The announcement of a trade deal between India and the USA after nearly a year of negotiations has seen a collective sigh of relief across Indian markets, industry and policy watchers. The salute to the hard-fought deal was apparent when the Nifty opened 1,220 points and nearly 5% in the green at 26,306; almost forgetting the pain of an increased securities transaction tax on F&O trade handed down just 48 hours earlier.

Here are the key reasons why this deal is such a big deal, even before we know the fine print.

It is an end to a long, sometimes frustrating process of negotiations and has brought back the India-US relationship back to a place of strength.

For equity investors, the lack of a deal was the biggest worry. While India's macroeconomic indicators are steady, corporate earnings are improving and Government policy is supportive, markets kept flailing. One of the biggest factors was constant selling by FPI. Foreign investors have sold over Rs 1.24 lakh crore since the last budget and a lot of these exits have been spurred by the lack of a deal. With a deal on the table, there is no reason for foreign investors to not look at India favourably again.

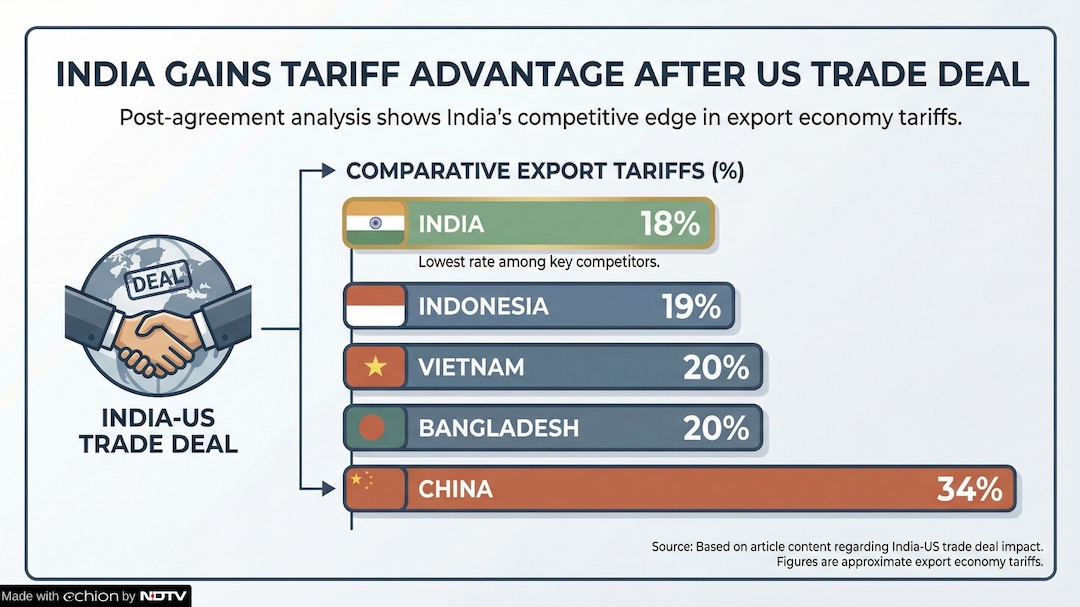

The drop in tariffs from 50% to 18% comes into effect immediately. Exporters told NDTV Profit that calls from buyers began as early as late Monday night once President Trump announced the deal . More importantly at an 18% tariff India is better placed than the neighbourhood, including Vietnam, Bangladesh, China.

The Flip Side

What we now need to see are the details. While a concession on Russian crude should not hurt too much eventually, the question will be on to what extent India has opened up it's agricultural sector and what will we spend the $500 bn on in US investments. The other risk factor, if any is US President Trump changing his mind and moving back on the terms agreed. But the hope is, a deal that has taken so long to freeze will stand the test of geopolitical turbulence.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.