Chinese banks have begun raising consumer loan interest rates just about two weeks after cutting them to record lows, underscoring the challenges of lowering funding costs amid sustained pressure on margins.

Lenders including China Merchants Bank Co. and Bank of Jiangsu Co., which previously engaged in a price war by offering consumer loan rates as low as 2.58% annually, have now adjusted their rates to no less than 3%, according to online advertisements.

Major banks such as Industrial & Commercial Bank of China Ltd. and Agricultural Bank of China Ltd. will also implement the 3% floor rate starting in April, according to ads. These rates were as high as 10% about two years ago.

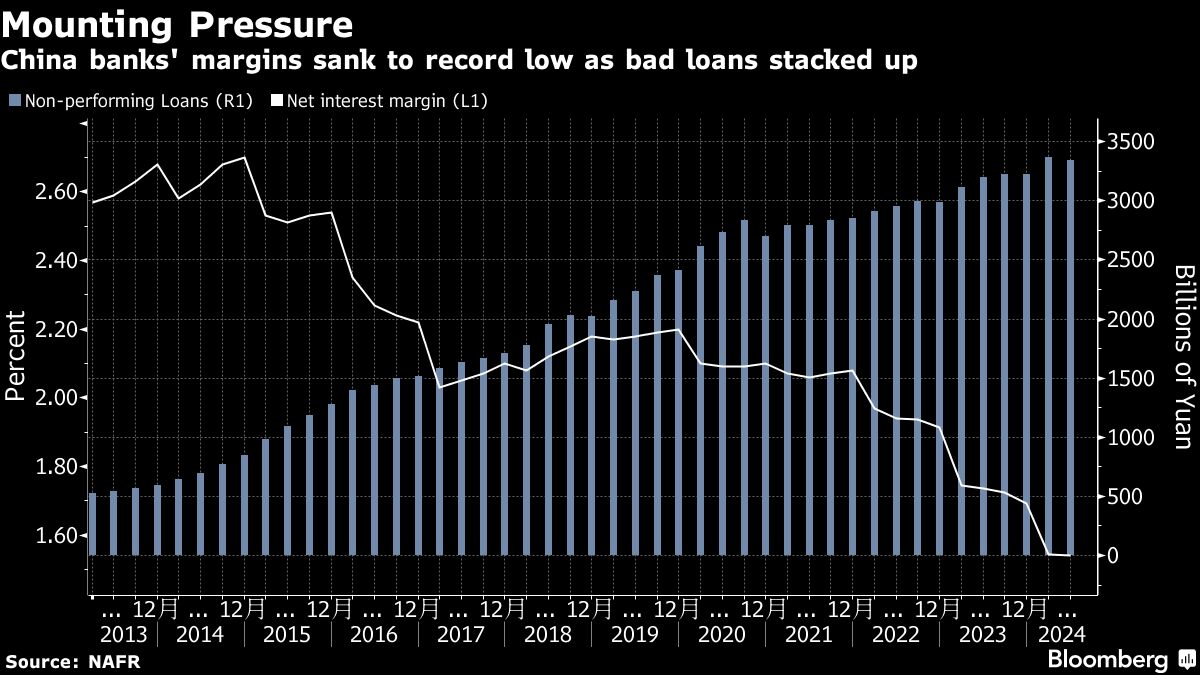

It remains unclear whether banks received guidance from regulators to make the shift. The record-low loan rates risk further squeezing the sector's net interest margin, which hit rock bottom of 1.52% at end of last year. Banks have been urged to expand the issuance of personal consumer loans while ensuring reasonable terms including credit limits and interest rates.

Jacqueline Rong, chief China economist at BNP Paribas, said authorities might have instructed the banks to lift consumer loan rates. “We think regulators aim to promote the fair pricing of credit risk, given the non-performing loan ratio of consumer loans have been picking up.”

The spread between consumer loans and outstanding mortgage rates might also encourage some borrowers to use cheaper consumer credit to prepay mortgages, she said, further hurting banks' net interest income.

The consumer loan rate price war means lenders will have to snatch existing consumer loan borrowers from their peers amid an unhealthy competition, bank officials familiar with the matter said earlier, adding the effectiveness in boosting consumption remains to be seen.

Beijing is seeking to ignite consumer spending and stoke local demand to help make the long-struggling economy less reliant on trade and exports. Still, boosting consumption has been a challenge since the end of the pandemic. Retail sales have been anemic, while consumer prices fell into deflation in February for the first time in over a year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.