Reserve Bank of India's mandate to link new floating loans to external benchmarks will limit banks' flexibility in managing interest rate risk, according to global ratings agency Moody's Investors Service Inc.

RBI has made it mandatory for all banks to link new loans offered to individuals, micro, small and medium enterprises to external benchmarks from Oct. 1.

“The new rules delay the ability of banks to reflect such changes in funding costs of their lending rates since they will be linked to an external benchmark,” Moody's said in a note released on Tuesday.

"Under the new rules, this direct linkage between lending rates and funding costs will no longer exist. This will expose banks to asymmetrical movements in cost of funding and loan yields, thus exposing them to interest rate risks,” the ratings agency said.

The initial impact will be mitigated as existing loans, based on Marginal Cost of Funds based Lending Rate, will make up for the larger chunk of loans issued by the lenders, but “over time, most of the retail and MSME loans will transition to the new mechanism,” added Moody's.

Banks depend on deposits in current and savings accounts (CASA) for funds, interest rates for which tend to be low but stable.

Financial institutions are unlikely to lower the rates further at the cost of losing customers. “Under the new regime, while the floating rate loan book will get re-priced, only the non-CASA deposits will see a re-pricing on deposits,” said Moody's. That will make a bank's Net Interest Margin volatile which, in turn, will impact the overall profitability, according to the ratings agency.

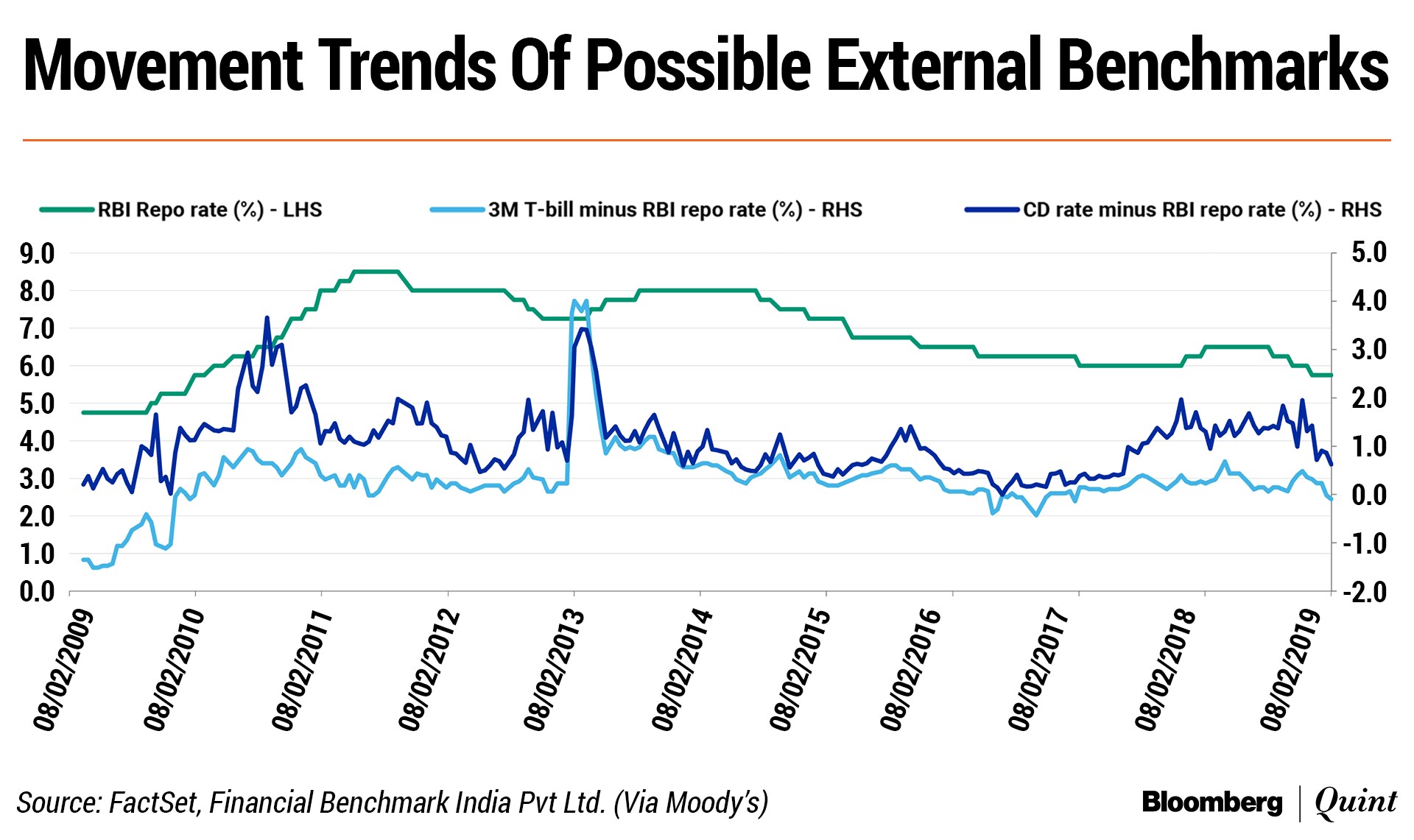

“Besides, the lack of a single benchmark that can consistently and accurately capture the movement of interest rates in the economy will also cause volatility to banks' NIMs,” it added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.