Asian stocks started the week on a cautious note as traders navigate deteriorating China-Japan relations, a heavy slate of central bank decisions and the broader outlook for risk assets heading into next year.

MSCI Inc.'s gauge of Asian equities fell 0.1%, in line with the decline in US stock index futures. Shares in Australia also dropped while the Nikkei 225 lost 0.4%. Japan's economy shrank in the three months through September, the government confirmed in a revised report, while the nation's relations with China cooled further.

The subdued tone in markets reflected increasing investor caution over the durability of this year's AI-driven rally, with global equities hovering near October's record highs. Markets were also bracing for policy announcements from central banks spanning Australia to Brazil and the US, just as renewed inflation pressures prompt a reassessment of next year's monetary outlook.

While the Federal Reserve is still likely to cut interest rates on Wednesday, “the rate path for 2026 is more uncertain as members balance lingering price pressures from tariffs, a cooling labor market, the likely pick-up in economic activity in the coming months,” Barclays strategists including Andrea Kiguel wrote in a note to clients. “We think 2026 is likely to be a year of prolonged holds, though markets could try to add hike premiums if inflation momentum persists.”

Japan-China relations and assets in both countries are a focus in Asia after a Chinese fighter aircraft over the weekend, trained fire-control radar on Japanese military jets for the first time.

Traders will also be keeping a close eye on Chinese trade data for November to help gauge the health of the economy and the impact from modest US tariff relief. Trade Representative Jamieson Greer at the weekend said China has been complying with the terms of the bilateral trade agreements so far.

Meanwhile, French President Emmanuel Macron warned that the European Union may be forced to take “strong measures” against China, including potential tariffs, if Beijing fails to address its widening trade imbalance with the bloc.

In commodities, gold edged higher as China's central bank added to its reserves for a 13th straight month in November. Oil was steady after settling above $60 a barrel on Friday, signaling that a risk premium persists as a peace deal between Russia and Ukraine remains elusive.

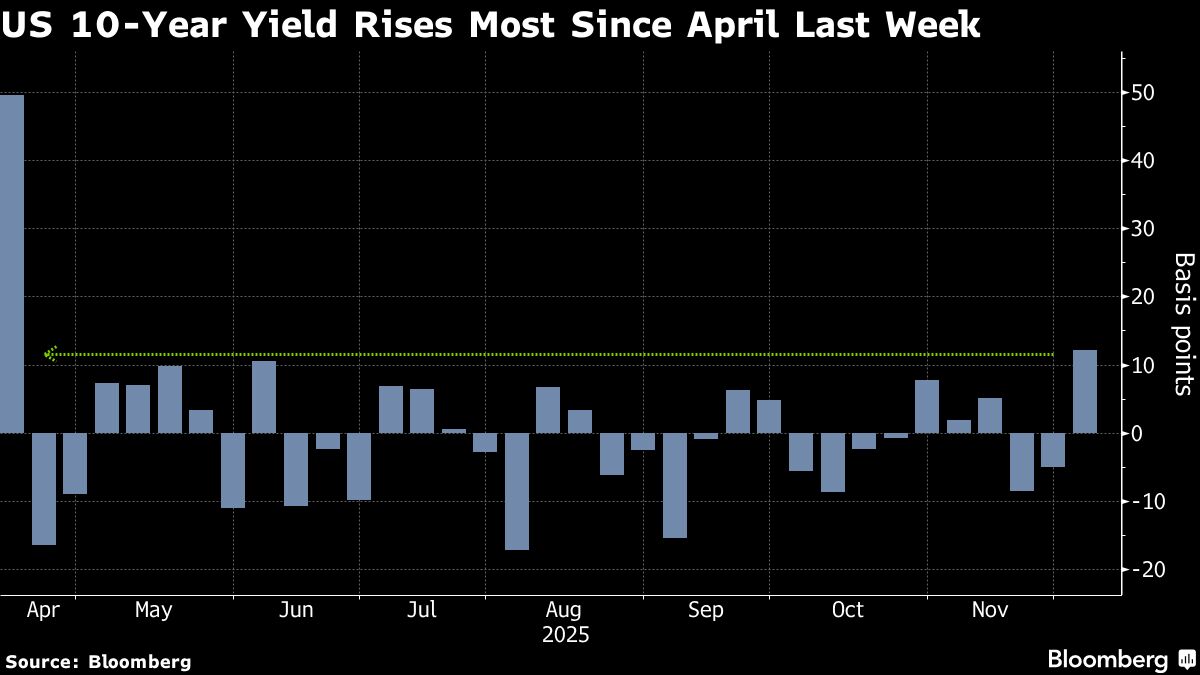

On Friday, the S&P 500 Index rose 0.2% to inch closer to a record high as a dated reading of the Fed's preferred inflation gauge met expectations. Treasuries declined, pushing the 10-year yield up four basis points to 4.14% and closing out their worst week since April, after conflicting economic data cast fresh uncertainty on the scale of potential Fed rate cuts next year.

Treasury yields may extend their rise, possibly toward 4.5%, on the back of impending fiscal boost from President Donald Trump's earlier spending bills, strong growth and “the broader reflationary momentum now ripping through global long-end bond yields,” Tony Sycamore, an analyst at IG Markets in Sydney, wrote in a note. “While we think this is likely more of a story for 2026, a rise of this magnitude could impact equities if it unfolds rapidly.”

This week's auctions of three-, 10- and 30-year government debt are slated to begin Monday, a day earlier than usual to avoid coinciding with the Dec. 10 Fed announcements. Australia is set to reopen a bond line maturing in 2054 just as the 10-year yield hits the highest since Nov. 2023.

The US continues to clear the data backlog with the delayed JOLTS reports scheduled for release. Weekly jobless claims and the employment cost index are also due. Besides the Fed rate decision, economists expect the Bank of Canada, Swiss National Bank and Reserve Bank of Australia will leave their respective policy rates on hold this week.

Corporate News

US lawmakers released annual defense authorization legislation that backs almost $901 billion in discretionary spending for national security programs and seeks to restrict American investments in sensitive Chinese industries.

Brookfield Asset Management Ltd. and Singapore's GIC Pte agreed to a binding deal with National Storage REIT to buy the Sydney-listed firm for around A$4 billion ($2.7 billion).

Qatar Airways Group named Hamad Ali Al‑Khater as its new group chief executive officer in a surprise shakeup, succeeding Badr Mohammed Al-Meer after just two years in the post.

An outage that took down markets operated by CME Group Inc. for more than 10 hours at the end of last week was caused by human error at a data center owned by CyrusOne.

Indian regulators held IndiGo's chief executive accountable for the severe disruptions that have roiled the country's biggest airline in recent days, faulting the company for “significant lapses in planning, oversight, and resource management.”

Eli Lilly & Co., Pfizer Inc. and Johnson & Johnson secured spots on China's first innovative drug catalog, opening a new market channel and boosting sales prospects for costly, cutting-edge treatments.

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:17 a.m. Tokyo time

Hang Seng futures were little changed

Japan's Topix was little changed

Australia's S&P/ASX 200 fell 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was unchanged at $1.1642

The Japanese yen was little changed at 155.22 per dollar

The offshore yuan was little changed at 7.0690 per dollar

The Australian dollar was little changed at $0.6637

Cryptocurrencies

Bitcoin fell 0.2% to $90,077.67

Ether fell 1.2% to $3,048.17

Bonds

The yield on 10-year Treasuries was little changed at 4.13%

Japan's 10-year yield advanced 1.5 basis points to 1.950%

Australia's 10-year yield advanced three basis points to 4.72%

Commodities

West Texas Intermediate crude rose 0.1% to $60.15 a barrel

Spot gold rose 0.2% to $4,204.84 an ounce

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.