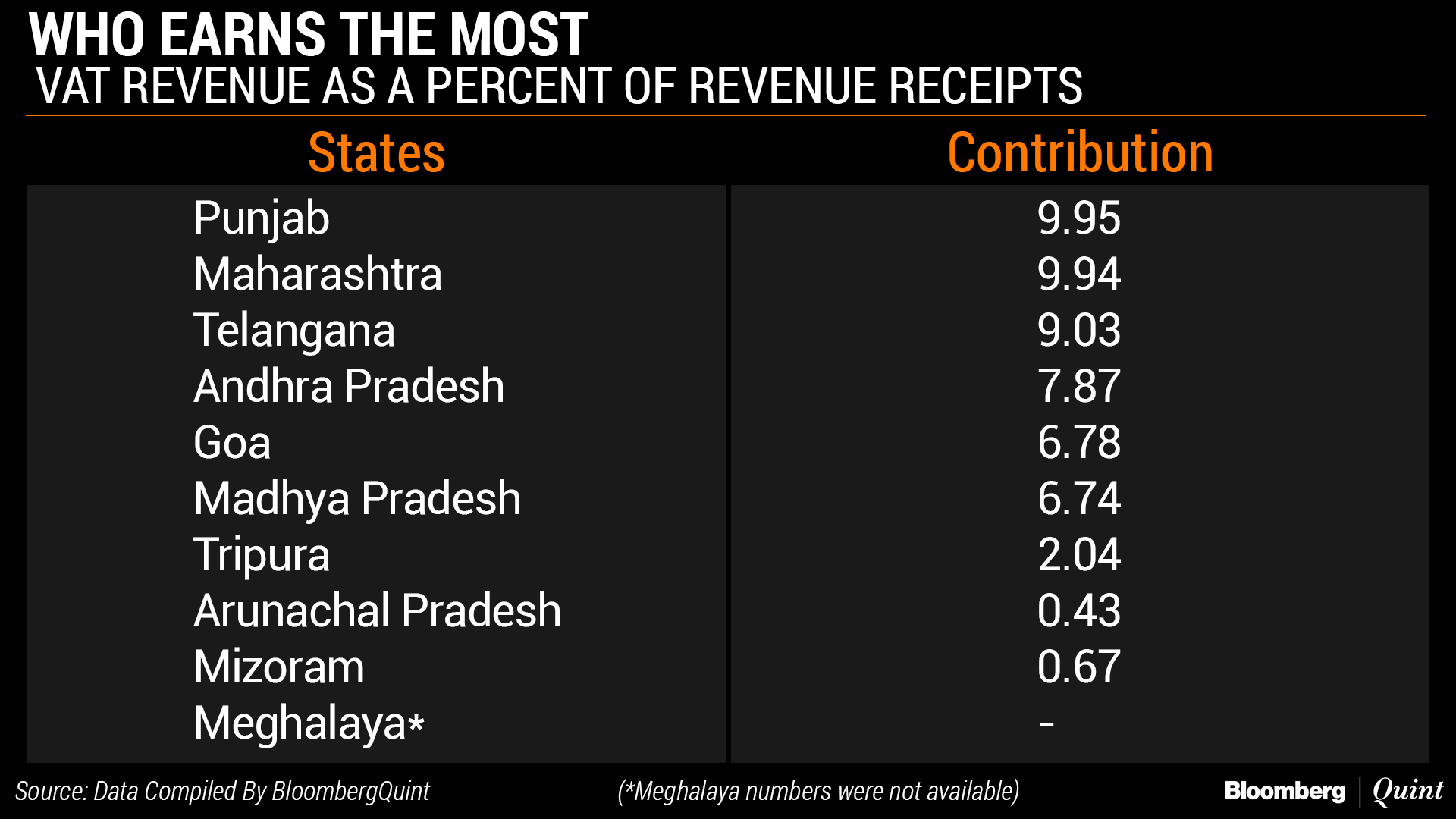

Maharashtra and Punjab are among the states that earn the most from value added tax on fuel.

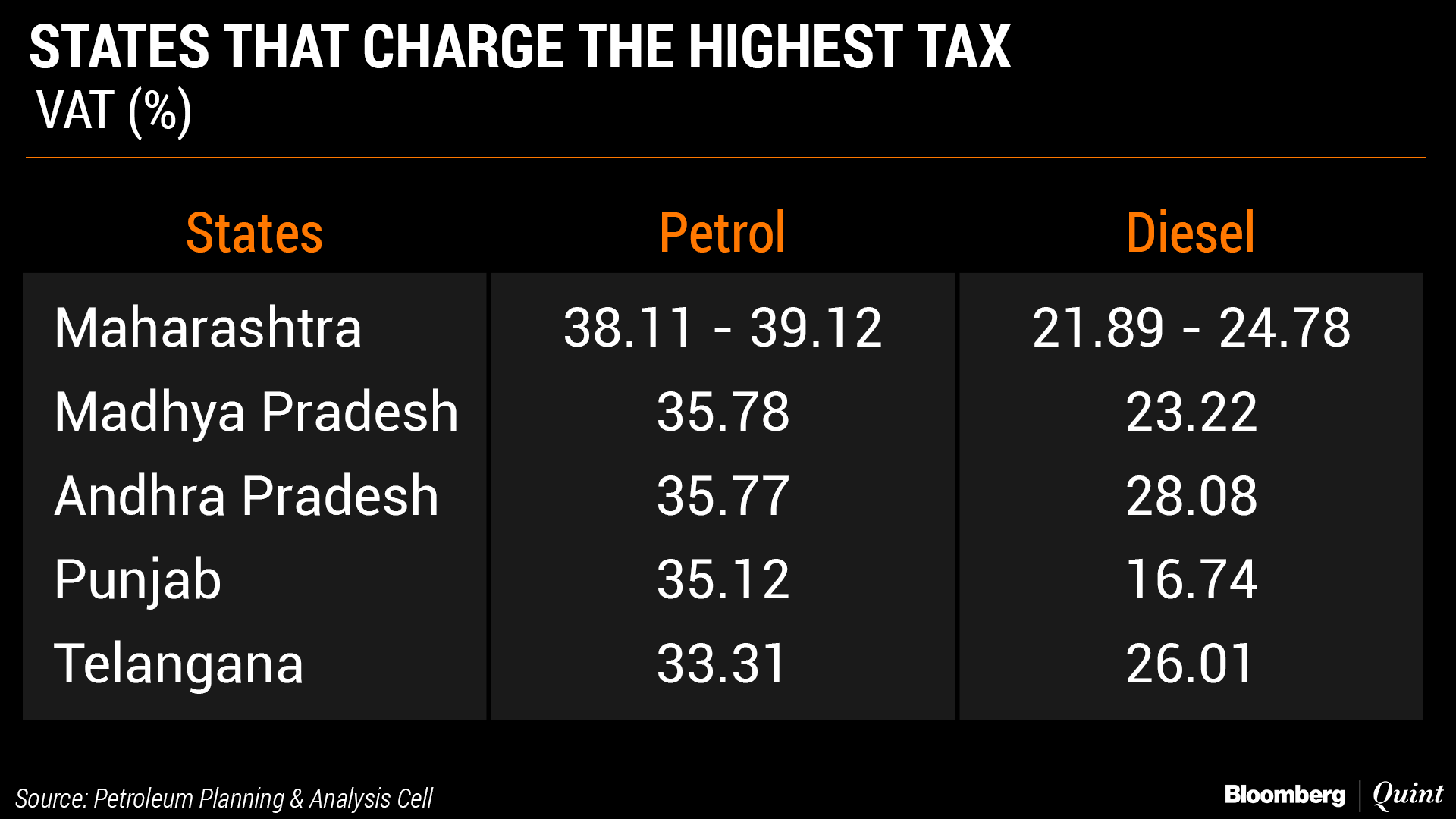

VAT on the sale of petroleum products contributes 9.95 percent of total revenue for Punjab, followed by 9.94 percent for Maharashtra. The two states are among the five where the rate of VAT on fuel is the highest.

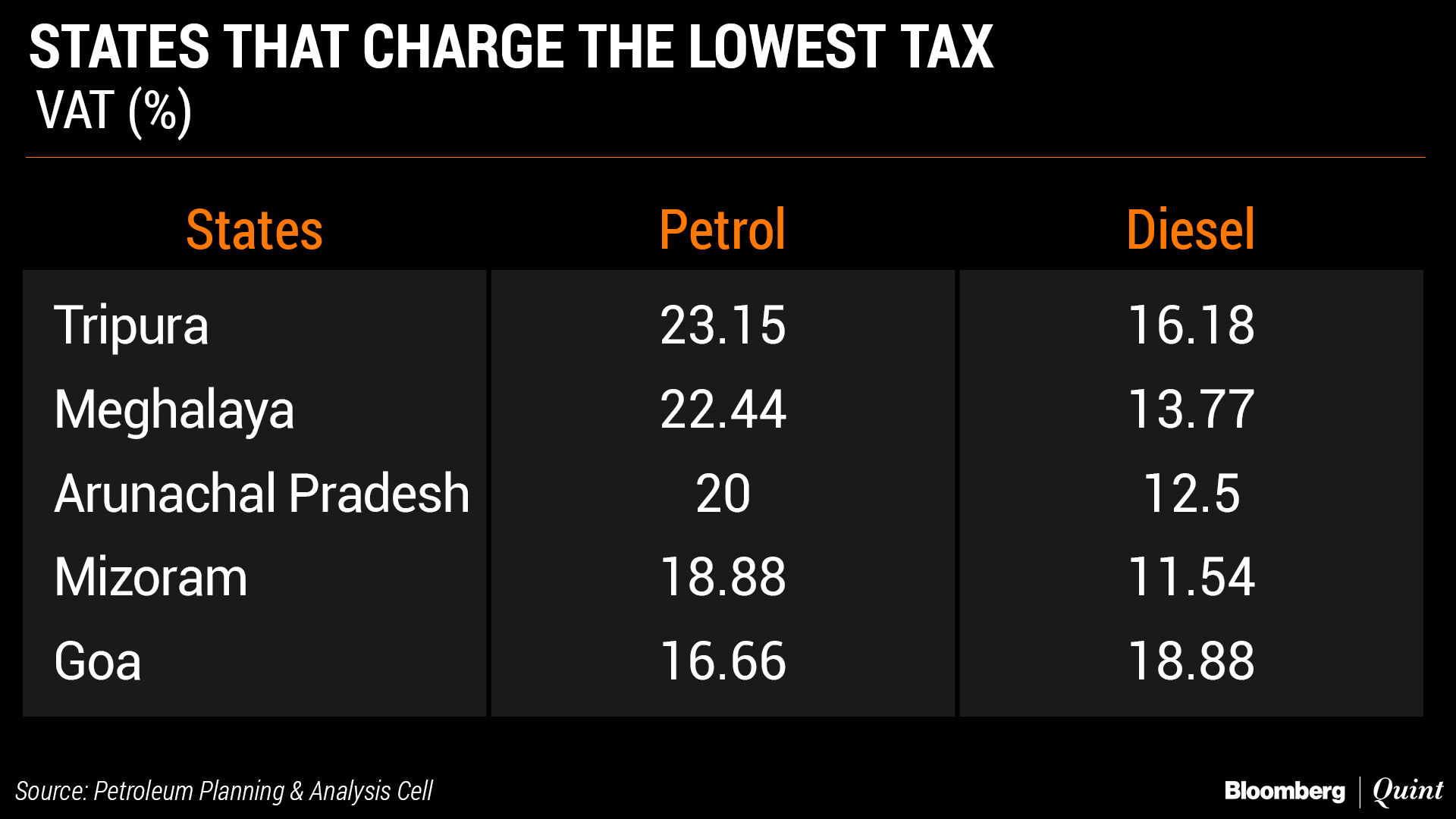

Mizoram and Goa are among the states which have the lowest rate of tax on fuel. Yet Goa earns about 7 percent of its revenue from the sale of petroleum products, while Arunachal Pradesh and Mizoram get less than a percent.

Fuel prices have been rising since mid-August due to a depreciation in the rupee against the dollar and higher crude.

Recently four states—West Bengal, Andhra Pradhesh, Rajasthan and Kerala—reduced VAT earned on sale of every litre of petrol and diesel to reduce the burden on consumers. This is after the central government cut the excise duty by Rs 2 a litre in October. The Union government now levies a total excise duty of Rs 19.48 a litre on petrol and Rs 15.33 a litre on diesel. VAT varies among states.

Prime Minister Narendra Modi is expected to hold a review meeting this weekend to explore ways to arrest rupee's weakness and rising fuel prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)