed non-residential fixed investment, which includes business spending on equipment and facilities, increased at a 1.9% annual rate after surging in the first quarter by the most in three years. Outlays for computer equipment added 0.3 point to GDP, marking the biggest back-to-back increases since 2000.

Earlier this month, Trump signed his budget bill into law, which made 2017 tax cuts permanent with incentives for business investment.

A separate report Wednesday showed companies stepped up hiring in July after a sharp pullback in the previous month, though the pace remained consistent with weaker labor demand. Private-sector payrolls increased by 104,000, according to ADP Research data.

Weakness in the housing market remains a dark cloud over the economy as the industry and potential homebuyers desperately seek cheaper borrowing costs. The GDP data showed residential investment declined an annualized 4.6%, the weakest pace since 2022.

Pending US sales of previously owned homes dropped 0.8% in June, dragged down by declines in the Midwest, South and West, a report from by the National Association of Realtors showed Thursday. Economists anticipated an increase.

Another hit to GDP came from business inventories. The change in stockpiles subtracted 3.17 percentage points from growth, the most since 2020. The reversal in net exports after business front-loading at the start of the year resulted in a pullback in inventories in the second quarter.

Federal government outlays declined for a second quarter, led by the biggest retreat in spending excluding defense since 2021 and consistent with the Trump administration's goal of downsizing the federal government.

The BEA report showed the Fed's preferred measure of underlying inflation rose 2.5% in the second quarter, a deceleration from earlier in the year. Detailed figures on inflation and spending for June are due Thursday and expected to show a slight pickup in underlying price pressure as some of the import duties are passed through to consumers.

The extent of the impact Trump's policies will have on inflation is currently the main point of contention among Fed officials. Some policymakers expect tariffs to result in one-time adjustment to price levels, while others are concerned that it could prove more extensive.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.