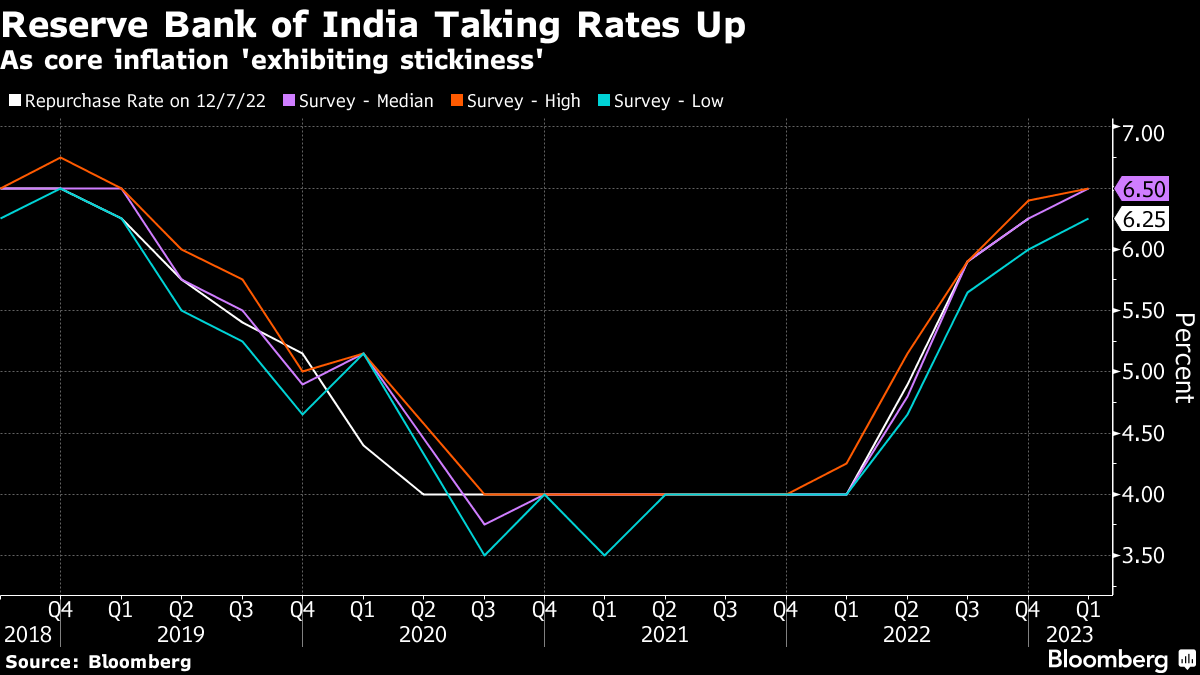

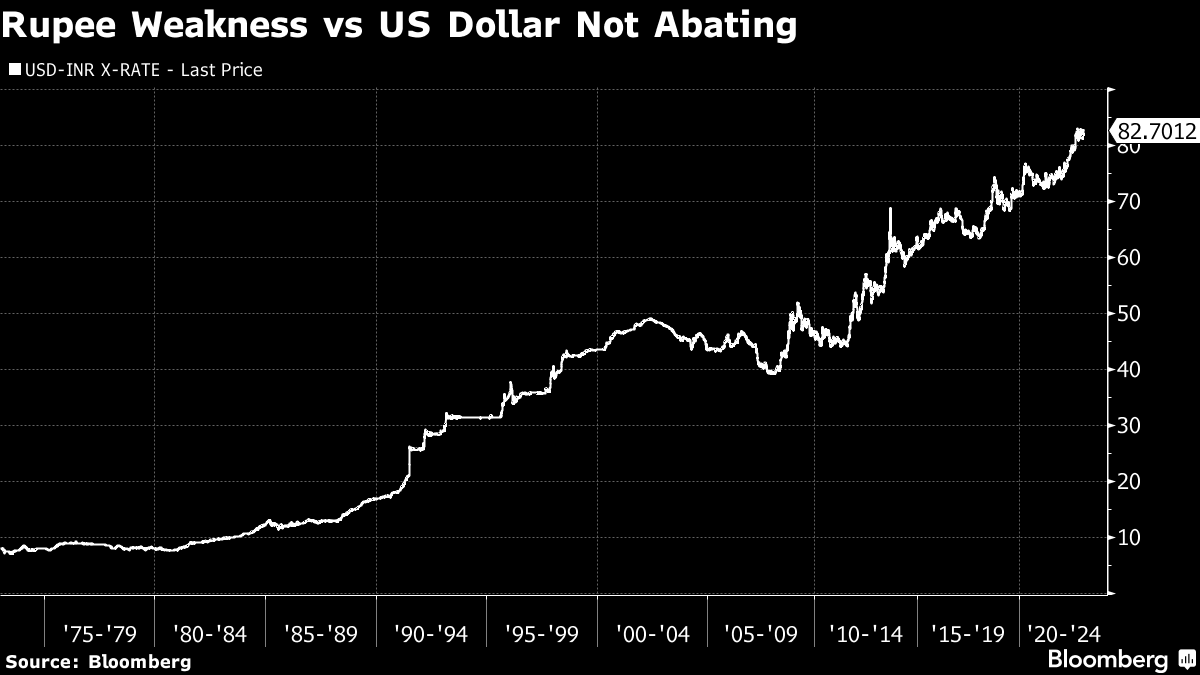

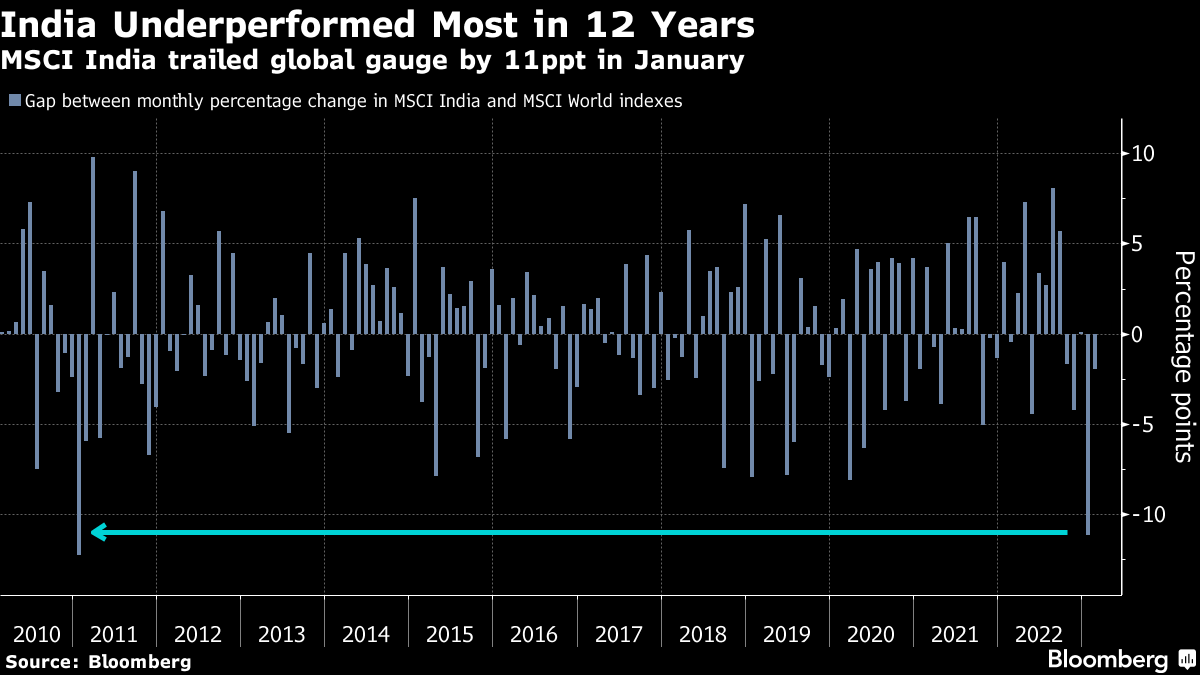

(Bloomberg) -- A weak currency and faltering stock market provide the backdrop for what's likely to be the Reserve Bank of India's final policy hike of this tightening cycle. The median forecast is for a 25 basis points increase in the repurchase rate to 6.5% on Wednesday, after RBI Governor Das pointed to sticky core inflation.

The hiking cycle has already brought 225 basis points of tightening since last April:

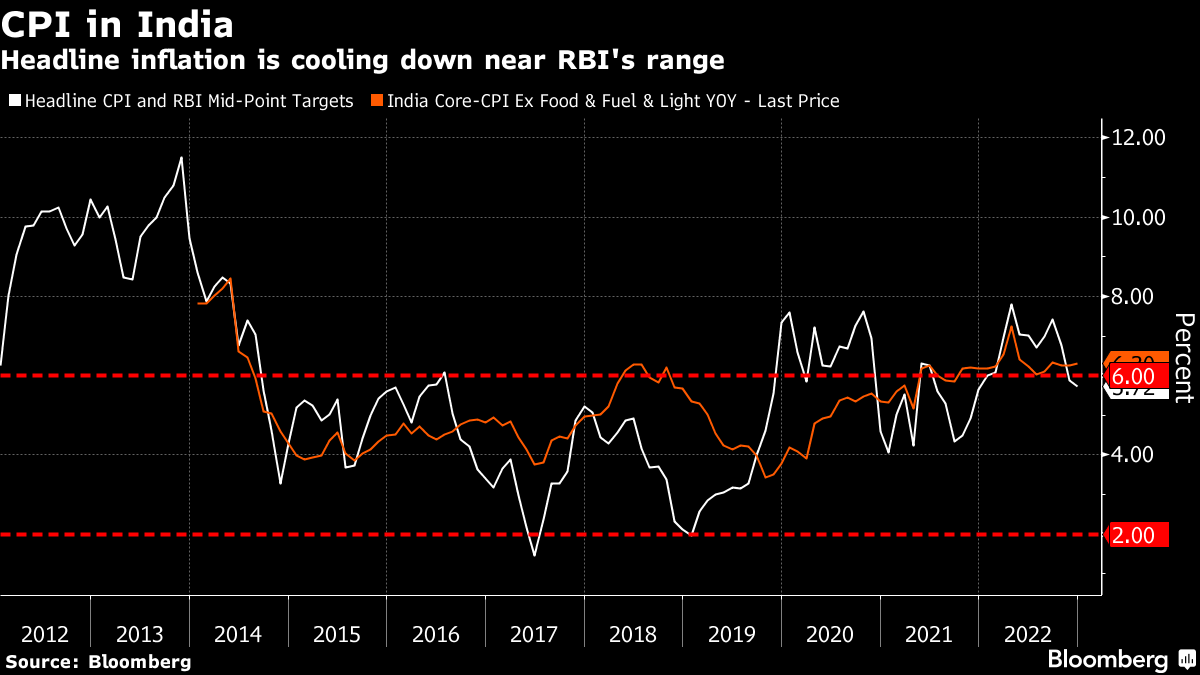

Headline CPI is cooling as food and fuel prices fall. However, core inflation remains above the 6% upper bound of the RBI's target range:

USD/INR hovers near its record highs:

India's stock market is having a hard time lately versus Global Developed Markets peers:

NOTE: Ernest Tsang is a markets producer for Bloomberg TV. The observations are his own and not intended as investment advice. For more markets analysis, see the MLIV blog.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.