Goods and Services Tax collections for April fell month-on-month but stayed above the average mop-up after the e-way bill launch.

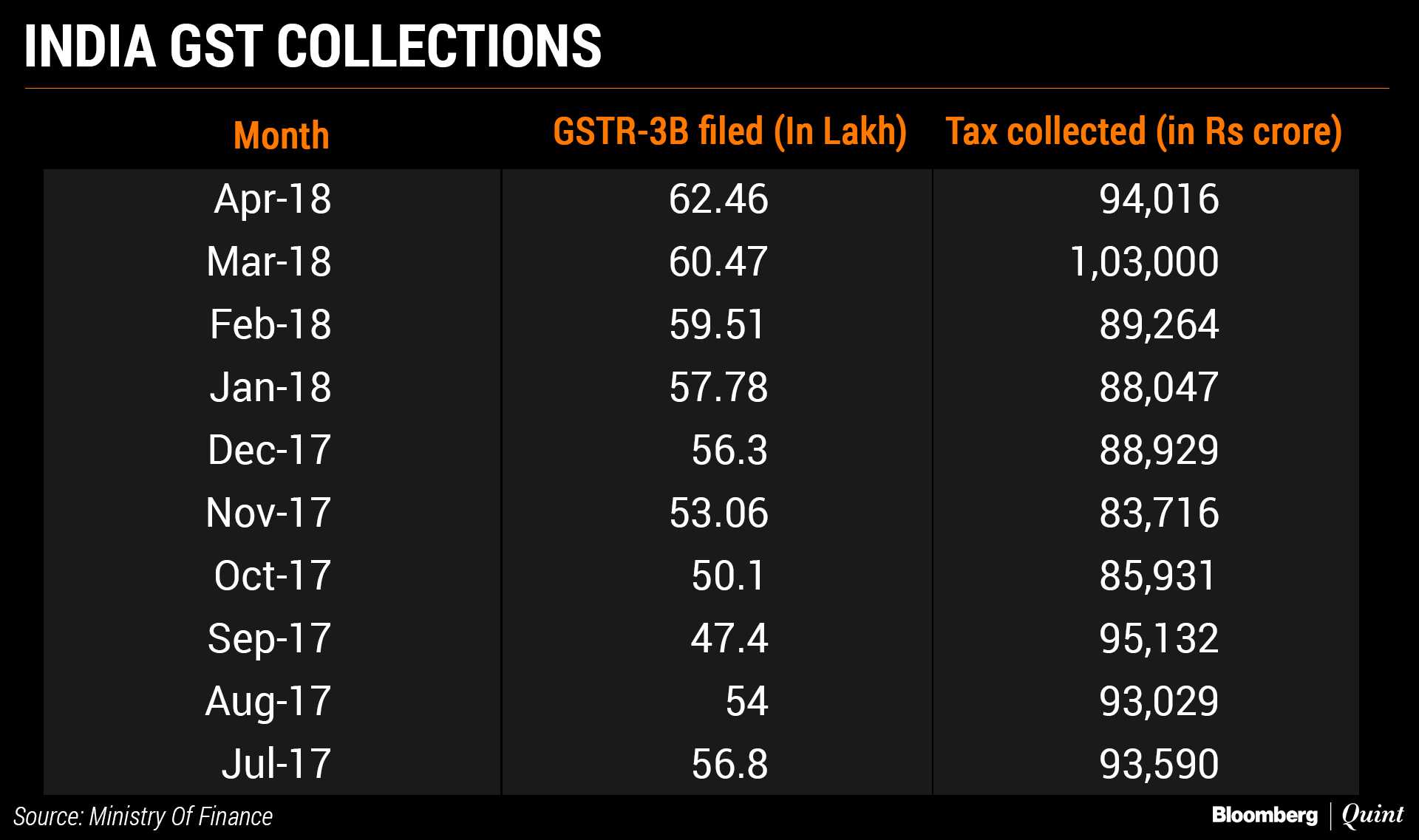

The total gross revenue collected in May (paid for the month of April) stood at Rs 94,016 crore, the finance ministry said in a press release. That's lower than Rs 1 lakh crore in April (for the month of March) but higher than the average of Rs 89,885 crore a month in 2017-18.

Compliance increased during the month after the e-way bill launch, Finance Secretary Hasmukh Adhia said in a tweet. A total of 62.46 lakh GSTR-3B returns were filed for the month of April, as on May 31, compared with 60.47 lakh returns for March, as on April 30. The last day for paying GST for April was May 20. The government releases the tax collection figure on the first day of the succeeding month.

Introduction of e-way bills could be one possible reason for the increased revenue collection, Abhishek Jain, indirect tax partner at EY India told BloombergQuint. The introduction of other anti-evasion measures including intra-state credit matching could further increase the revenue in coming months, he added.

Revenue from GST in April (paid for the month of March) was Rs 1.03 lakh crore which the government attributed to the economic recovery, and improvement in compliances. The higher number should not be taken as a trend, the finance ministry added as a caveat, since it could be partly due to the payment of tax arrears in the last month of the previous financial year.

The higher than average tax collection is a “positive surprise”, according to a report by Japanese brokerage firm Nomura. That's because, seasonally, tax collections for the month of April are significantly lower than those for the month of March. “This increases our confidence that the government's budgeted FY19 GST target (of Rs 7.4 lakh crore) will be met,” authors Sonal Varma and Aurodeep Nandi said in the report.

Goods and Service Tax collection break-up:

- Central GST: Rs 15,866 crore

- State GST: Rs 21,691 crore

- Integrated GST: Rs 49,120 crore

- Compensation Cess: Rs 7,339 crore

After settlement of IGST between states and the centre, CGST collected was Rs 28,797 crore while SGST was Rs 34,020 crore. That's because of the utilisation of IGST credit for paying GST on inter-state business-to-consumer transactions where the consuming state gets its share in the IGST.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.