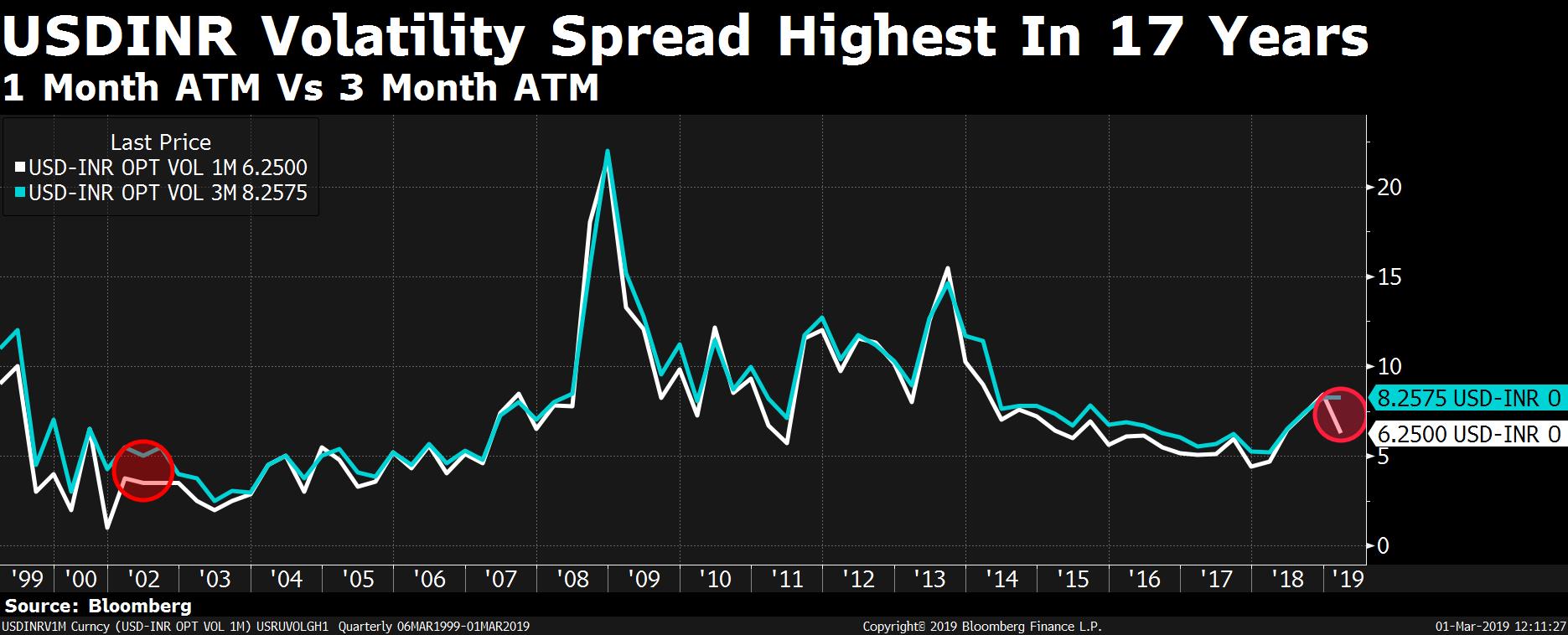

The gap between one- and three-month rupee-dollar volatility spread has spiked to its highest in about 17 years amid uncertainty about the general election.

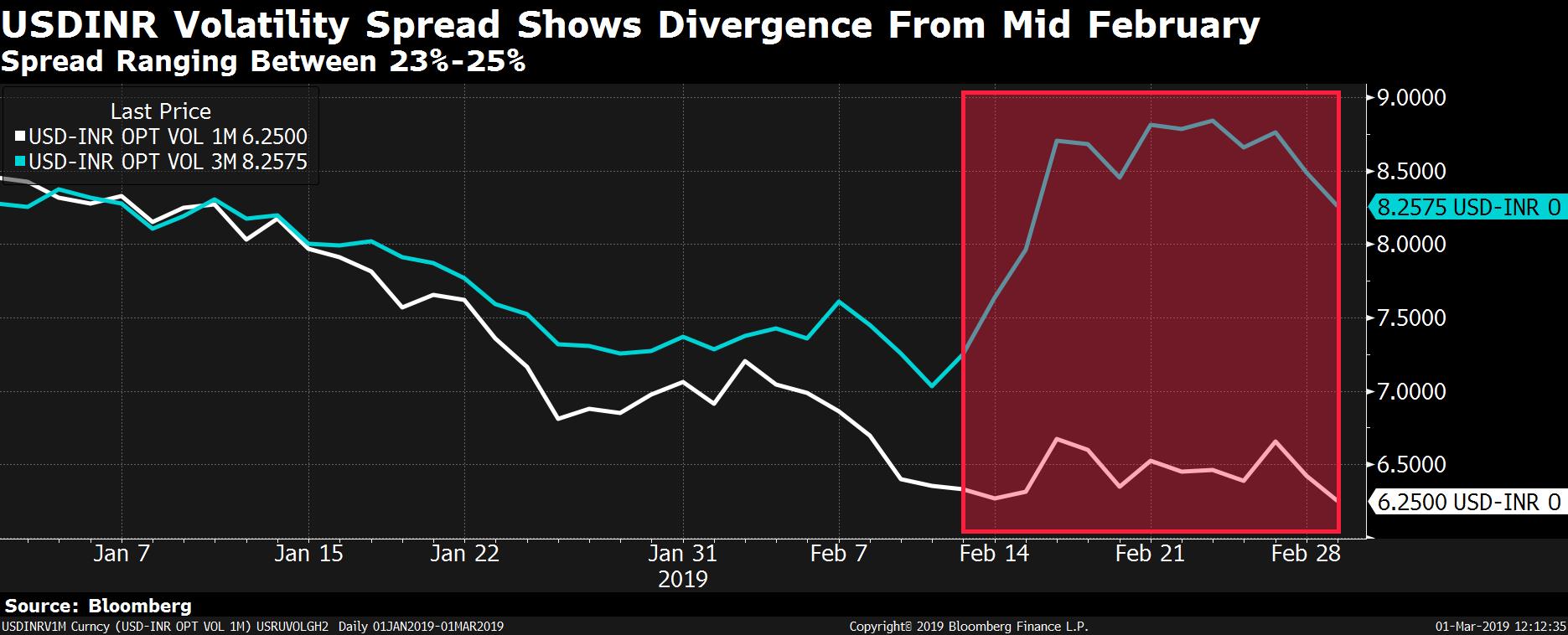

While one-month volatility spread has largely remained stable, the three-month reading started rising from Feb. 12 and only increased after the Feb. 14 terror attack in Pulwama. The gap has since remained at more than 20 percent. The general election results will be out in about three months.

The spike in three-month volatility spread has been fuelled by the uncertainty in election results and the markets have priced this in, according to Ananth Narayan, international banking and financial market expert and professor at SP Jain Institute. The one-month volatility hasn't factored in the elections, and he expects the divergence to narrow from April 15.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.