Public and private companies contribute nearly two-thirds of the goods and services tax despite accounting for less than a tenth of the taxpayer base in India.

They contributed 63% of total GST revenues while they comprised 6.5% of the total taxpayers in the first three years of the GST that subsumed a web of state and central levies, according to the data disclosed by the Goods and Services Tax Network.

Public limited companies are the biggest contributors followed by private limited firms. Proprietorship firms, accounting for more than 80% of the taxpayer base, paid just 13.3% to the total GST collected, the data show.

Which means large taxpayers continue to pay bulk of the indirect tax. India's gross GST collection for the year ended March stood at Rs 12.22 lakh crore.

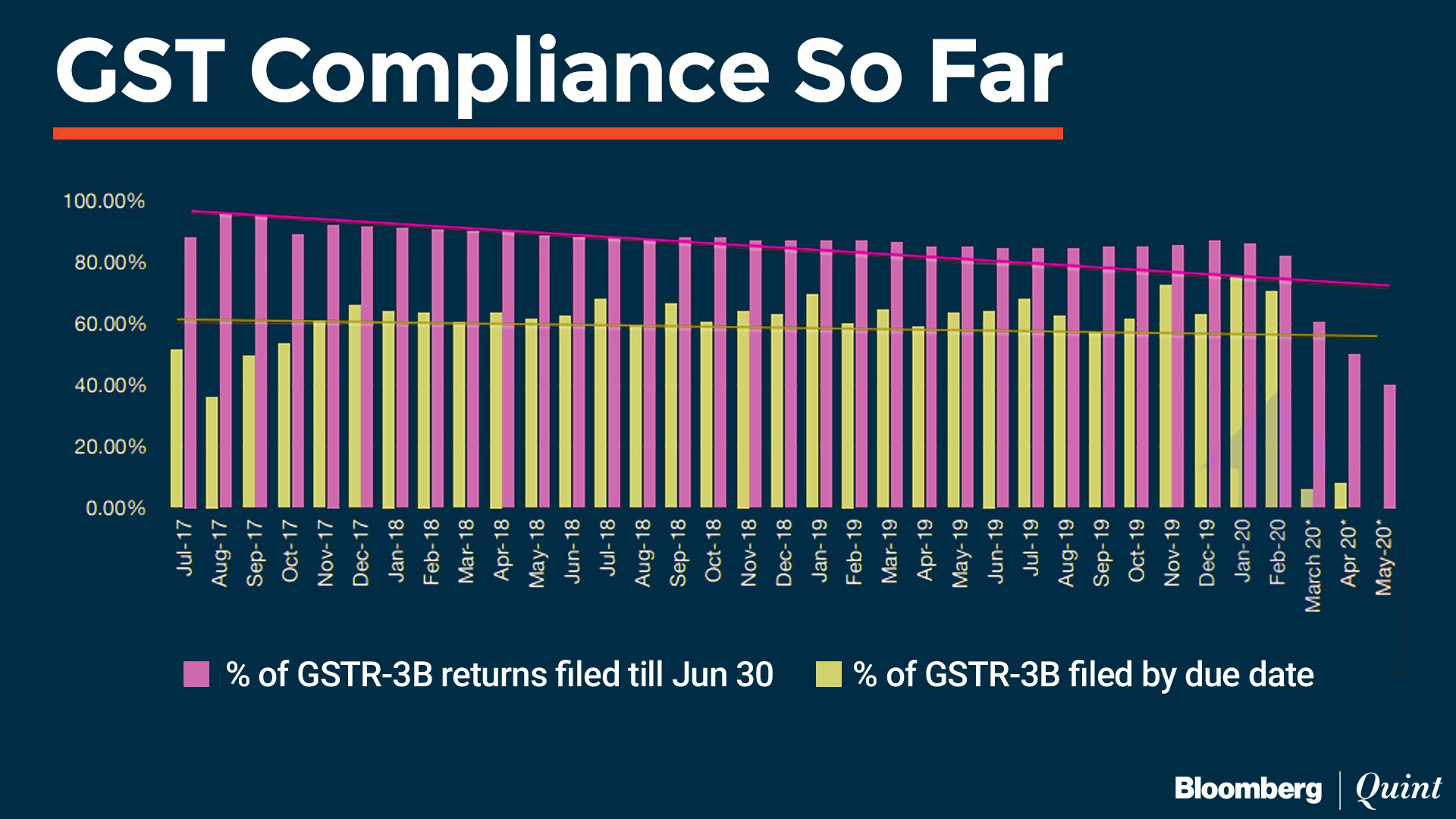

Only 40% of the eligible taxpayers filed monthly summary of GSTR-3B returns for May. About 50% and 60% filed for April and March as on June 30. That came as India extended payment deadlines after the nation imposed the world's strictest lockdown to curb the Covid-19 outbreak.

Earlier this month, the government disclosed that Rs 32,294 crore was collected for March, and Rs 62,009 crore for April. The collections increased to Rs 90,917 crore for May. It didn't specify if the tax due for previous months spilled over to May as deadlines were extended after the lockdown.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.