Shares of Uno Minda Ltd. rose to their highest level since listing after Goldman Sachs initiated coverage with a 'buy' rating. The company is poised to leverage the growth of the industry, the brokerage house said.

Goldman Sachs has set the target price for the stock at Rs 1,350 apiece, implying an upside of 27.87% from Wednesday's closing price. The auto-equipment maker is benefiting from the ongoing premiumisation of sports utility vehicles, motorcycles and electric scooters, according to the brokerage.

The upcoming capacity in alloy wheels, lighting, electric powertrain and motor supply optionality could be positive key catalysts for Uno Minda, Goldman Sachs said in note on Wednesday.

Regarding key risks, the brokerage stated that if the company's share in automotive switches peaks, the demand for automobiles slows down, and the growth focus shifts to free cash flow.

Key risks to the stock include Uno Minda's share in automotive switches peaking, the demand for automobiles slowing down, and shift in growth focus to free cash flow.

Uno Minda manufactures and supplies OEMs with exclusive automotive solutions and systems. It is also a leading manufacturer of automotive switching systems, auto lighting systems, automotive acoustics systems, automotive seating systems, and alloy wheels.

Key Takeaways From Goldman Sach's Note

Goldman Sachs has initiated coverage on Uno Minda with a 'buy' rating and a target price of Rs 1,350 apiece, implying a 28% upside.

Uno Minda is well-positioned to grow in the industry.

Select businesses are benefiting from the ongoing premiumisation shift to SUVs, premium motorcycles, and EV scooters.

Currently, it enjoys more than 50% share in auto switches, over 40% in four-wheeler alloy wheels, and sub-25% in lighting and seating.

Key catalysts are the Korean OEM opportunity, EV powertrain/motor supply optionality, and upcoming capacity in alloy wheels and lighting.

Risks: include peak switch share, auto demand slowdown, and growth focus over free cash flows.

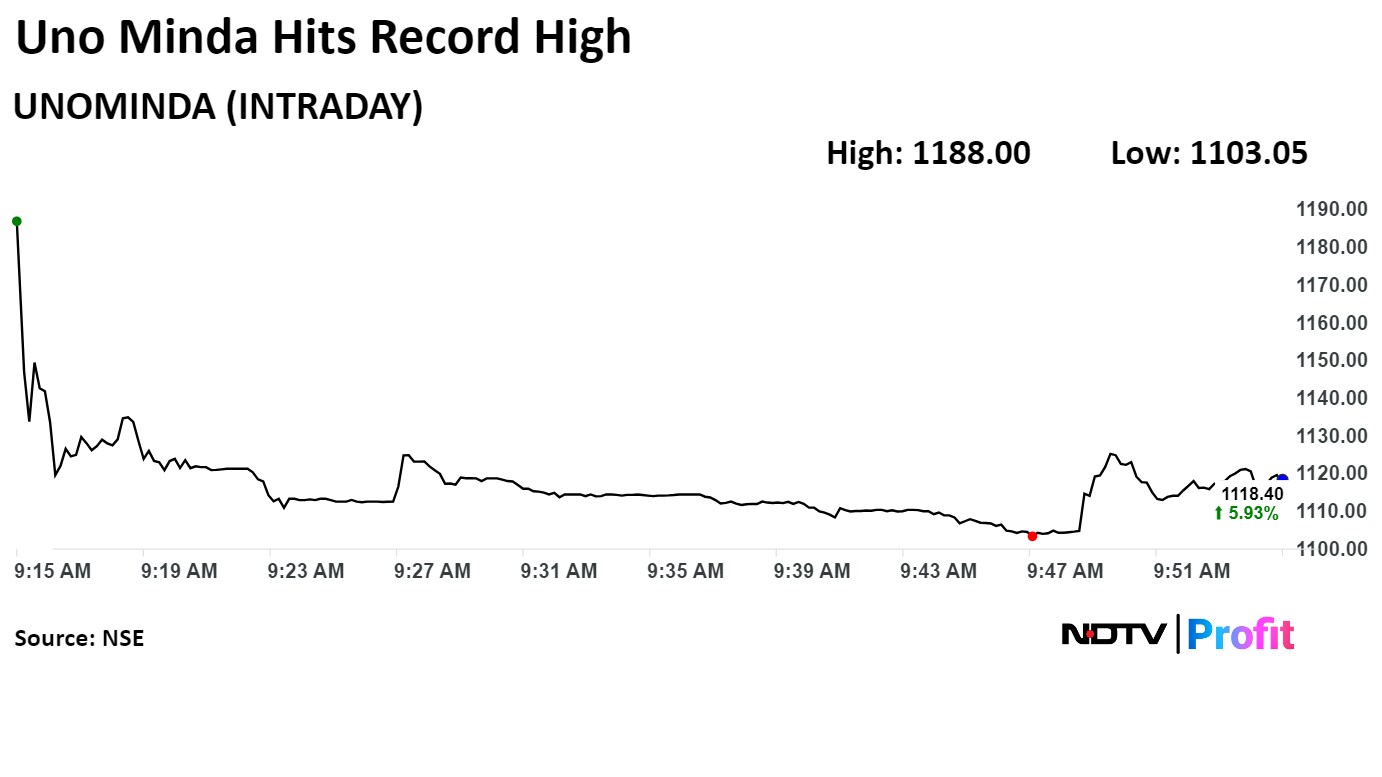

Shares of Uno Minda jumped 12.53% to a record high of Rs 1,188.00 apiece. It pared gains to trade 4.16% higher at Rs 1,099.65 apiece as of 10:18 a.m., compared to a 0.1% decline in the NSE Nifty 50 index.

The stock gained 87.3% in 12 months and 59.75% on a year-to-date basis. Total traded volume so far today was 1.24 times its 30-day average. The relative strength index was at 80.21, which implied the stock was overbought.

Out of 18 analysts tracking the company, 12 maintain a 'buy' rating, three recommend a 'hold,' and three suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 18.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.