(Bloomberg) -- The Reserve Bank of India will likely delay cutting interest rates until the final quarter of the year, the latest Bloomberg survey shows, as inflation risks rise and the US Federal Reserve keeps rates on hold for longer.

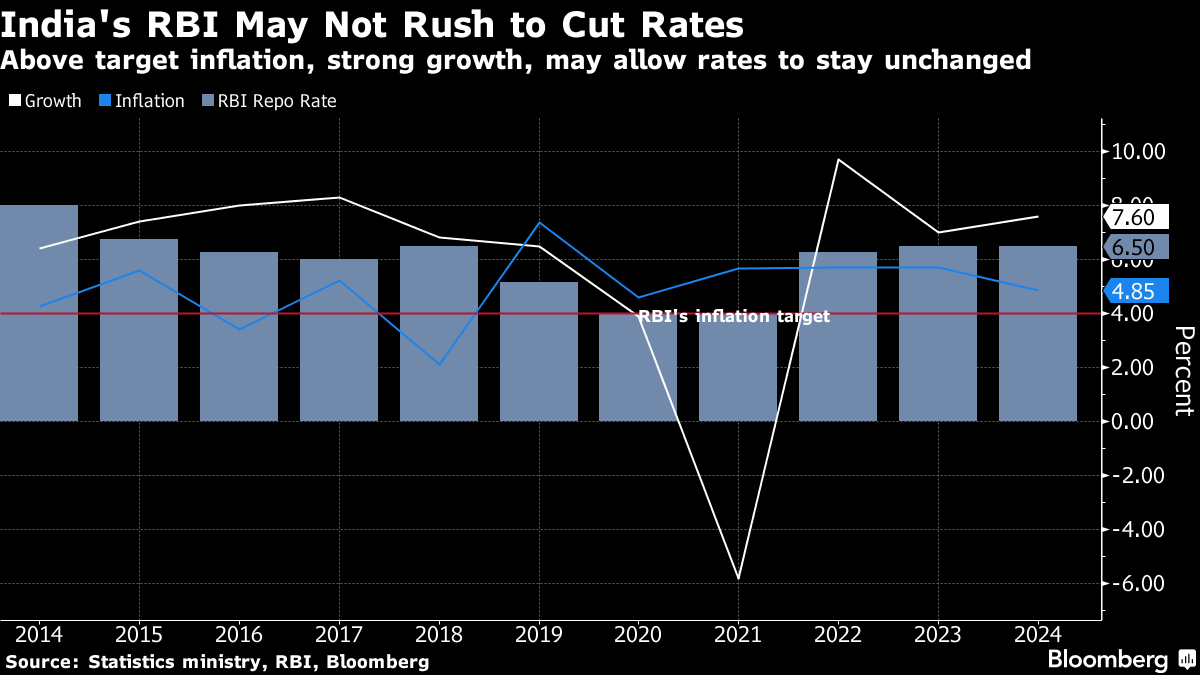

The RBI may start cutting its benchmark repurchase rate, currently at 6.5%, by a total of 50 basis points in the October-December period before pausing for a few months, the monthly survey shows. In the previous survey, economists had predicted a reduction in July-September quarter.

With India's growth-inflation dynamics healthy, “the global and geopolitical developments remain key to track,” said Achala Jethmalani, an economist at RBL Bank Ltd. “The monetary policy pivot in advanced economies, particularly the US Fed, could possibly alter the domestic rate scenarios too.”

The RBI has kept interest rates on hold for seven straight meetings, with Governor Shaktikanta Das signaling his unwillingness to ease rates unless inflation settles around the central bank's target of 4%. Inflation eased to below 5% in March, though an unusually hot summer could push up food costs.

Economists lowered their quarterly inflation forecasts through to December slightly, according to the Bloomberg survey. The projection for the full fiscal year was kept unchanged at 4.5%, the survey results showed.

Most economists don't expect the RBI to cut rates before the Fed pivots, which may not be until later in the year or at all in 2024. Central bankers in emerging markets like India would be wary of undermining their currencies further by cutting rates. Morgan Stanley predicted this month that most central banks in Asia will delay cutting rates, with India not expected to ease at all this year.

Radhika Rao, an economist at DBS Group Holdings Ltd., said India's rate cuts could be pushed back to the next financial year that starts in April 2025.

“Considering near-term inflation risks, strong growth and a delay in US rate cut expectations, we expect the RBI to stay on an extended pause in fiscal year 2024-25,” she wrote in a note this week.

Economists in the Bloomberg survey raised their projections for economic growth for the January-March quarter slightly to 6.3% from 6.1%. They see the economy expanding 6.7% in the full fiscal year that ends in March, up from last month's estimate of 6.6%, according to the survey.

“RBI should not be in a hurry to cut rates and has no need to hike rates further,” said Shaun Lim, a currency strategist at Malayan Banking Bhd. “The economy is doing well and inflation is under control.”

--With assistance from Anup Roy.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.