China: Firmly opposes US tariffs and will take resolute countermeasures.

European Union: First package of countermeasures soon, further retaliation if negotiations fail.

Canada: Will fight US tariffs, discussing response with provincial leaders.

Japan: Willing to negotiate trade solutions, disappointed with tariffs.

Australia: Totally unwarranted US policy, but no retaliation now.

Taiwan: Highly unreasonable, will make serious representations to the US.

South Korea: Mulling options to stabilise financial markets, minimise damage.

Japanese Prime Minister Shigeru Ishiba expressed significant concerns over the US tariff measures, stating that Japanese firms have played a substantial role in the US economy. Calling the moving to levy a move24% reciprocal tariff on Japanese exports to the US "very disappointing", he said US policies will have a profound impact on global trade.

Ishiba emphasised his willingness to engage in direct discussions with former US President Trump if necessary, highlighting his commitment to addressing trade issues.

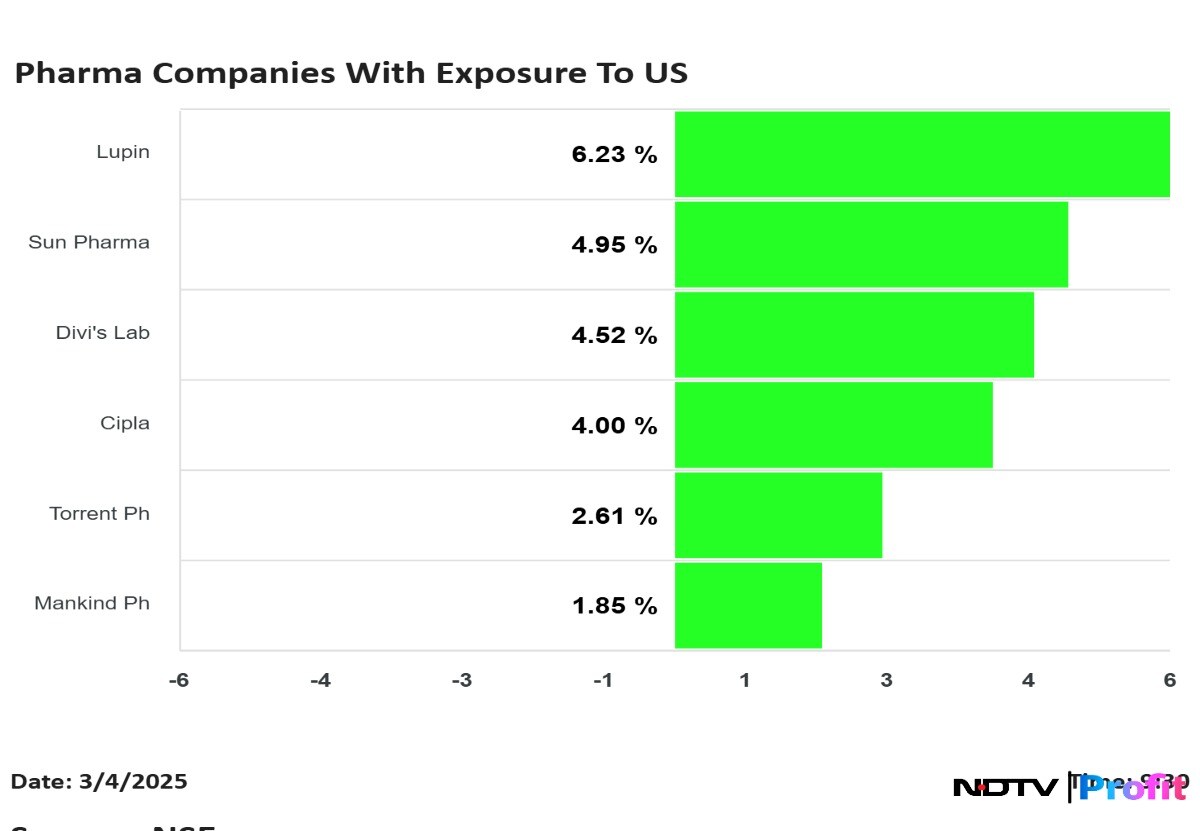

The impact of these tariffs in terms of export losses to the US is estimated at $30-35 billion for India, according to Dhiraj Nim, economist at ANZ. In terms of GDP growth, the impact is currently estimated at 0.7-0.8% of GDP, he said.

Madhavi Arora, lead economist at Emkay, said that previous static analysis suggests that India’s exports to the US could drop by $30-33 billion or about 0.8-0.9% of GDP at 26% tariffs, not adjusting for cross country hits.

The United States is India's top export destination and single-handedly made up for 18.6% of India's merchandise exports in FY25.

Read full story here.

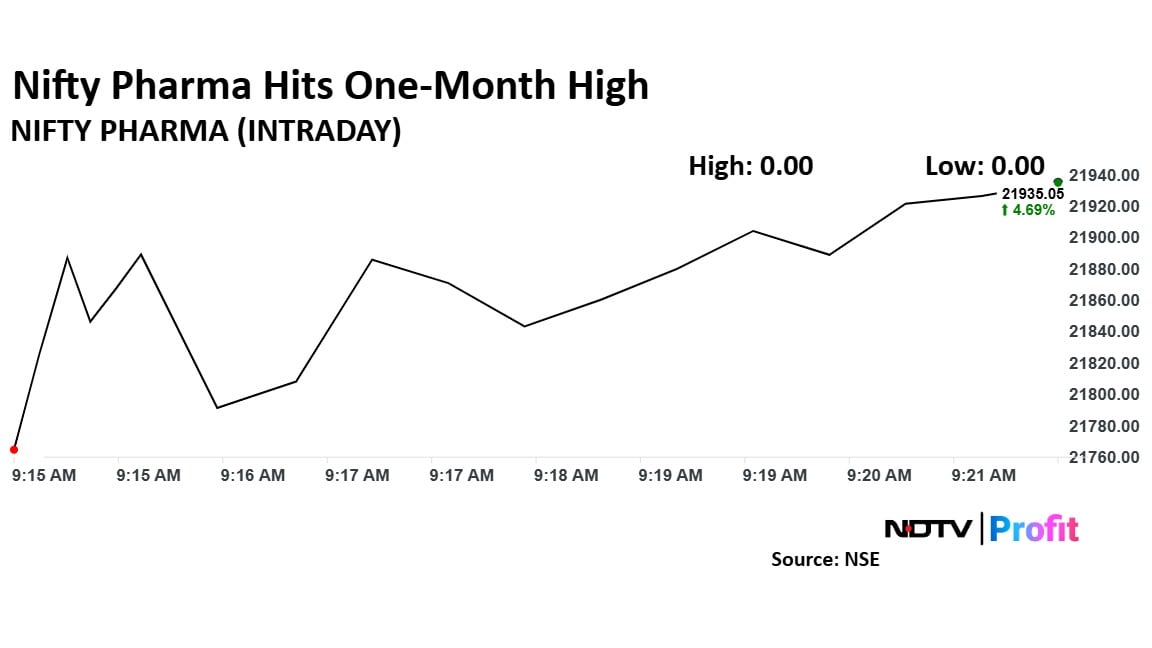

The NSE Nifty Pharma index rose on Thursday to hit over one-month high, driven by relief across the sector as it was excluded from US President Donald Trump's new tariffs. Meanwhile, Sun Pharmaceutical Industries, Dr. Reddy's Laboratories Ltd., and Cipla Ltd. were the top gainers in Nifty 50.

Going against the market decline, pharma benchmark was trading 4.54% higher, as of 9:17 a.m., the highest levels since Feb. 10.

The NSE Nifty Pharma index rose on Thursday to hit over one-month high, driven by relief across the sector as it was excluded from US President Donald Trump's new tariffs. Meanwhile, Sun Pharmaceutical Industries, Dr. Reddy's Laboratories Ltd., and Cipla Ltd. were the top gainers in Nifty 50.

Going against the market decline, pharma benchmark was trading 4.54% higher, as of 9:17 a.m., the highest levels since Feb. 10.

The NSE Nifty Pharma index rose on Thursday to hit over one-month high, driven by relief across the sector as it was excluded from US President Donald Trump's new tariffs. Meanwhile, Sun Pharmaceutical Industries, Dr. Reddy's Laboratories Ltd., and Cipla Ltd. were the top gainers in Nifty 50.

Going against the market decline, pharma benchmark was trading 4.54% higher, as of 9:17 a.m., the highest levels since Feb. 10.

The NSE Nifty Pharma index rose on Thursday to hit over one-month high, driven by relief across the sector as it was excluded from US President Donald Trump's new tariffs. Meanwhile, Sun Pharmaceutical Industries, Dr. Reddy's Laboratories Ltd., and Cipla Ltd. were the top gainers in Nifty 50.

Going against the market decline, pharma benchmark was trading 4.54% higher, as of 9:17 a.m., the highest levels since Feb. 10.

US President Donald Trump on Thursday imposed a series of extensive tariffs on India and several countries, noting that unfair trade policies have significantly hurt the US economy.

Britain and Ukraine have been hit with a baseline tariff of 10%, while European Union partner nations face a reciprocal tariff rate of 20%. Notably, Russia and Israel were excluded from Trump's tariff list.

Check Full List Of Countries And Imposed Tariffs.

India will face 26% "discounted" tariffs, with the auto industry facing a 25% levy. Stocks like Sona BLW, Bharat Forge, Ramkrishna Forging, Tata Motors and more derived more than 20% of their FY24 revenues from the US.

Avanti Feeds, Apex Frozen Food, and Waterbase are some companies that derive revenues from the US in the seafood sector.

Read full story here.

India will face 26% "discounted" tariffs, with the auto industry facing a 25% levy. Stocks like Sona BLW, Bharat Forge, Ramkrishna Forging, Tata Motors and more derived more than 20% of their FY24 revenues from the US.

Avanti Feeds, Apex Frozen Food, and Waterbase are some companies that derive revenues from the US in the seafood sector.

Read full story here.

European Commission President Ursula von der Leyen said the 27-nation bloc will explore countermeasures if trade talks with the US fail.

"Europe is already finalising its first package of measures in response to the first tariffs on steel and preparing further countermeasures if negotiations fail," she said at a press conference.

The official also tressed the impact that Trump's tariffs will have on consumers and businesses, who typically end up paying the extra cost on goods following the enforcement of such measures.

Trump has imposed a 20% reciprocal tariff on the EU.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveiled sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed a 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively,, as of 9:21 a.m.

Follow the live blog on markets at the link below:

The Indian rupee weakened 24 paise against the US dollar on Thursday after President Donald Trump triggered a tariff war that shook markets worldwide. The local currency opened at 85.75 against the greenback, its biggest opening drop since March 10.

India could maintain or even expand its agricultural exports to the United States despite newly announced tariffs, as competing nations face even steeper duties, agricultural economist Ashok Gulati said.

Trump's 26% tariff on Indian goods would have a limited impact on key agricultural exports like seafood and rice when compared to higher duties imposed on regional competitors, Gulati said.

Gulati, currently chair professor for agriculture at the Indian Council for Research on International Economic Relations (ICRIER), suggested India could potentially gain market share in spaces vacated by higher-taxed competitors.

Source: PTI

CapitalMind CEO Deepak Shenoy said central banks may dump the US dollar and move to Euros or Japanese Yen for reserves after Trump's tariff policies.

"I suppose it's not crazy if all central banks dump the us dollar and move to euro bonds or jpy for reserves. No point using usd as currency any longer since they won't import from you meaningfully. This is a very scorched earth strategy by the US and will impact markets negatively perhaps. The big plus is that most of the uncertainty is gone," he said in a post on his X profile.

Vietnam stocks fall the most in about three years after Trump imposes 46% tariff on imports. Shares of Vietnam's textile and garments, wood, seafood and logistics companies declined.

Source: Bloomberg

President Trump's tariff measures will dissuade countries from negotiating trade terms with the US, according to Marko Papic, macro and geopolitical expert at BCA Research.

"Algorithm to calculate the tariff is sixth grade mathematics. It is a negotiating strategy but the price is so high that customer will likely walk away. Many countries will just walk away from the negotiating table," he told NDTV Profit.

He also said Trump must recognise that approval ratings will fall to the mid-30s very quickly and there will be constraints on many Republicans which will impact the numbers in the US Congress.

Donald Trump's proposed tariff system is not going to work and there will be no recourse with the World Trade Organization or any other organisation, said Ray Vickery, former US Assistant Secretary of Commerce for Trade Development.

"President Trump is out to destroy global organisations like the WTO which have ensured world peace since World War Two. The tariffs will increase chances of trade wars. It will make countries start looking inward with each country looking to take care of themselves," he told NDTV Profit.

It will be a tough ask for the world to make up for the $3.3 trillion US import bill, according to market expert Ajay Bagga.

"Potential global economic pain will have unintended consequences for the world. We should compete on a fair basis and not on tariffs. You cannot shut down factories nor can you export to the US at the tariff rates currently imposed. Given the deficits in the US, the tariffs levied will impact the US consumer and will further impact the US fiscal deficit," Bagga told NDTV Profit.

Responding to US President Donald Trump's reciprocal tariffs of 34%, China's Commerce Ministry said it “firmly opposes US tariffs and will resolutely take countermeasures to safeguard its rights and interests".

Source: State media agency Xinhua

In 2024, the US trade deficit with China was an estimated $395.4 billion, with US goods imports from China totaling $438.9 billion and exports to China at $143.5 billion.

Australian Prime Minister Anthony Albanese said US tariffs of 10% on its products have "no basis in logic" and are "totally unwarranted", but the government will not retaliate.

"This is not the act of a friend. Today's decision will add to uncertainty in the global economy and push up costs for American households. That is why our government will not impose reciprocal tariffs. We will not join a race to the bottom," he said. reciprocal tariffs. We will not join a race to the bottom," he said.

Source: Press conference

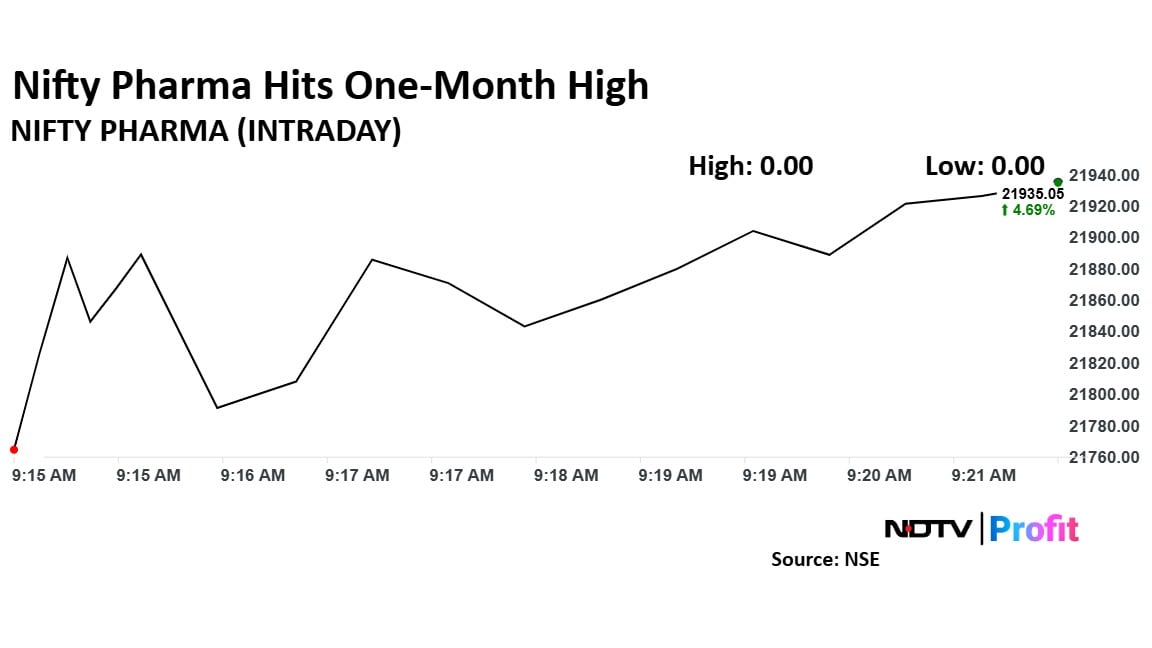

Jefferies and Citi analysts have weighed in on the impact of US tariffs on India's pharmaceutical industry.

Jefferies suggests that Indian pharma companies can "breathe easy for now" as sweeping reciprocal tariffs have exempted the pharma industry, at least temporarily. However, they caution that a pharma-specific tariff order can't be entirely ruled out in the future. For now, they anticipate minimal impact on Indian pharma and expect a rally in US-focused generic pharma stocks.

Citi analysts share a similar view, noting that the pharmaceutical sector has been excluded from the tariffs. While they're unsure whether this exemption is short-term or medium-term, they see it as a positive development for the sector. With Indian pharma companies being significant contributors to lowering drug costs in the US, both Jefferies and Citi believe they may be spared from harsh tariff implications.

Commerce Ministry is monitoring the impact of reciprocal tariffs imposed by the US. The common 10% baseline tariff to come into effect starting April 5, additional 16% reciprocal tariff to hit India starting April 10.

The tariffs seen as a mixed bag for India. Some sectors will get impacted, some might benefit as India might competitive edge against nations like Vietnam and Indonesia.

The US President retains power to reduce tariffs for countries that negotiate or satisfy American concerns. India is ahead in this scenario, given that BTA negotiations have already started. A more elaborate statement, analysis by the Commerce Ministry is expected during the day.

Source: Commerce Ministry official sources

Read full story here.

South Korea's Finance Minister, Choi Sang-mok, has pledged to minimize the economic impact of US tariffs on the country's economy. To achieve this, the government will take swift and bold actions to stabilize the financial markets.

Trump has imposed a 25% reciprocal tariff on Korean goods.

Source: Bloomberg

Bernstein's India strategy notes that the 26% tariffs imposed on India exceed what India levies on most US items. Sectors like IT services and pharmaceuticals remain unaffected, aligning with the view that healthcare faces minimal tariff threats. In contrast, apparels and auto parts face significant tariff hikes, but India's competitive position appears protected. Tariffs on competing South Asian economies are even higher. The main impact will be on US discretionary spending, affecting IT firms.

Bernstein believes India will navigate tariff challenges and engage with the US through negotiations rather than a trade war.

The immediate market sentiment is expected to be negative.

The second-half macro recovery thesis remains intact, with potential for a trade agreement.

Healthcare: Upgraded to equal weight due to limited impact from tariffs.

IT: Downgraded to equal weight due to US recession risks.

The government of Brazil said it is evaluating all possible actions to ensure reciprocity in bilateral trade, including going to the World Trade Organization, in defense of legitimate national interests.

Trump has imposed a 10% reciprocal tariff on Brazilian goods.

Source: Reports

Nikkei 225: Down 3%

Topix: Down 3.17%

US reciprocal tariff on Japan is 24%

Kospi: Down 1.22%

US reciprocal tariff on South Korea is 25%

Hang Seng: Down 2.7%

Shanghai Composite: Down 0.5%

US reciprocal tariff on China is 34%

S&P/ASX 200: Down 1.4%

US reciprocal tariff on Australia is 10%

Taiwan futures: Down 1.64%

US reciprocal tariff on Taiwan is 32%

The GIFT Nifty is down 0.73% or 172 points at 23,056. The futures contract based on the Nifty 50 index is pointing to a lower opening for the benchmark at 9:15 a.m.

Canadian Prime Minister Mark Carney said his government will fight US tariffs imposed by President Donald Trump on Thursday. Trade tension between the two neighnours has been on a boil.

"During this crisis, we must act with purpose and force. My government will fight U.S. tariffs, protect Canadian workers and industries, and build the strongest economy in the G7," Carney said in a post on X.

The PM will meet premiers of provinces to discuss countermeasures, according to Bloomberg.

Besides, the US Senate narrowly voted to approve a bill that would block Trump's previously announced 25% tariff on Canada from going into effect.

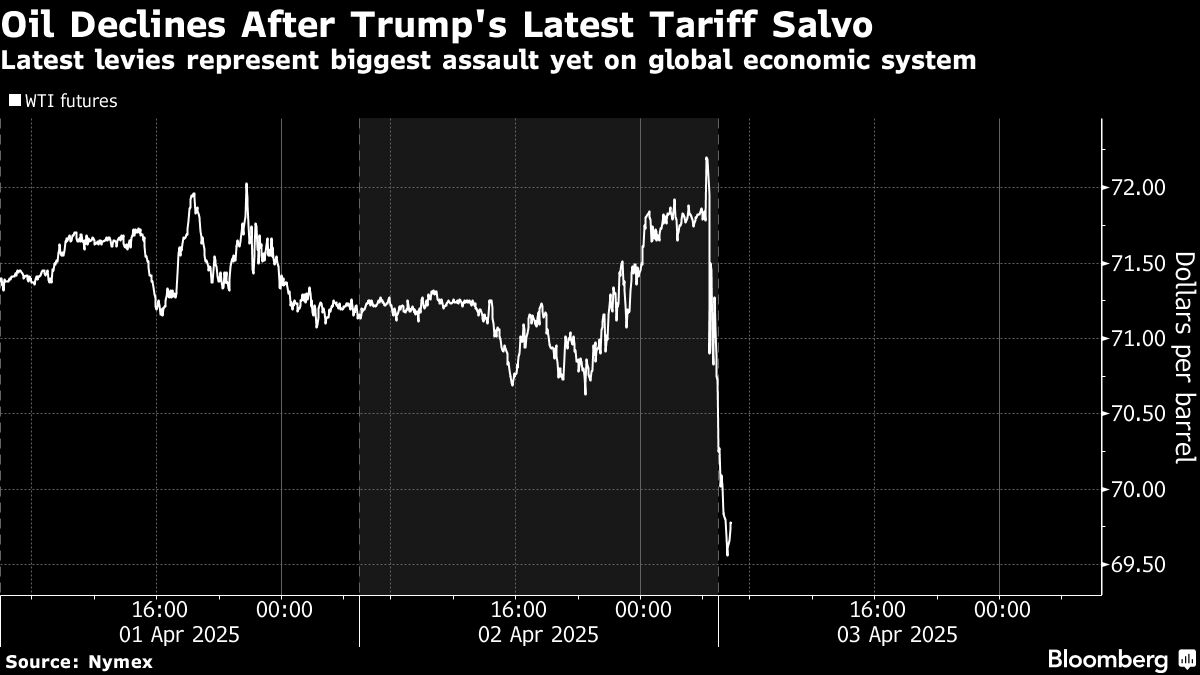

Oil fell after US President Donald Trump rolled out stiff tariffs on major trading partners, including China and the European Union, ratcheting up a trade war that threatens global demand.

West Texas Intermediate declined as much as 3.3% to $69.38 a barrel, tracking a slump in wider markets. Markets are also busier than usual, with volumes far above typical levels in the Asian session.

Prices:

WTI for May delivery fell 3.2% to $69.45 a barrel at 7:40 a.m. in Singapore.

Brent for June climbed 0.6% to settle at $74.95 a barrel on Wednesday.

Source: Bloomberg

Oil fell after US President Donald Trump rolled out stiff tariffs on major trading partners, including China and the European Union, ratcheting up a trade war that threatens global demand.

West Texas Intermediate declined as much as 3.3% to $69.38 a barrel, tracking a slump in wider markets. Markets are also busier than usual, with volumes far above typical levels in the Asian session.

Prices:

WTI for May delivery fell 3.2% to $69.45 a barrel at 7:40 a.m. in Singapore.

Brent for June climbed 0.6% to settle at $74.95 a barrel on Wednesday.

Source: Bloomberg

Shares in Australia, Japan and South Korea tumbled at the open on Thursday after US President Donald Trump imposed reciprcal tariffs.

Nikkei: Down 2.9% or 1,000 points lower

Kospi: Down 1.8%

S&P/ASX 200: Down 1.63%

India's apex exporters' body, FIEO, stated on Thursday that the 26% tariffs or import duties announced by US President Donald Trump on India will undoubtedly affect domestic players.

However, India is much better placed than many other countries, said Ajay Sahai, Director General and CEO of the Federation of Indian Export Organisations (FIEO).

He expressed hope that the proposed bilateral trade agreement (BTA), currently being negotiated between the two countries, would be concluded at the earliest, as it would provide relief from these reciprocal tariffs.

Read story here.

The futures contract for the Dow Jones Industrial Average index fell over a 1,000 points or 2.5% at 5:30 a.m. India time.

S&P 500 futures: Down 3.63%

Dow Jones futures: Down 2.5%

Nasdaq futures: Down 4.5%

Billionaire Elon Musk, a special advisor to US President Donald Trump, is yet to react to the tariff announcements made during the Rose Garden speech. Among the first ones to post messages on his social media platform X in support of Trump, Musk has been vocal about his thoughts on various policies.

On Wednesday, he visited the CIA office.

— Elon Musk (@elonmusk) April 2, 2025

Gold hit a new record of nearly $3,160 an ounce after President Donald Trump unveiled his sweeping “reciprocal” tariffs, imposing a minimum levy of 10% on imports and stoking fears it may trigger a global economic slowdown.

Bullion was one of the few commodities exempted from the tariffs, according to a White House factsheet.

Investors regard gold as a haven when concerns rise over the health of the global economy.

Spot gold hit a new record of $3,159.48 an ounce after peaking at $3,149 on Tuesday.

Source: Bloomberg

An aggressive suite of tariffs announced Wednesday by President Donald Trump will significantly complicate the Federal Reserve’s job as it struggles to quash inflation and avoid an economic downturn, likely keeping officials in wait-and-see mode.

The levies, which are harsher than many analysts were anticipating, are expected to raise prices on trillions of dollars in goods imported each year if left in place. A full blown trade war, with escalating retaliatory tariffs between the US and other countries, could disrupt supply chains, reignite inflation and worsen a souring economic outlook.

For Fed officials still working to rein in the price gains that spiked during the pandemic, the inflationary fallout from the president’s actions may limit policymakers’ ability to step in and bolster the economy.

Read full story here.

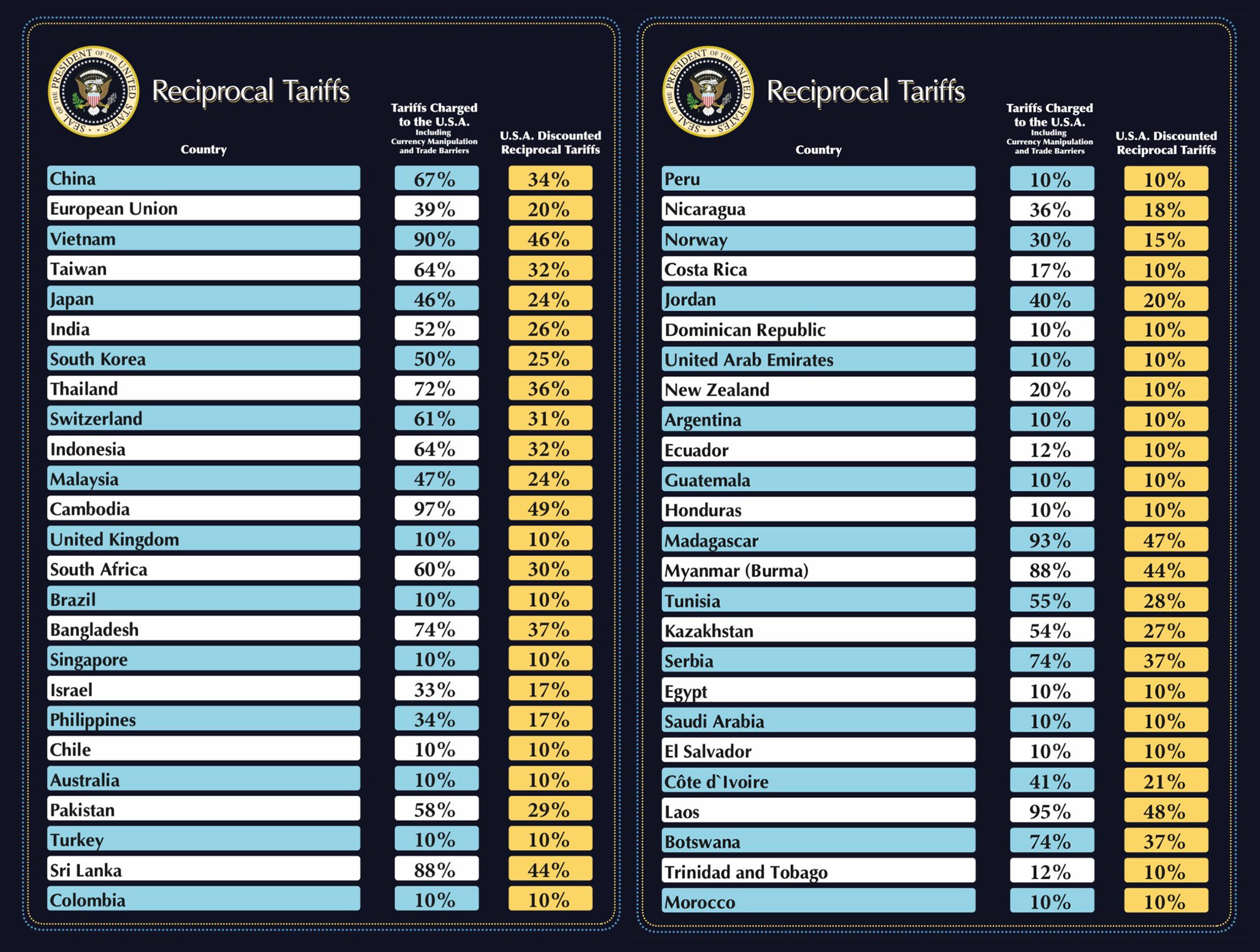

The White House shared a reciprocal tariff rate card on its X handle. The list has over 50 countries with the rate at which they charge US imports and the rate the US will now charge on them.

The White House shared a reciprocal tariff rate card on its X handle. The list has over 50 countries with the rate at which they charge US imports and the rate the US will now charge on them.

The White House on Wednesday has said India’s high tariffs and trade barriers increase costs for US exports, citing disparities in tariff rates between the two countries.

India imposes a 70% tariff on passenger vehicle imports with internal combustion engines, while the US applies a 2.5% tariff, The White House said in a statement, adding that networking switches and routers face a 10-20% tariff in India, whereas the US imposes none.

India levies an 80% tariff on rice in the husk, compared to the US rate of 2.7%, it noted, adding, Apple imports to India are subject to a 50% tariff, while the US allows duty-free entry.

India’s simple average most-favoured-nation tariff rate stands at 17%, compared to 3.3% in the US, the White House said.

Read full story here.

President Trump said that reciprocal tariffs are essential for fair trade, arguing that other countries should treat the US as it treats them. He calls access to the American market a privilege, not a right.

The US supply chain remains vulnerable due to reliance on foreign manufacturers, the White House said, adding, events like the Covid-19 pandemic and Houthi attacks on shipping exposed supply chain weaknesses, prompting Trump’s push for domestic production.

Argentina bans US cattle imports, South Africa restricts US pork and poultry, and Indonesia enforces local content requirements, the White House said, adding that these barriers, combined with high tariffs on US goods, are driving the Trump administration’s push for reciprocal tariffs.

India enforces non-tariff barriers that make US exports more expensive. Unique certification requirements in telecom, medical devices, and chemicals add costs, while high tariffs on rice (80%) and apples (50%) further limit US access to the Indian market.

Beyond tariffs, the US faces restrictive policies that limit market access. Countries like India, China, and Japan impose duplicative testing requirements, while others restrict imports of remanufactured goods, blocking billions in potential US exports.

President Donald Trump is imposing reciprocal tariffs to counter unfair trade practices that have disadvantaged American industries. The US has long faced higher tariffs abroad, with countries like India, China, and the European Union imposing significantly higher duties on US exports.

Certain imports, including pharmaceuticals, semiconductors, lumber, bullion, and specific minerals, will be exempt from the new reciprocal tariffs. Goods already covered under Section 232 tariffs, such as steel and autos, will also not face additional duties.

The US will impose a baseline 10% tariff on imports from all countries starting April 5, 2025, under President Donald Trump’s executive order. The move aims to counter trade imbalances and address nonreciprocal economic policies affecting US industries.

The newly announced tariffs will remain in place until President Donald Trump determines that trade imbalances and nonreciprocal policies have been addressed. The White House has signaled potential tariff adjustments if trading partners take corrective actions.

President Trump’s executive order includes modification authority, allowing tariff increases if trading partners retaliate. However, tariffs may be reduced if countries take steps to align their trade policies with US economic and security priorities.

Countries with the largest trade deficits with the US will face higher individualized tariffs starting April 9, 2025. The decision, under the International Emergency Economic Powers Act, seeks to counter nonreciprocal trade policies and economic threats.

President Donald Trump has declared foreign trade practices a national emergency, citing their impact on the US economy and national security. His executive order imposes new tariffs to address the trade deficit, strengthen US manufacturing, and protect American workers.

The US will continue to exempt Canada and Mexico from reciprocal tariffs under the USMCA, President Donald Trump announced. The two countries will not face the new tariff measures “for now,” he said during his Rose Garden speech on “Liberation Day.”

US President Donald Trump reiterated that tax cuts will be passed and expressed his intent to make them permanent. Speaking at the Rose Garden on “Liberation Day,” Trump also pledged that the upcoming tax bill will not reduce Social Security, Medicare, or Medicaid benefits.

US President Donald Trump said more immigrants are needed to work in manufacturing plants and on farms. Speaking at the Rose Garden on “Liberation Day,” Trump linked his tariff policy to domestic job creation, stating that businesses will require more workers as production shifts to the US.

US President Donald Trump described his new tariff policy as “kind reciprocal” during his Rose Garden speech. He stated that countries can avoid tariffs by manufacturing products in the US.

“If you want your tariff rate to be zero, then you build your product right here in America,” he said. Trump also warned that any attempts to bypass the tariffs would face “extremely strong” repercussions.

US President Donald Trump announced new tariff rates on Wednesday, setting a 26% duty on Indian imports. China will face a 34% tariff, while the European Union will be charged 20%.

Other rates include Japan at 24%, South Korea at 25%, and the UK at 10%, with a minimum global tariff of 10%.

Trump made the announcement during his Rose Garden speech on “Liberation Day.”

US President Donald Trump said on Wednesday that the new tariffs will not be fully reciprocal. “We will charge them approximately half of what they charge,” Trump said during his Rose Garden speech on “Liberation Day.”

US President Donald Trump announced a 10% baseline tariff on all countries during his speech at the Rose Garden on “Liberation Day” Wednesday. The new tariff policy takes effect tarting midnight ET on Thursday.

US President Donald Trump said the US will impose 25% tariffs on foreign automakers starting midnight ET on Thursday. He cited high tariffs from countries like India, Vietnam, and Thailand as justification for the move.

US President Donald Trump said he will sign executive orders for reciprocal tariffs, aiming to counter what he calls unfair trade practices. The announcement marks a major shift in US trade policy, with immediate implications for global markets.

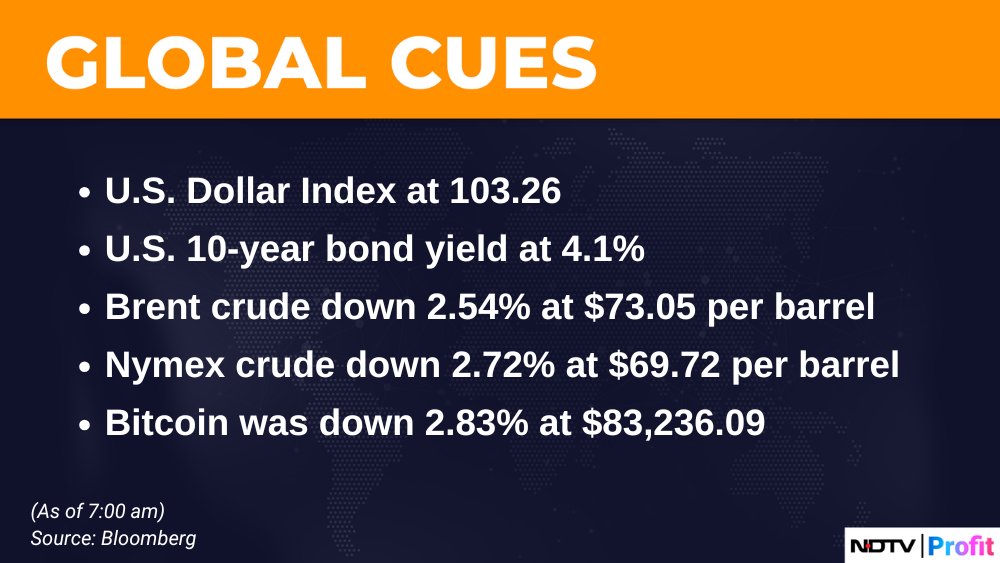

US markets end higher as Trump begins his speech.

Here’s how markets ended:

S&P 500 up 0.70% to 5,672.67.

Nasdaq 100 up 0.91% to 17,609.33.

Dows Jones up 0.69% to 42,280.31.

Dollar Index down 0.36% to 103.84.

US 10-year treasury yields at 4.189.

US President Donald Trump will begin his speech at 1:30 AM IST.

Oil prices edged higher as traders awaited US President Donald Trump’s tariff announcement. West Texas Intermediate settled just below $72 per barrel, while Brent closed near $75.

Markets are watching for potential tariff structures, with proposals including flat rates for different countries or a customised “reciprocal” plan. Equity markets also posted gains.

Source: Bloomberg

Citi sees a low probability of the US imposing tariffs on Indian pharmaceuticals, despite ongoing discussions. The brokerage notes that a 10% tariff could impact Ebitda by 9-12% for firms with high US generics exposure, while companies like Torrent Pharma and Divi’s Laboratories would face only a 1-3% hit.

Citi prefers firms with lower reliance on US generics and highlights challenges in passing tariffs to buyers.

US indices remain marginally in the green an hour before the announcements are expected to take place.

Here’s how markets are reacting ahead of Trump’s speech:

S&P 500 up 0.31% to 5,650.57.

Nasdaq 100 up 0.48% to 17,533.93.

Dows Jones up 0.34% to 42,133.25.

Dollar Index down 0.43% to 103.81.

US 10-year treasury yields at 4.194.

India’s commerce ministry is evaluating potential fallout from the US administration’s reciprocal tariffs set to be announced on April 2, sources told PTI.

Industry stakeholders have raised concerns over export competitiveness, as the US remains India’s largest trading partner.

India may see a rise in steel imports as US tariffs push global trade flows towards the country, SAIL Chairperson Amarendu Prakash said.

Speaking at an event in New Delhi, Prakash noted that the situation remains volatile, and it is crucial to monitor how US President Donald Trump’s reciprocal tariff plans unfold.

Maruti Suzuki India Ltd. will raise car prices from April 8, 2025, citing higher input costs, operational expenses, and regulatory changes. This marks the company’s fourth price hike this year.

The price of the Grand Vitara will rise by up to Rs 62,000, while other models like the Eeco, Wagon-R, and Ertiga will also see increases. The announcement comes as the US prepares to impose a 25% tariff on auto imports, adding further cost pressures on the industry.

Goldman Sachs has raised its US recession probability to 35% from 20%, citing escalating tariffs as a key risk, according to a CNN report. The bank also cut its 2025 GDP forecast to 1% and raised its year-end unemployment estimate to 4.5%.

While Goldman still sees a downturn as avoidable, other forecasters consider the odds closer to 50/50, with trade tensions under President Donald Trump adding uncertainty, the report said.

Israel has cancelled import duties on all American goods ahead of US President Donald Trump’s reciprocal tariff announcement.

Finance Minister Bezalel Smotrich and Economy Minister Nir Barkat issued the order under Prime Minister Benjamin Netanyahu’s directive. In a post on X, Netanyahu said the move aligns with his government’s long-standing policy to boost market competition and lower living costs while strengthening US-Israel ties.

Indian auto parts manufacturers, already grappling with weak domestic demand, now face the risk of declining US sales as President Donald Trump’s tariffs disrupt global car manufacturing.

While a 25% duty on fully assembled vehicles takes effect on April 3, additional levies on key components such as engines and transmissions are set for May 3. Automakers like Ford, General Motors, and Stellantis are lobbying for exemptions, leaving Indian suppliers uncertain. The US is India’s largest auto parts export market, accounting for nearly a third of the $21.2 billion industry in FY24.

Source: Bloomberg

Ahead of the US tariff NDTV Profit took a deep dive into the the Trump tariffs to find out how this move will affect the stock market and its impact on various sectors. Watch the video to get a complete analysis.

As President Donald Trump prepares to unveil new tariffs on Thursday, trade expert Jayant Krishna says India must brace for friction but remain firm in negotiations.

“Countries don’t get what they deserve, they get what they negotiate,” Krishna, a Senior Fellow at the Centre for Strategic and International Studies, told NDTV Profit. Trump’s “Liberation Day” tariffs are expected to impose reciprocal duties on countries accused of unfair trade practices, with India under scrutiny for high levies on US farm goods, including walnuts, almonds, and coffee.

The impending tariffs announcements triggered significant stock market volatility. Initially, the S&P 500 experienced a decline exceeding 1%, but subsequently recovered.

Here’s how markets are reacting ahead of Trump’s speech:

S&P 500 up 0.49% to 5,660.90.

Nasdaq 100 up 0.78% to 17,586.22.

Dows Jones up 0.33% to 42,129.72.

Dollar Index down 0.42% to 103.82.

US 10-year treasury yields at 4.207.

Spanish Minister José Manuel Albares said he had an “excellent conversation” with US Secretary of State Marco Rubio on Spain-US relations.

In a post on X, Albares highlighted discussions on the transatlantic bond, cooperation in security and trade, and ties with Latin America.

Excelente conversación con el Secretario de Estado norteamericano @SecRubio.

— José Manuel Albares (@jmalbares) April 2, 2025

Hemos abordado las relaciones España - Estados Unidos, la importancia del vínculo transatlántico y el diálogo y la cooperación en seguridad y comercio. También nuestros lazos con América Latina.

Spot Gold gained 0.27% to trade at $3,121.76 as of 11:13 p.m. IST, as per Bloomberg data.

The yellow metal, considered a safe-haven investment amid tariff-incurred economic uncertainty, is expected to scale the Rs 1 lakh per 10 gram-mark in Indian markets soon, expect analysts.

European officials have raised concerns over the impact of President Donald Trump’s impending tariff announcement, warning of global economic fallout.

European Central Bank President Christine Lagarde said the tariffs would have a “negative impact” worldwide, though the severity would depend on factors such as scope, duration, and targeted products. Speaking to Ireland’s Newstalk radio, she cautioned that tariff hikes often “prove harmful, even for those who inflict it.”

President Donald Trump has made a final decision on his reciprocal tariff strategy, CNBC reported quoting a White House official as saying.

The announcement signals the conclusion of internal deliberations that were reportedly ongoing just hours before Trump’s scheduled Wednesday afternoon event, the report added.

Mexican President Claudia Sheinbaum said on Wednesday that she will announce a broad economic plan on Thursday in response to President Donald Trump’s new tariffs.

Sheinbaum referenced former Brazilian President Dilma Rousseff’s efforts to strengthen Brazil’s automotive industry, suggesting her administration is considering similar measures.

The UK will not “rush” to retaliate against potential US tariffs on British goods, Finance Minister Rachel Reeves said on Wednesday.

Speaking in parliament, Reeves said the government would take a “clear-headed” approach to protect national interests. She noted that major UK exporters prefer a measured response, as the focus remains on securing an economic agreement rather than escalating trade tensions.

The tariff rates President Donald Trump announces on Wednesday will serve as a ceiling and can be negotiated downward, Treasury Secretary Scott Bessent told lawmakers, CNN reported quoting a source familiar with the matter.

Bessent’s remarks indicate the administration sees the tariffs as a bargaining tool to push other countries to lower their duties on US imports, CNN reported, adding that Trump has signaled flexibility if trading partners adjust their rates but has also warned that retaliatory measures could lead to further tariff increases.

US President Donald Trump said India will “drop its tariffs very substantially” as he prepares to announce reciprocal tariffs on Wednesday.

Speaking in the Oval Office on Monday, Trump said many countries would lower their tariffs, citing the European Union’s recent move to cut car tariffs to 2.5%.

“They’ve been unfairly tariffing the United States for years,” he said, adding that the US has maintained relatively low tariffs in comparison.

India has several options to counter Trump’s proposed tariffs, including increasing oil and natural gas imports from the US. During his first term, New Delhi boosted liquefied natural gas purchases to ease trade tensions, and it has already pledged to raise energy imports by $10 billion to $25 billion.

Read the full story here to understand sector-wise breakdown of possible responses.

India’s electrical machinery sector, particularly electronics like mobile phones, could be among the hardest hit if the US imposes reciprocal tariffs. iPhones, a key export to the US, may see price increases for American consumers under new levies.

Currently, India imposes a 15% duty on fully assembled phone imports, while the US has zero tariffs on the same. With existing 40% tariffs on Chinese imports, higher US tariffs on Indian goods could further influence Apple’s production strategy.

Read the full story here.

The US is one of India’s largest trading partners, with a significant trade imbalance in India’s favour. In 2024, India’s exports to the US stood at $81 billion, making up 17.7% of total outbound shipments.

Donald Trump has previously criticised this imbalance, calling India the “tariff king” during his first term. India’s weighted average tariff on American imports is 12%, while US tariffs on Indian goods stand at 3%. This higher tariff rate provides greater protection to certain Indian sectors from US competition.

Read the full story here.

Reciprocal tariffs adjust a country’s import duties to match those imposed by its trading partners. This strategy aims to create a level playing field by preventing any nation from benefiting from disproportionate tariffs.

The current Trump administration’s push for reciprocal tariffs reflects its focus on addressing trade imbalances and ensuring fair competition in global markets.

Financial markets have exhibited volatility following the announcement of new tariffs. Investors are assessing the potential impact on various sectors, with particular attention to industries directly affected by the tariffs, such as automotive and manufacturing.

Here’s how markets are reacting ahead of Trump’s speech:

S&P 500 up 0.44% to 5,657.25.

Nasdaq 100 up 0.5% to 19,534.19.

Dows Jones up 0.4% to 42,142.60.

Dollar Index down 0.42% to 103.82.

US 10-year treasury yields at 4.186.

Effective Wednesday, the United States is implementing a 25% tariff on imported automobiles and introducing reciprocal tariffs to match those that other countries levy on American goods. These measures are part of the administration’s strategy to encourage domestic production and rectify trade imbalances.

President Trump has designated April 2 as “Liberation Day” to unveil new reciprocal tariffs intended to bolster US manufacturing and address perceived inequities in international trade practices.

While the administration views this as a step toward fairer trade, economists express concerns about potential economic repercussions and the strain it may place on global alliances.

Welcome to our live coverage of President Donald Trump’s Liberation Day speech, scheduled for 1:30 a.m. IST.

This event marks the announcement of new reciprocal tariffs aimed at aligning U.S. import duties with those imposed by other nations on American products.

Our live blog will provide real-time updates, context, and analysis leading up to and during the speech

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.