Overseas investors are returning to India's sovereign bonds eligible for global index inclusion as local debt gains on bets the central bank will boost liquidity.

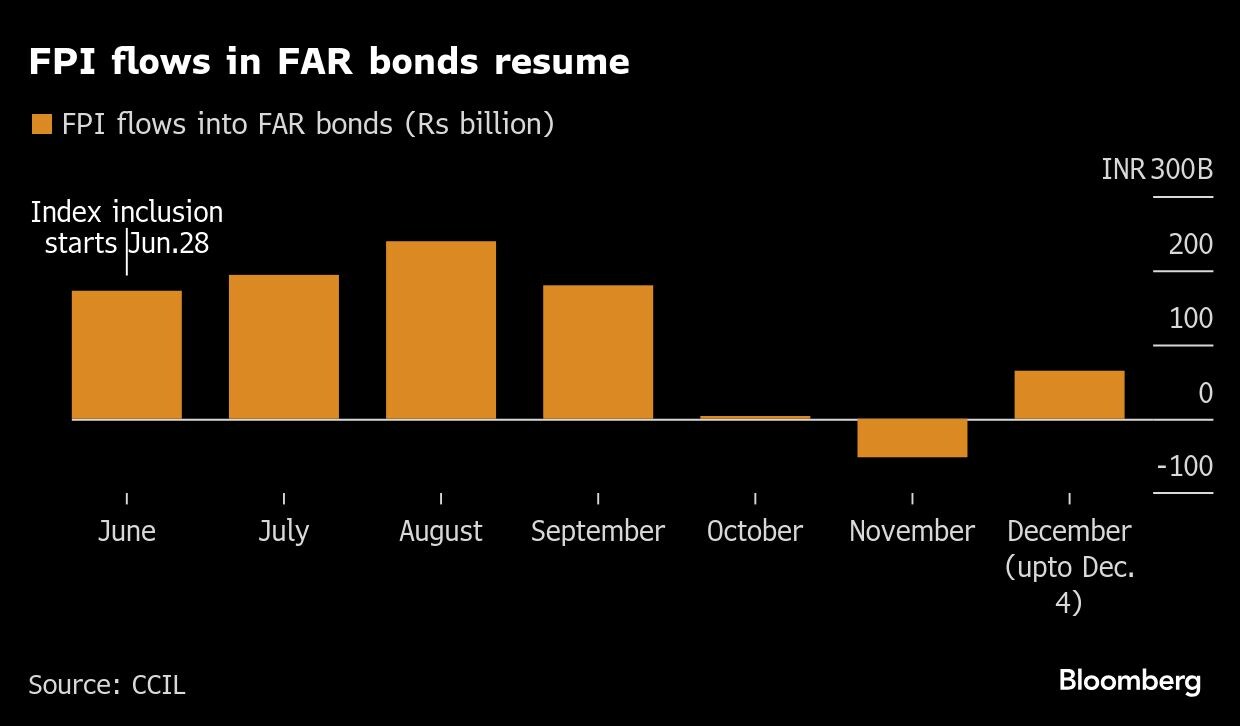

In just four days this month, global funds have added Rs 6,472 crore ($764 million) of so-called Fully Accessible Route bonds, Clearing Corp. of India Ltd. data showed. That has already more than offset the withdrawal of Rs 5,187 crore in November, the first monthly outflow since India's addition to JPMorgan Chase and Co.'s index in June.

Pressure is mounting on the Reserve Bank of India to announce liquidity injections and keep local borrowing costs anchored after a shocking slowdown in last quarter economic growth.

While the central bank will likely hold interest rates in its decision due Dec. 6 to fight above-target inflation, some traders are expecting measures such as bond purchases or a cut in the cash-reserve ratio.

Bonds have rallied following the GDP data Friday, with the 10-year benchmark yield dropping to its lowest level since February 2022 earlier this week. A rise in the dollar and US yields, driven by threats of inflation-stoking tariffs under a Trump presidency, prompted foreign funds to pare exposure to Indian debt last month.

While monetary easing would drive local bond yields lower and propel flows for now, the outlook on the dollar would be the key determinant of the longer-term trend, according to HSBC economists including Pranjul Bhandari.

“The dollar is never really a one-way street,” they said. “After overshooting, it may stabilize or weaken for a period. That would provide emerging market central banks an opportunity to cut rates and recoup lost FX reserves.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.