We're just three days away from the Union Budget 2026, and the Economic Survey sets the tone for Feb. 1. It offers a detailed snapshot of the thought process, and of where India stands financially before new policy decisions are announced.

Here, NDTV Profit cuts through the clutter, and take you through the importance of the survey.

Here are the key highlights.

The live blog session has concluded.

"As India navigates its journey to become a Global AI leader, government's focus on promoting safe, secure, and home-grown AI innovation, particularly in the financial sector where trust and data security is needed. Government projections indicate that AI may contribute as much as $1.7 trillion to India's economy by 2035, with banking and financial services being some of the primary sectors reaping the rewards of its integration,'' said Vishal Maru, Global Processing Head, Financial Software and Systems (FSS).

''Although approximately 87% of Indian businesses utilize AI in various capacities, merely 26% have reached maturity at scale, underscoring a disparity between adoption and innovation. AI plays a crucial role in India's digital financial system, aiding in real-time fraud detection, risk assessment, and providing conversational support; however, most foundational models and platforms are externally sourced rather than focused on India,'' added Maru.

''The Economic Survey introduces two interesting phrases that presents the core of the fleeting economic snapshot that India currently faces. These terms are 'strategic sobriety' and 'running the sprint and marathon' at the same time. There is an honest assessment in the survey of the achievements of the government and also the course corrections that the Government has done that is termed as an 'entrepreneurial state' i.e. learning and agile policy making,'' said Ranen Banerjee, Partner and Leader Economic Advisory, PwC India.

''The survey points to a contained inflation from supply side efficiencies being achieved through progressive logistical improvements from high capex. It presents the risk to exchange rates owing to negative capital flows. It also raises the issue of high cost of capital in India that makes businesses less competitive owing to higher deficits, especially at the state level,'' added Banerjee.

''The Economic Survey 2025–26 reinforces a defining reality: India’s growth trajectory is now inseparable from its global trade ambition. The nation is moving beyond the narrative of self-reliance toward becoming strategically indispensable in global value chains. With manufacturing strength, high-technology competitiveness driven by PLI, and world-leading Digital Public Infrastructure as a foundation of trust and efficiency, India is emerging as a future-ready hub for global commerce,'' said Sunil Kharbanda, Co founder and COO at Trezix.

''What makes this moment even more transformational is India’s accelerating adoption of AI positioning technology, talent, and data as new pillars of productivity and trade advantage. Backed by growing confidence in Free Trade Agreements and deeper international partnerships, India is no longer just integrating into the world economy it is preparing to shape the next era of AI-enabled global trade,'' added Kharbanda.

CEA Nageswaran believes the progress report for state-level deregulation reforms has been good. The 7% GDP growth is compatible with 8% dollar-GDP growth. The 7% growth rate doesn't depend on tariffs or trade negotiations. ''If a deal happens, it bolsters our chance to do better,'' said CEA Nageswaran while addressing the press conference.

-Need a state that accepts failures, encourages risk-taking. Need a state that accepts failures, encourages risk-taking

-IT simplification, GST 2.0, relaxation of QCOs, replacement of MNREGA, labour code, bidding for highway DPRs among policy reforms in 2025

-IT simplification, GST 2.0, relaxation of QCOs, replacement of MNREGA, labour code, bidding for highway DPRs among policy reforms in 2025

CEA on India's inverse duty structure:

-Indian rupee has done well since 2000, in ballpark since Covid with other emerging economies

-For currency strength, need to raise manufacturing strength

-Services plays secondary role in exports, goods remain primary for currency strength

-Manufacturing and export surplus will lead to lower cost of capital

-Indigenisation, strategic resilience and indispensability pillars of atmanirbharta

-Inverse duty structure, deregulation, cross-subsidisation needed to achieve independence

CEA on policy indigenisation and deregulation:

-Self-sufficiency in base metals, crude oil etc essential

-Need to build buffers since supply can be affected anytime

-Imports will rise as per capital income grows

-Need to export, attract capital to pay for rising imports

-No matter how successful indigenisation is, imports will go up

CEA Nageswaran states the three global scenarios for 2026-27:

- Business as usual but with more fragility (40-45% probability)

- Disorderly multipolar breakdown, weaponised trade (40-45% chance)

- Systemic shock cascade (10-20% chance)

Need to work on civic order by citizens, said CEA. ''Consequences such as trade wards, geopolitical risks will be with us for the next 5-7 years. Uncertainty index at decadal highs due to geopolitical tensions. Gold is responding to global uncertainty,'' he said.

CEA on Swadeshi policy:

-Era of easy money from 2008 has resulted in high valuation of financial markets

-Rising concentration of wealth posing risks in markets

-Trade, markets no longer neutral

-Swadeshi is a legitimate policy instrument in today's environment

-The country shouldn't be squeamish about swadeshi policy, he added.

According to CEA Nageswaran, data centre resource consumption, financial requirement for AI development, data localisation, access to chips, dependence on foreign models among structural challenges for India's AI journey. India committed to net-zero by 2030, added CEA Nageswaran.

-Scaling renewable energy requires scaling of minerals, capacity, logistics, energy inputs. Low floor space index, floor area ratio incentivise urban sprawl. Gaps in segregation, processing waste is still a challenge, as per CEA. Traffic is also a challenge for urbanisation, he added.

V. Anantha Nageswaran, Chief Economic Advisor, outlines the key highlights of the Economic Survey 2026.

— NDTV Profit (@NDTVProfitIndia) January 29, 2026

Here are some of the major takeaways: pic.twitter.com/oDVW1BfxoW

CEA on demographic dividend:

-Indian obesity a major issue for reaping demographic dividend

-Ultra-processed foods consumption leading cause of obesity

-UPF marketing often includes explicit overconsumption encouragement

-Cheap data mixed blessing because compulsive scrolling is linked to anxiety

-Happy that Andhra Pradesh considering U-16 ban on social media

-Need to fix this if India wants to achieve long-term growth aspirations

-Employers still value soft skills, even in AI-era

-Youth can be driven to areas like eldercare, nursing, culinary arts, environmental restoration, early and special needs education

-These fields must be made more attractive than they currently are, said CEA Nageswaran.

CEA on sector-specific growth:

-Agriculture, manufacturing, services need to fire together

-Livestock, fishing growth at 6%

-Need to rebalance fertiliser consumption

-Crop diversification has to be encouraged through policies

CEA on fiscal prudence in states:

-Opportunity cost for investing abroad is higher, that shows up in currency

-Centre has successfully incentivised states to maintain capex at 2.4% of GDP

-Unconditional fiscal transfers have a short-term role

-Sustaining growth however, will require careful reprioritisation

-Fiscal indiscipline by states casts shadow on sovereign borrowing costs

-States must walk on path of fiscal prudence, said CEA Nageswaran

CEA Nageswaran on macro growth:

-Survey projects balanced outlook for FY27 at 6.8%-7.2%

-Confident that we'll be able to maintain this growth under new base year

-Developments in India's external account reflect impact of rise in global uncertainty

-India's net FDI on weaker side due to profit taking, compulsion that Indian businesses face to invest overseas

-Net FDI numbers not where we would like them to be, but not alarming

-Uncertainty caused by tariffs leading to net portfolio investment being contained

-Rupee has weakened 6-7% against the dollar in the past year

CEA on India's infrastructural growth:

-Operational high-speed corridors have risen 10x in 11 years

-Growth of inland water transport has risen at 21% CAGR which is very impressive

-Steep decline in data costs, perhaps we're the cheapest and this is a mixed blessing

-Broadband subscribers have gone up

-Application approval time down 90% for centralised Right of Way portal

CEA Nageswaran said India's macroeconomic fundamentals are supported by physical infra improvements. Banning of online gaming matters for mental health, he added.

-Reading, numerical solving ability doing well, still progress to be made, said CEA.

-Enrolment problem largely fixed by India, now we're looking at improving outcomes

-Unemployment rate is down from 6% to 3.2% in FY24, said CEA Nageswaran

-Female labour force participation up 18% in 6-7 years, he added.

CEA on resource mobilisation:

-Flow of resources to households, businesses expanding at healthy pace

-Ample resources in ecosystem for growth

-Resource mobilisation augurs well for investment, capital formation

Economic Survey 2025-26 | Chief Economic Advisor says,India's growth has accelerated along with lower inflation.#UnionBudget2026

— NDTV Profit (@NDTVProfitIndia) January 29, 2026

Read live updates here: https://t.co/wjDUzSO9mN pic.twitter.com/fUCizWa8rJ

-CEA Nageswaran highlighted that India's forex reserve has doubled in 11 years. External debt to GDP is also down about 4% in 11 years, he added.

-India about to deliver fiscal deficit promise of going down to half since Covid

-Sustained revenue buoyancy, broadening of tax base helping public finance

-India got three credit rating upgrades -- Morningstar, S&P and R&I

CEA Nageswaran on inflation:

-Inflation softens to all time low in FY26 (up to Dec. 2025)

-Core inflation also well behaved

-Inflation excluding gold and silver behaving well

-Expect the soft outlook to continue in FY27

CEA Nageswaran on Eco Survey:

-India an oasis of stability in turbulent world

-India's growth stands out against any other part of world

-India's growth has accelerated along with lower inflation

CEA on Eco Survey:

-Survey covers importance of manufacturing, exports in India's growth

-Unpredictable, dangerous uncertainties in a difficult global environment

-Growth momentum is sustained by domestic drivers

Chief Economic Advisor Dr. V. Anantha Nageswaran to address press conference on Economic Survey 2026 at 2:30 pm.

JUST IN: The Finance Minister will respond to the budget discussion in the Lok Sabha on February 11 and in the Rajya Sabha on February 12, 2026.

India needs to monitor the core inflation trajectory, as per the Economic Survey. The long-term capital markets must be strengthened while the corporate bond market shallow, illiquid, led by the top-rated issuers. The rice and wheat procurement grows faster compared to the food security needs. While the securitisation is limited and the municipal bonds are underdeveloped, but the government is on track to meet FY26 fiscal deficit target of 4.4% of GDP, as per the Survey.

The Economic Survey 2025–26, penned by V Anantha Nageswaran, Chief Economic Advisor to the Government of India, strikes a confident tone on India's growth prospects but has also delivered a clear message of caution: the global environment is entering a phase of heightened fragility where geopolitical tensions, tariff wars, leveraged AI investments and shifting capital flows could trigger sudden, cascading shocks. From global uncertainty to capital outflows, here are the top 10 warnings highlighted in Economic Survey 2026.

While India posts robust domestic fundamentals, the Economic Survey has warned that multiple challenges could complicate the road ahead. The economy, it says, must brace for a world that is "less coordinated, more risk‑averse, and vulnerable to non‑linear shocks".

— NDTV Profit (@NDTVProfitIndia) January 29, 2026

Here are 10… pic.twitter.com/kzFVk9piNe

''The Economic Survey 2025-26 strikes a caution tone while projecting FY27 real GDP growth at 6.8–7.2%, which is supportive for BFSI through steady domestic demand and credit appetite. For financial markets and lenders, the Survey’s messaging is also constructive on macro stability and inflation with headline inflation expected to stay within the 4% (±2%) band and RBI’s FY27 inflation path around ~4% in H1—helping anchor rates, spreads and asset-quality assumptions,'' said Anil Rego-Founder and Fund Manager at Right Horizons PMS.

''Importantly, it reiterates a reform-led framework highlighting measures such as income-tax/GST relief, a simplified direct-tax law from April, and tweaks to FDI and bankruptcy frameworks, alongside a renewed push for systematic deregulation/EoDB 2.0—all of which should aid formalisation, intermediation and long-term savings. However, the Survey’s emphasis on a tougher global environment and external shocks implies BFSI leaders should remain focused on liquidity, cost of funds, and risk controls, especially amid potentially volatile capital flows and currency sentiment,'' added Rego.

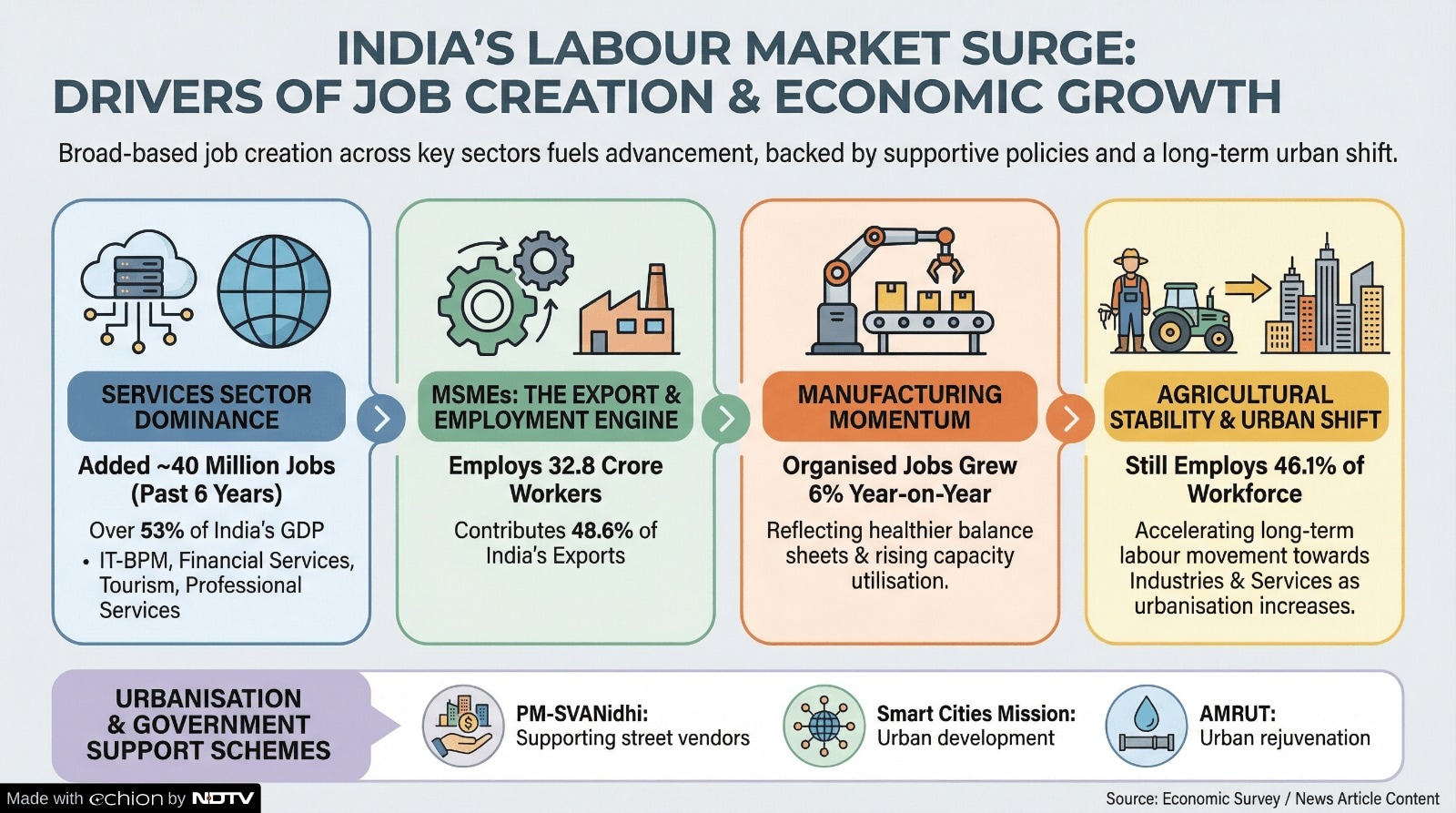

India's labour market is showing clear signs of strengthening with unemployment declining and workforce participation rising, according to the Economic Survey 2025-26 tabled on Thursday. The Survey also highlights that employment conditions have improved steadily through FY26, mostly supported by structural reforms, rising formalisation of the sector, and stronger economic activity. READ FULL STORY HERE

Eco Survey

The economic survey highlighted that that a robust, stable currency only possible via the export competitiveness. India must separate farmer income support from the fertiliser purchase. The financial regulators must walk tightrope to balance growth and stability. The survey said that the inflation outlook is benign and supported by supply-side conditions as well as pass through of GST cuts. The regulators must balance capital flows, insulate economy from shocks.

The Economic Survey highlighted that more secondary market liquidity will help in better price SDLs. The farm supply prospects will strengthen farm incomes and rural demand. The government is expected to remain on consolidation trajectory. States' debt, deficit trend underline is needed for fiscal calibration. The country needs to anchor fertiliser decisions in soil, crop requirements, as per the Survey.

With the Union Budget just around the corner, the Ministry of Finance has released the Economic Survey for 2025/26, in which it has issued a warning on 'highly-leveraged' AI infrastructure, which, upon failing, could have a cascading effect on global markets, potentially leading to an economic crisis worse than the 2008 Financial Crisis.

The survey, which has highlighted three potential market scenarios that could play out globally in 2026, has given a 10-20% possibility of a systemic shock where financial, technological and geopolitical stresses could amplify each other and have a cascading effect.

READ FULL STORY HERE

The Survey said high-frequency data for Q3 shows a healthy investment activity. It needs a holistic roadmap balancing energy security and food security. The climate action is a core component of India development strategy. Trade deals with US, others will support India's export momentum, as per the Survey. The energy security objectives must not compromise the food security, it added.

India's economy is set to grow 7.4% in FY26, reaffirming its position as the world's fastest‑growing major economy, even as the global economy grapples with heightened uncertainty, geopolitical fragmentation and financial market volatility, the Economic Survey 2025–26 said.

The Survey, tabled in Parliament on Thursday, paints a picture of strong domestic momentum, resilient macroeconomic fundamentals, and a cautiously optimistic outlook for FY27. It also marks what the Economic Survey calls "India's strongest macroeconomic performance in decades." READ FULL STORY HERE

Farmers are growing ethanol-related grains over pulses, oilseeds. India disbursed Rs 836 billion as capex loans to states till Jan. 4, 2026. The document said tensions can emerge between Aatmanirbharta in energy, food. India needs to retain more fiscal policy freedom in the current global setup. The Centre must ensure government incentives don't favour one crop over others. The new FRBM aim may be considered at end of 16th finance panel period . The demand is buoyant on GST cuts and softer inflation, as per the Survey.

The Economic Survey highlighted that the sustained tax reform will bolster revenues and cut extra borrow need. The economic policy must focus on supply stability and buffer creation. The policy must focus on route and payment system diversification and cultivating strategic indispensability, as per the Survey.

India's Economic Survey said that the country must build "strategic indispensability" as it heads into FY27, with global trade and capital flows now shaped by tariffs and economic statecraft. The survey projects real gross domestic product growth of 6.8% to 7.2% in FY27, and puts FY26 growth at 7.4% in the First Advance Estimates, with domestic demand driving activity.

India's macro position remains strong, it said, adding that, howver, the external setting has changed. India's performance "has collided with a global system that no longer rewards macroeconomic success with currency stability, capital inflows, or strategic insulation," Chief Economic Adviser V Anantha Nageswaran wrote. READ FULL STORY HERE

#EconomicSurvey2026 flags stronger growth outlook, raises GDP forecast, and flags global risks.

— NDTV Profit (@NDTVProfitIndia) January 29, 2026

Focus on tariffs, external headwinds, and a changing base year as key watchpoints ahead of #UnionBudget2026.@Shrimichoudhary with more key highlights. pic.twitter.com/QPfz6bFyWx

According to the Eco Survey, the next phase of GST reforms can focus on e-way bill system. However, the investor reluctance to commit to India warrants examination. The document highlighted that the government sees steady economic growth and needs caution, not pessimism. Centre can get more receipts from equity sale in some PSUs and contains interest costs via active debt management going forward.

The economic survey said ''it does not hurt to have undervalued rupee amid US tariffs'. The global risks are manageable however, the country must keep buffers. The domestic demand underpins the FY26 economic growth. The balance of risks around growth are broadly even, it added.

The Eco Survey said India's demand remains resilient and private investment intentions are improving. The CPI base year revision will impact the inflation assessment. The rupee valuation is not accurately showing India's economic fundamentals. The CPI base year revision warrants a careful study of price dynamics.

Union Finance Minister Nirmala Sitharaman tabled the Economic Survey 2025–26 in Parliament on Thursday. Read Full Text Of Document Here

The survey highlights firming in inflation seen going forward while the consumption demand looks resilient. The global risks look manageable. However, the country must keep buffers and policy credibility, according to Eco Survey.

#BudgetSession2026

— SansadTV (@sansad_tv) January 29, 2026

Union Finance Minister @nsitharaman lays papers on the table.@nsitharamanoffc @FinMinIndia @LokSabhaSectt pic.twitter.com/SQBrb0ALpE

India remains the fastest-growing major economy for the fourth consecutive year, according to the Economic Survey. The economy is driven by domestic demand, strengthening investment cycle, and resilient services sector. The manufacturing up 8.4%, services up 9.3% in H1 FY26.

The India-US trade deal talks are likely to conclude in 2026, according to the Economic Survey. The global situation does not pose immediate macroeconomic stress for India while the fiscal prudence is on track, indicates adherence to the budgeted glide path, as per the Survey. The domestic economy remains on stable footing, it added.

According to Economic Survey 2026, India's GDP grew on structural reforms and policy steps despite US tariffs. The data shows strengthening econ momentum in recent months on reforms. The global conditions translate to external uncertainties for India, according to the document. The outlook for India's growth remains steady amid global uncertainties.

The government's fiscal trajectory stands out amid elevated global debt while the downside risks to global growth are prominent. The stability to global growth is fragile. GST rate cut changes will support demand and revenue resilience, according to the Eco Survey.

The Economic Survey has pegged India's FY26 GDP growth at 7.4%. India's medium-term growth potential is around 7%. The FY27 GDP growth is seen at 6.8-7.2%.

Finance Minister Nirmala Sitharaman tables Economic Survey 2025-26.

Finance Minister is set to present the Union Budget on Sunday, Feb. 1, marking her ninth consecutive one!

Since assuming office in July 2019, and delivering her maiden Budget the same year, Sitharaman has presented eight Budgets, including an interim Budget in February 2024.

But who holds the record for the most Budgets presented? It's Morarji Desai, who has delivered a total of 10 Budgets, including two interim Budgets. Desai was the finance minister between 1959 and 1963, and then again from 1967 to 1969.

Read more: Union Budget 2026: Morarji Desai To Nirmala Sitharaman — Who Has Presented The Most Budgets?

"India's democracy and demography is a big hope to the world today. This is an opportunity to send across a message to the global community through this temple of democracy - of our capability, of our dedication to democracy, of honouring the decisions made through democratic processes. The world welcomes and accepts this,'' said PM Modi.

''Today, the country is advancing. This is not the time for obstruction. This is the time for solution. Today, the priority is not obstruction, but solution...I urge all MPs to come and let us speed up and strengthen the era of important solutions for the country. We should go ahead towards last mile delivery,'' he added.

"It is natural for the attention of the country to be towards the Budget...Now, we have swiftly taken off on 'Reform Express'' said PM Modi.

#WATCH | Budget session | PM Narendra Modi says, "It is natural for the attention of the country to be towards the Budget. But the identity of this Government has been reform, perform and transform. Now, we have swiftly taken off on 'Reform Express'. I express gratitude to all… pic.twitter.com/p9JpR7teTf

— ANI (@ANI) January 29, 2026

"The country is coming out of long-term pending problems and confidently walking the path of long-term solutions...In all our decisions, the progress of the country is our goal. But all our decisions are human-centric, our role and schemes are human-centric. We will contest against technology, we will adapt to technology, we will accept the capability of technology. But with this, we will not undermine human-centric system. Understanding the importance of sensitiviteness, in partnership with technology, we will go ahead,'' said PM Modi speaks at start of Budget session.

Prime Minister Narendra Modi speaks to the media ahead of the tabling of the Economic Survey.

Watch here:

Speaking at the start of the Budget Session of Parliament. May both Houses witness meaningful discussions on empowering citizens and accelerating India’s development journey. https://t.co/tGqFvc4gup

— Narendra Modi (@narendramodi) January 29, 2026

Market sentiment, in particular, hinges on several factors, including the tax structure. According to Anand Rathi Group Founder Anand Rathi, reducing transactional taxes such as the Securities Transaction Tax (STT) and lowering personal income tax rates would help trigger a market rally.

Rathi argued that to boost investor confidence, the government should rationalise capital gains tax and reduce personal income tax in the upcoming budget. Easing these tax burdens, Rathi said, would encourage greater retail participation, improve domestic investors' net returns, and lift overall market sentiment.

As Budget 2026 approaches, much of the debate remains centred on fiscal discipline and capital expenditure. But a contrarian proposal from Saurabh Mukherjea has shifted the spotlight. India's small and mid-sized enterprises, which account for the bulk of job creation but have seen little benefit from the post-pandemic recovery.

India's economic rebound, he says, has been sharply K-shaped, with smaller firms struggling while larger corporates continue to compound profits. That divergence matters because of where employment sits. "Eighty percent of the jobs are created in companies with less than Rs 1 crore PAT," Mukherjea said.

According to Mukherjea, such a tax cut could be financed by trimming 10-15% of the government's capex budget without derailing fiscal consolidation.

CEA Nageswaran, in an OpEd in Mint, highlighted five economic themes to watch out for ahead of Economic Survey 2026:

The CEA says that as of now, estimated growth in real terms is 7.4%, and that India has "sustained growth since the pandemic and has roughly halved the Union government’s fiscal deficit as a proportion to gross domestic product". This is based on the projected 2025-26 budget deficit announced in February 2025, and despite significantly ramping up public infrastructure investment.

On the point of fiscal prudence, CEA Nageswaran says that, "Deficit reduction has been accompanied by an improvement in the quality of fiscal expenditure. Fiscal prudence, conservatism and economic growth earned the country three credit-rating upgrades last year."

He adds that the price of one dollar in Indian rupees has gone up by more than 6% since the beginning of 2025. "Over this shorter horizon, several other emerging-market currencies have performed better. However, when the frame is widened to a six-year window beginning February 2020, most major emerging-market currencies, including the Indian rupee, have weakened against the dollar by a similar magnitude."

The CEA emphasises that countries that have "built a strong manufacturing base, export manufactured goods and run external surpluses have enjoyed strong and stable currencies." However, he says that they did so at a time "when the climate was not a pressing concern and energy-transition considerations were distant."

The CEA pointed out that, "Rapid advances in artificial intelligence over the last year have raised new questions for a nation that needs to generate at least 8 million jobs annually." This comment also comes amid chatter around job loss, as well as job creation, in the age of AI.

The Economic Survey 2026 typically reviews key aspects of the economy, including GDP growth patterns, inflation and monetary policy developments, the fiscal landscape, external sector performance (trade, forex trends), and social indicators such as jobs, health, and education. It also features dedicated chapters on new and emerging policy themes.

For markets, the focus will be on the Survey’s assessment of global risks, the roadmap for fiscal consolidation, and sector‑specific insights — all of which shape sentiment across equities, bonds, and currencies. Although the Survey does not announce policies, it often sets the tone for the Budget and influences the direction of future economic strategy.

Ahead of the Budget 2026, sources told NDTV Profit's Rishabh Bhatnagar that the Modi government is planning to expand the definition of startups to promote innovation in deep-tech in the upcoming Union Budget.

The sources added that the broader definition of startups will also allow flexibility for companies to pivot fields, and the new definition aims to incentivise more companies to innovate and take risks.

Keep in mind that just last week, Commerce and Industry Minister Piyush Goyal said the government has readied draft guidelines for the second Rs 10,000 crore Fund of Funds for Startups with a clear focus on deeptech segments.

India’s economic expansion has frequently outpaced the forecasts presented in the Economic Survey. For instance, growth for 2025-26 is expected to reach 7.4%, higher than the 6.3-6.8% range projected in the pre‑Budget document.

In 2023-24, GDP growth came in at 9.2%, well above the Survey’s estimate of 6-6.8%.

For 2024-25, however, the economy grew 6.5%, broadly in line with the projected 6.5-7% range. The analysis shows that the only significant undershoot occurred in 2022-23, when actual growth of 7.6% fell short of the 8-8.5% projection.

In 2021-22, the Economic Survey did not provide a forecast due to the uncertainties surrounding Covid‑19. Growth for that year eventually stood at 9.7%, driven largely by a favourable base effect.

By contrast, 2020-21 recorded a contraction of 5.8%, reflecting the severe economic disruptions caused by the pandemic and nationwide lockdowns.

There's a bunch of terms and concepts in the soon-to-be-tabled Economic Survey, that might seem like jargon, but are important in knowing how the Economic Survey and Union Budget impact us.

NDTV Profit has a list of articles that you can go through, for better understanding of the document to be presented today.

The Economic Survey 2026 is scheduled to be presented in Parliament between 11 a.m. and noon. The proceedings can be viewed live on Sansad TV, as well as on NDTV Profit.

Chief Economic Advisor V. Anantha Nageswaran will later brief the media on the key insights, trends, and the country’s projected growth path.

The complete document will also be made available online on the Union Budget website.

You can watch FM Sitharaman tabling the Economic survey right here:

The Economic Survey, typically tabled a day before the Budget, gives an overview of what the Budgetary panel had in mind before framing the key policy decisions in the main Budget document.

The Survey is traditionally presented by India's Chief Economic Advisor (CEA) before both Houses of Parliament on Jan 31 annually, and it is prepared by the Finance Ministry's Department of Economic Affairs (Economic Division).

Although it does not introduce new policies or tax measures, it offers the analytical groundwork that shapes the final decisions presented in the Budget.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.