(Bloomberg) -- Maybe now more so than ever, the investment strategy of loading up on pick-and-shovel makers during the middle of a gold rush is playing out in the cryptocurrency world.

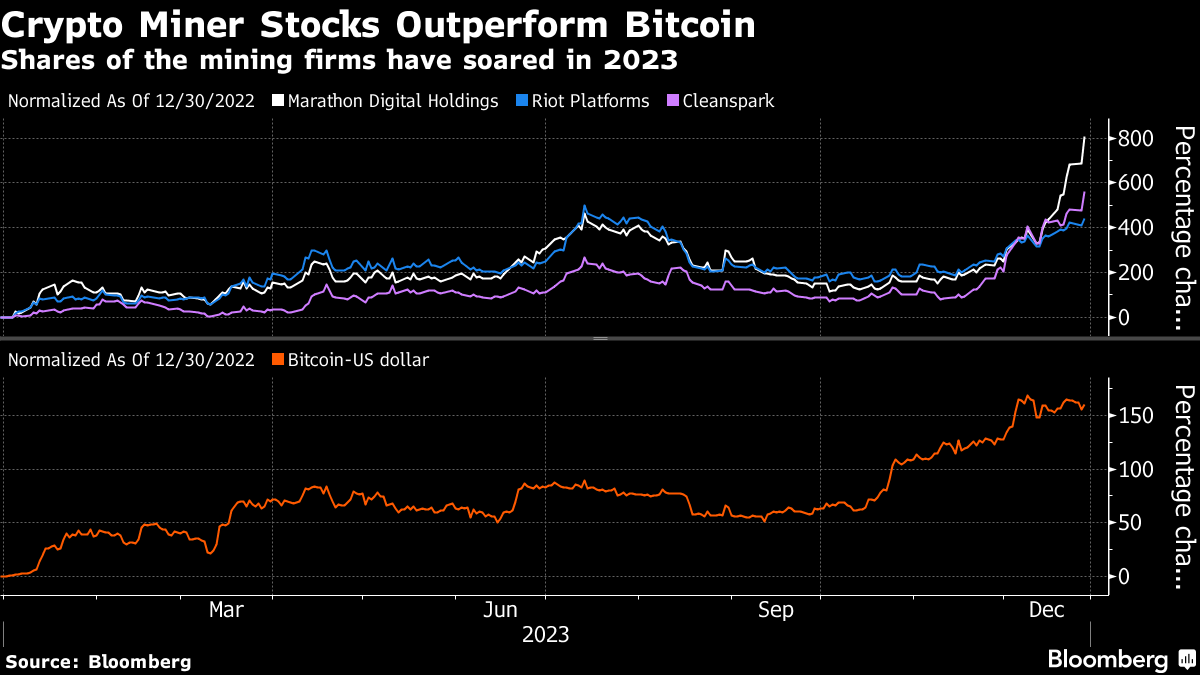

Shares of Bitcoin miners such as Marathon Digital Holdings and Riot Platforms are significantly outperforming the largest digital currency, posting gains this year of more than 800% and 400%, respectively. Meanwhile, the US crypto exchange Coinbase Global and Bitcoin proxy MicroStrategy have each jumped more than 350% during the same time period. Bitcoin is up around 160% in 2023.

Bitcoin mining is an energy-intensive process in which miners use specialized computers to validate transactions on the Bitcoin blockchain and earn rewards in the token.

The surge in the stocks comes as digital-asset mining companies expand operations to increase Bitcoin production with expectations that demand for the cryptocurrency will jump if US regulators allow exchange traded funds to hold it directly. In the next two weeks, Bloomberg Intelligence analysts forecast that the Securities and Exchange Commission will approve a spot Bitcoin ETF.

Riot Platforms recently announced large purchases of mining machines. Marathon, the largest miner by computing power, acquired new facilities to increase its mining efficiency, a notable shift from its long-held strategy as an asset-light mining company.

“Marathon Digital's announcement of acquiring new sites last week could lead to stronger mining efficiency metrics,” said Brian Dobson, managing director of equity research at investment bank Chardan. “That's what the investors are focused on.”

Marathon has gained for 11 consecutive trading sessions, more than doubling over that period to $31.07. The stock traded at more than $80 when Bitcoin reached its record high in November 2021.

The mining stocks may see more buying pressure and a short squeeze if the rally continues, pushing the prices even higher, according to Ihor Dusaniwsky, managing director of predictive analytics at S3.

Like the majority of cryptocurrencies, most crypto stocks began 2023 at the lowest price levels of the year after a series of industry scandals and bankruptcies such as the collapse of the FTX exchange, making them a popular target to bet against.

“The price move was not due to short covering from a short squeeze but from long buying pressure,” Dusaniwsky said. “MARA has a 100/100 squeeze score and if its stock price continues its recent trend, we should see more short covering and a definite short squeeze.”

The CoinShares Blockchain Global Equity Index is up 29% in December, on pace for its best month on record.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.