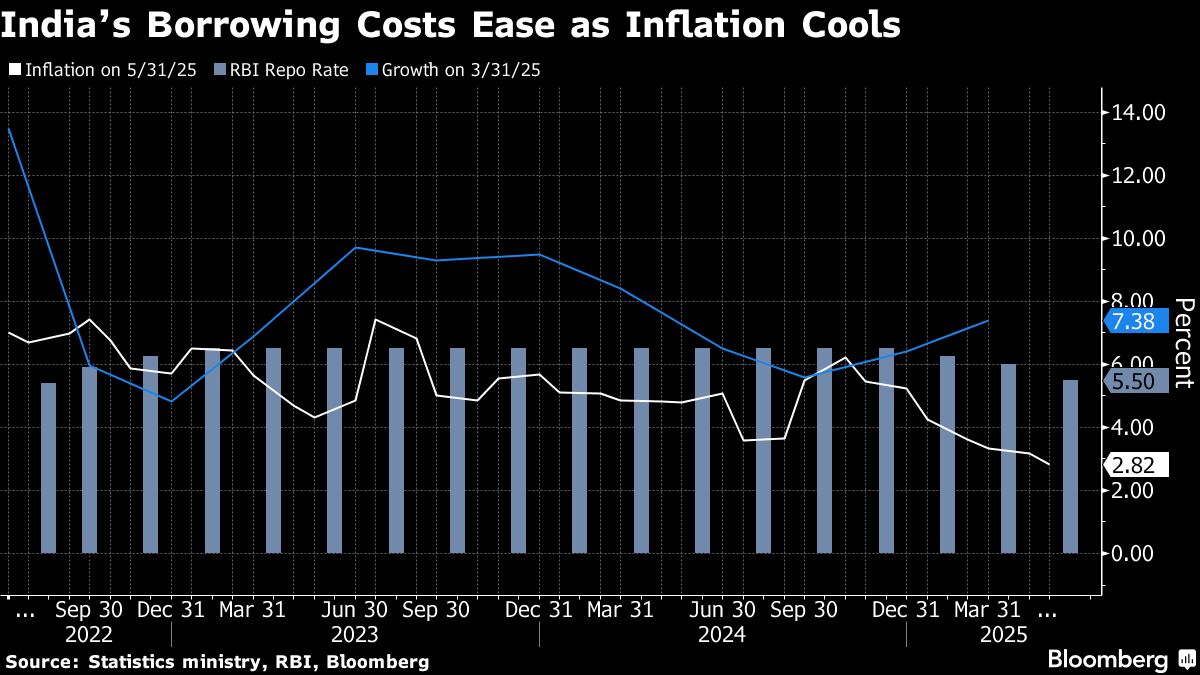

A relatively hawkish member of the Indian central bank's interest rate-setting panel said there is room for borrowing costs to come down, despite a shift in stance in the last policy indicating a tightening bias.

The change from ‘accommodative' to ‘neutral' in the June 6 policy does not “preclude further rate cuts. Absolutely not,” said Saugata Bhattacharya, an external member of the monetary policy committee of the Reserve Bank of India, in an interview Wednesday.

“If inflation allows a further cut in the policy repo rate, so be it,” he added. A good monsoon and easing vegetable prices support a benign inflation outlook, with global food prices contained and edible oil prices declining, he said.

Bhattacharya was the only rate-setter to vote for a quarter-point cut in the last monetary policy decision, where the central bank delivered a bigger-than-expected interest rate cut along with a cash boost for banks to spur growth

This follows similar remarks by RBI Governor Sanjay Malhotra last week, as he sought to clarify the central bank's recent policy moves.

Despite the liquidity boost, the RBI on Tuesday announced a plan to withdraw up to 1 trillion rupees ($11.7 billion) through short-term measures.

Bhattacharya said the immediate liquidity withdrawal was necessary because overnight rates had fallen below the floor of the RBI's rate corridor, warranting calibration.

“Managing liquidity down to the last rupee is always a very difficult proposition,” due to multiple unpredictable and constantly evolving factors such as government cash balances, currency in circulation, global capital flows, and RBI's market interventions, he said.

Here's more from Bhattacharya's interview:

“I'm closely monitoring every little signal in terms of the trade and tariff environment, which is far more engaging at this point than any other geopolitical disruptions”

RBI's growth forecast of 6.5% for FY26 is considered appropriate, but studies on key parameters like India's potential output are outdated and need to be refreshed

“I don't know whether this growth rate is sub-optimum, but the underlying movement in core inflation suggests that we are far from overheating”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.