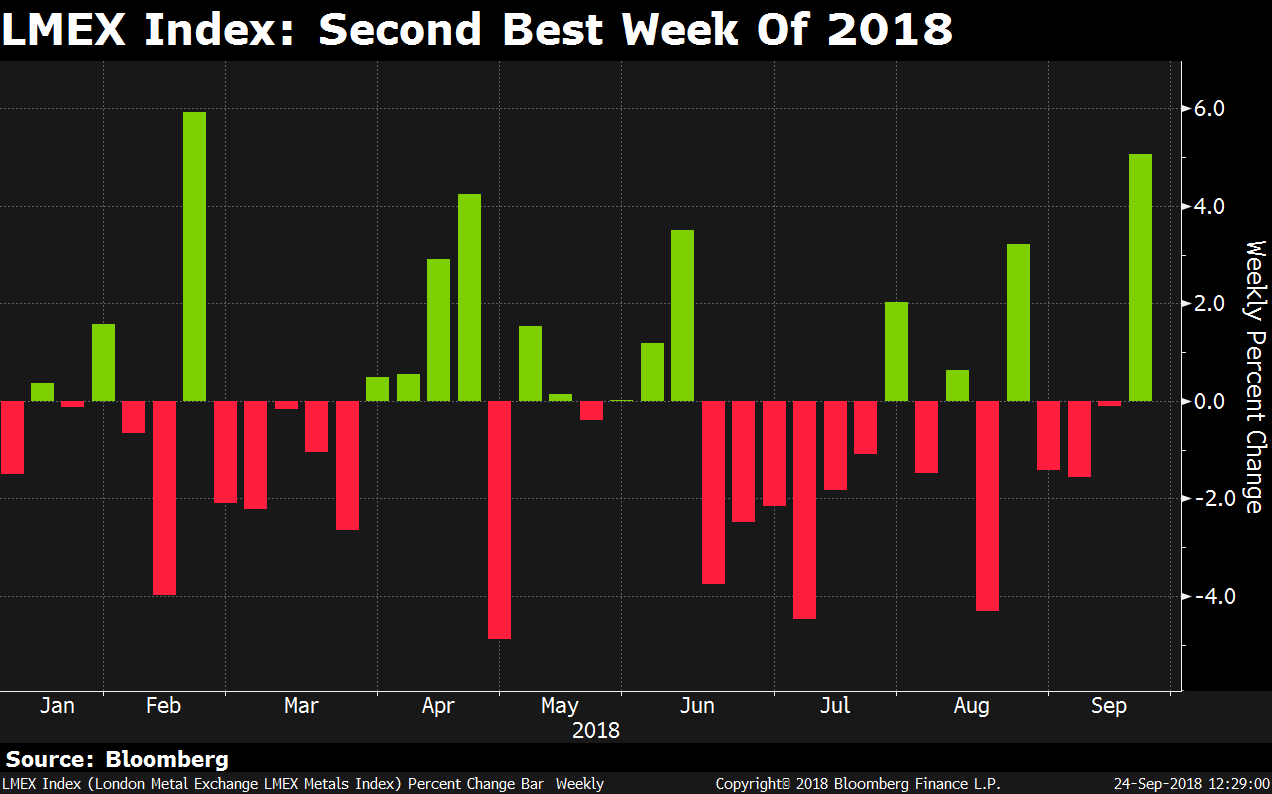

Metals may get more support after posting second-best weekly gains in the week ended Sept. 21. as the U.S. set tariffs against China at a lower rate than expected.

The market took heart from the lower tariff rates and came back into base metals, David Lennox, resource analyst at fatPROPHETS, said in an emailed statement to BloombergQuint. The U.S. dollar also weakened, providing another tailwind for the base metals, he said.

That comes after the LMEX, tracking key metals on the London Metals Exchange, jumped 5 percent last week. That's the most since week ended Feb 16. The metals index had snapped a three-week fall as the dollar index weakened for the second straight week. All the main metals except tin ended the week higher. Zinc and copper led the rally, gaining nearly 7 percent apiece, while nickel surged nearly 5 percent.

Base metals rallied last week as investors shrugged off concerns about the fallout of the Trump's trade war on the Chinese demand for key commodities, said Navneet Damani, assistant vice president at Motilal Oswal Financial Services Ltd. Concerns eased further this week, he said, as U.S. set tariffs at a lower rate.

Lennox expects the greenback to weaken further and volatility to persist. Zinc is the top bet owing to supply deficit amid demand from the steel sector. Nickel and copper are tied in the second spot in terms of preference. But for the rest of 2018, Lennox expects base metals to remain soft.

Robin Bhar, head of metals research at Societe Generale CIB, however, remains positive on industrial metals, with copper, nickel, lead and palladium as is top picks. “Given how far they have fallen, we recommend buying the dips as physical demand should pick up in 4Q 2018 for seasonal reasons,” said in an emailed response. “Micro fundamentals (positive demand, tightening supply and falling inventories) should come to the fore helping to offset some of the negative macro fundamentals.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.