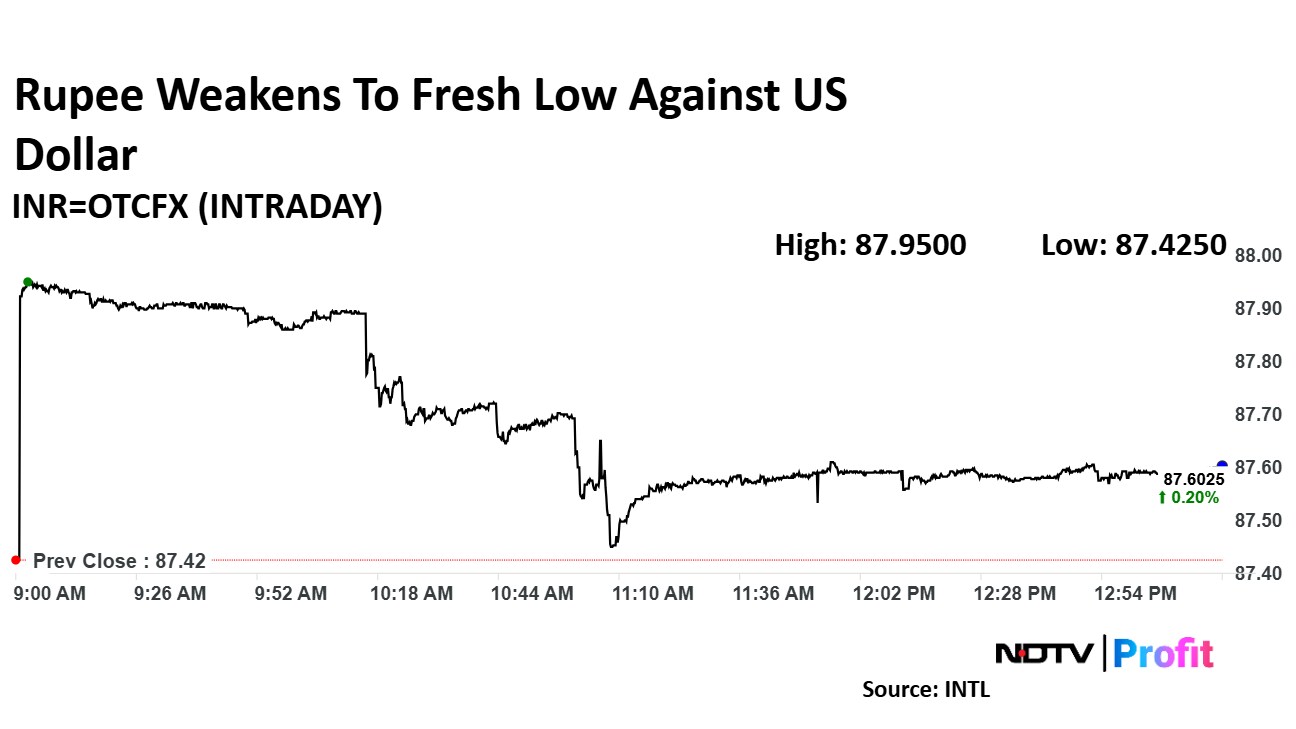

The rupee plummeted to a record low against US dollar, shortly after domestic markets opened Monday, as uncertainty heightened amid fear of more tariffs from the US. The Indian unit slumped 53 paise to a record low of 87.96 a dollar, just shy of psychologically crucial level of 88.

"We do not see major reversal in the rupee going forward. The current reversal is supported by the Reserve Bank of India. We see a broader range of 87.30–87.90 a dollar," said Amit Pabari, managing director, CR Forex Advisors. "Breaching 88 level is less likely because the way they intervened today, it's likely they will maintain it below this level."

President Donald Trump said Friday that the US will impose reciprocal tariffs on many countries by Monday and Tuesday in the ongoing week, indicating further woes for global trade. Trump also said that the country will levy 25% tariff on steel and aluminum entering US. These announcements followed Trump's earlier decision to levy tariffs on Canada, China, and Mexico.

Risk-aversion sentiments following Trump's announcements compelled traders to purchase the safe-haven unit in the foreign exchange markets, which pressured the rupee, according to market participants.

The dollar index extended gains to a third day as fear of potential tariff war in the international markets offset the impact of mixed economic data from the US. The index rose 0.37% to 108.44 so far today.

"All depends on Trump's further statements on tariff. If there's any adverse development on geopolitical front, rupee may fall till 87.90–88.00 a level, and then RBI may come in to support," said Vivek Shah, foreign exchange spot and forward markets dealer, LCR Forex Brokers Ltd.

Sentiment towards the Indian unit also weakened as the RBI Governor Sanjay Malhotra said Friday that the regulator will only ease the excessive volatility rather than targeting a particular level for USDINR. Now, most of the market participants believe that the regulator will reduce rupee's pace in breaching the 88-a-dollar mark in February.

Earlier in the day, the regulator stepped in to arrest runway depreciation in the rupee against US dollar, according forex traders. Moreover, exporters sold the greenback around 87.90 a dollar level, to take benefit from the relatively higher USDINR level, which supported the Indian unit.

As far as the rupee's long-term trajectory is concerned, many market participants are expecting a gradual depreciation because India's Real Effective Exchange Rate remained quite high. High REER is not conducive for the country's trade competitiveness.

It was signaled at the beginning of the year, that rupee was kept too strong, said Samir Arora, founder and fund manager, Helios Capital. He sees another 2–3% depreciation in the domestic unit going forward.

The rupee was trading 87.95 a dollar as of 1:34 p.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.