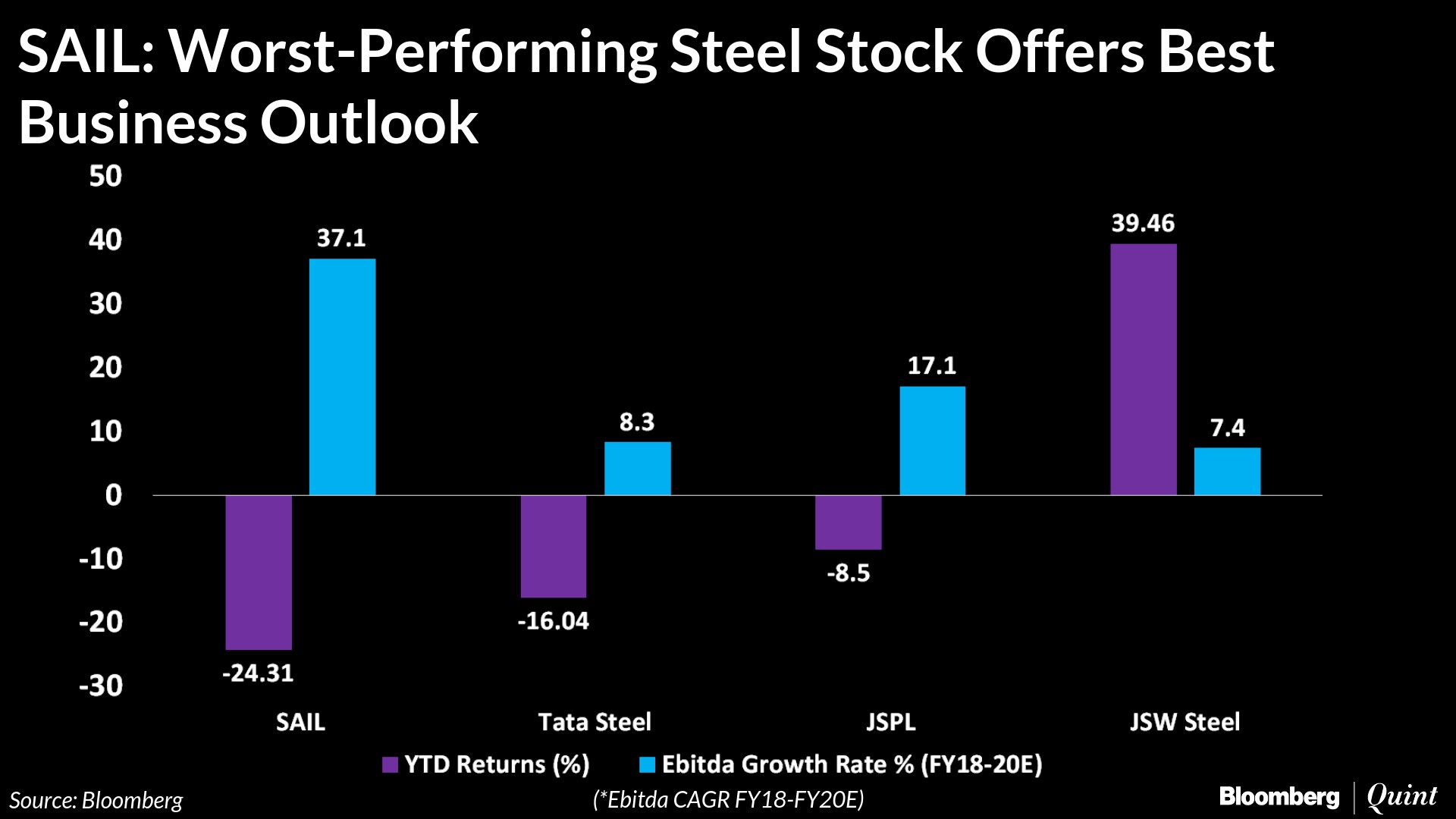

Steel Authority of India Ltd. is the worst-performing stock so far this year. Yet, analysts expect its business to grow at a faster pace than peers over two years.

Shares of the steelmaker slumped nearly 25 percent this year, Bloomberg data showed. That compares with a 16 percent and an 8.5 percent decline in Tata Steel Ltd. and Jindal Steel & Power Ltd., respectively, and about a 40 percent rise in JSW Steel Ltd.

Analysts expect SAIL's operating profit to grow at an annualised rate of 37 percent over FY18-20, higher than 7-17 percent for peers.

Factors such ramping up of volumes over the next two years, cost cuts and a better product mix are expected to fuel the steelmaker's earnings growth, according to brokerages, including BP Equities, JPMorgan and Edelweiss Securities.

The estimated earnings before interest, tax, depreciation and amortisation for financial years through March 2019 and March 2020 are 20-30 percent higher than peers, as the street starts factoring in the company's turnaround prospects, Edelweiss Securities said. SAIL, according to the brokerage, is expected to report a positive profit after tax for the ongoing financial year as operations turn around and modernisation plan nears completion.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.