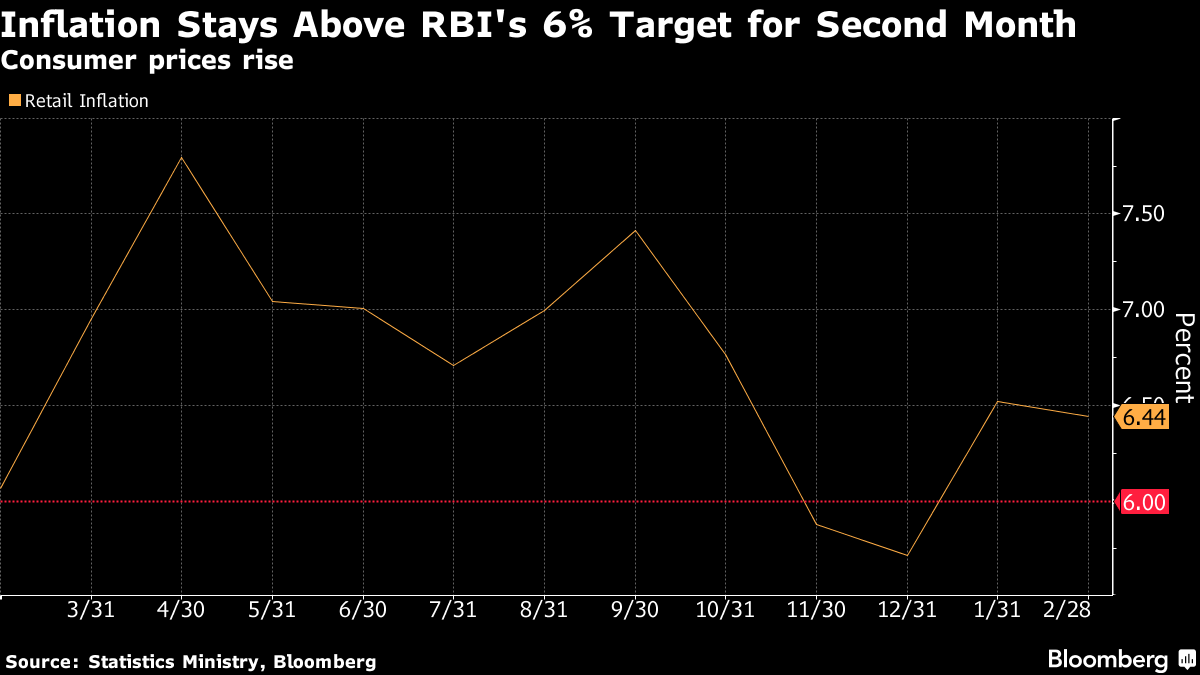

(Bloomberg) -- India's retail inflation breached the central bank's target for a second straight month in February, raising odds of further monetary tightening even as markets weigh the fallout of Silicon Valley Bank's collapse.

Consumer prices rose 6.44% last month from a year earlier, according to data released by the Statistics Ministry Monday. That's lower than a 6.52% gain in January and compares with a 6.40% median estimate in a Bloomberg survey.

Price pressures resurfacing after easing below 6% in the last two months of 2022 will probably convince RBI to increase the benchmark rate for a seventh straight time when it meets on April 6. A 25-basis-point hike, as seen by Goldman Sachs Inc. and Citigroup Inc. last month, will take the borrowing costs to a seven-year high.

“Given two consecutive CPI inflation prints above 6%, the monetary policy committee may go in for another rate hike,” said Aditi Nayar, chief economist at ICRA Ltd, adding that the global developments over the next three weeks could impact the RBI's decision.

The reading comes in the backdrop of sudden eruption of financial strains in the US after the closures of Silicon Valley Bank and Signature Bank, prompting traders to pare bets of a US rate increase this month, just days after Federal Reserve Chair Jerome Powell flagged the possibility of returning to bigger rate hikes as inflation proved persistent.

Food prices, which make up about half of the inflation basket, increased 5.95% from a year ago, while ‘fuel and light' rose 9.90%. Clothing and footwear costs also jumped sharply by 8.79%, while housing prices increased 4.83%, keeping core prices elevated.

Core inflation, which strips out volatile food and fuel costs, stayed above the 6% mark for the 17th month in a row, raising further concerns for rate-setters who will also have to factor in the risk of heat wave on India's farm sector and food production.

What Bloomberg Economics Says..

“India's headline inflation eased slightly in February as declines in fuel, electricity and core inflation offset slightly higher food inflation. Inflation holding above the Reserve Bank of India's 2%-6% target range for a second consecutive month is likely to tilt the balance in favor of another rate hike at the central bank's April review.”

— Abhishek Gupta, India economist

RBI has raised the policy rate by 250 basis points since May 2022 to 6.5% and an increase up to 6.75% would take India's repurchase rate to the highest since February 2016.

The impact of RBI's most aggressive policy tightening in a decade has started taking a toll on Asia's third-largest economy, with gross domestic product growth disappointing in the three months to December. The growth-inflation trade off has divided the MPC, with two of its six members calling for a pause in February to ensure economic growth isn't derailed.

(Updates with a chart and economist comment in the fourth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.