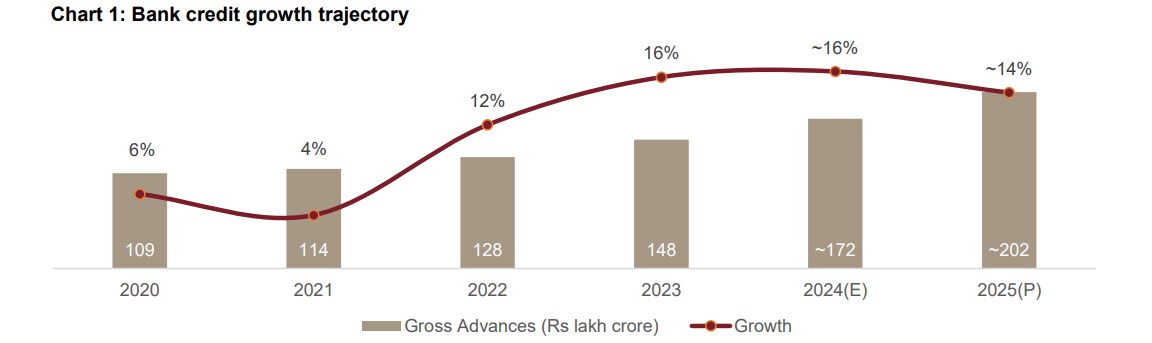

Bank credit growth may dip 200 basis points to 14% in the current fiscal due to revised risk weights and lower gross domestic product growth, according to Crisil Ratings. In fiscal 2024, credit growth was 16%.

The major factors driving credit demand are broadly intact, along with a revival in private corporate capital expenditure towards the second half of fiscal 2025, which can help accelerate credit growth, Crisil said in a report on Tuesday.

The retail segment will grow the fastest at 16%, while corporate credit—the largest segment—will see steady growth at 13%, the report said.

The growth in corporate credit will be supported by private sector industrial capex in fiscal 2025, said Ajit Velonie, senior director at Crisil Ratings.

"Steel, cement, and pharmaceuticals will lead the capex recovery. Emerging sectors such as electronics and semi-conductors, electric vehicles, and solar modules will also contribute to capex, especially over the medium term," he said.

Retail credit growth will fall to 16%, compared to 17% in fiscal 2024. But it will remain the fastest-growing segment for banks, Crisil said. "The high-base effect, especially with the merger of HDFC Ltd. with HDFC Bank Ltd. in fiscal 2024, will also have a bearing on retail growth."

In the current financial year, MSME segment growth may slow down to 15% from the robust 19% growth seen in fiscal 2024. A revival in downstream capex will support this segment, Crisil said. Agricultural credit growth will depend on monsoon trends but should witness a moderation due to strong fiscal 2024, it said.

Source: Crisil press release

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.