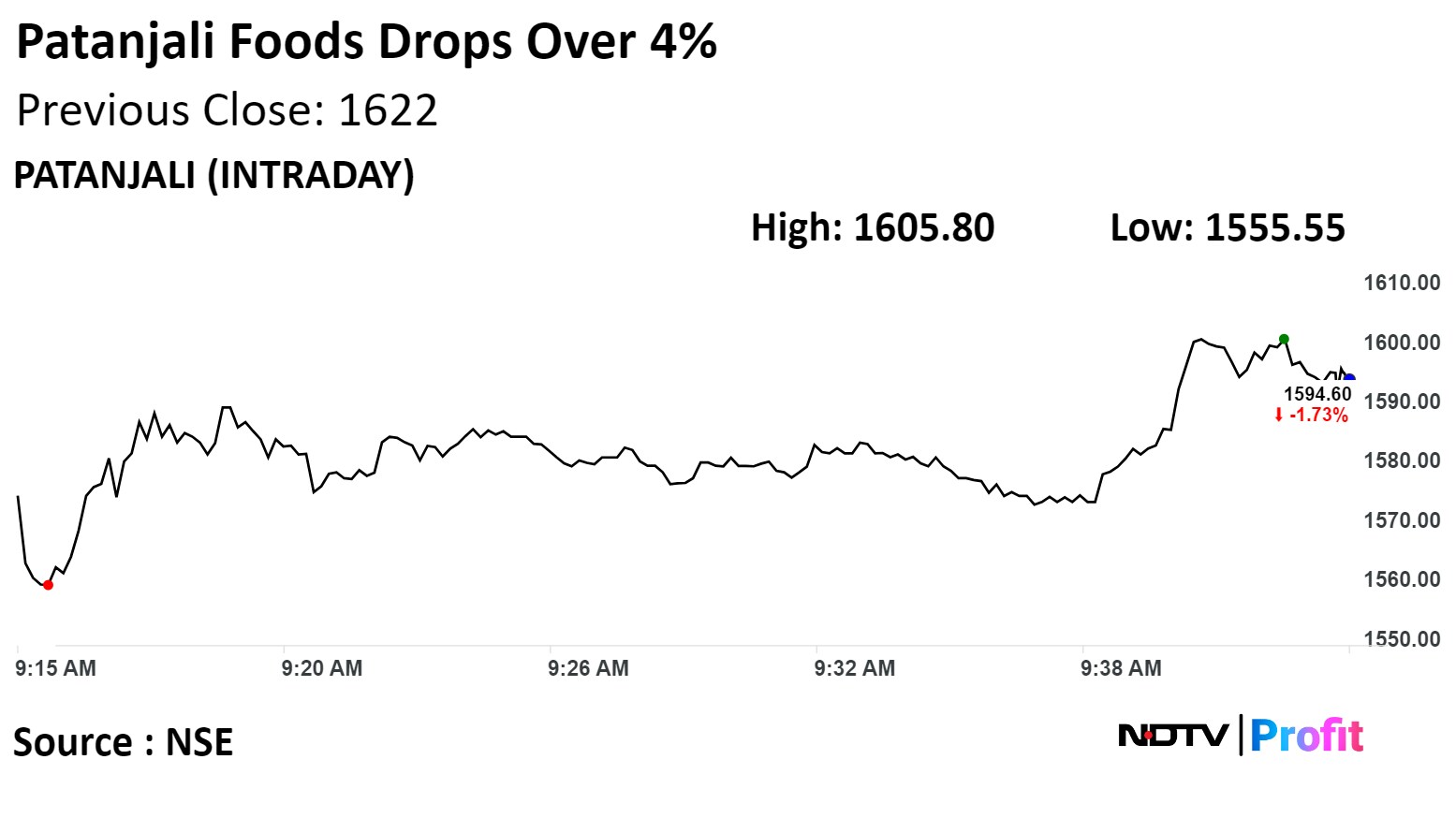

Shares of Patanjali Foods Ltd. dropped over 4% to the lowest level in two weeks on Wednesday.

On Tuesday, the Supreme Court restrained promoter group firm Patanjali Ayurved Ltd. from advertising medicinal products manufactured and marketed by it that aim to address diseases or ailments specified in the Drugs and Magic Remedies (Objectionable Advertisements) Act.

The apex court observed the entire country has been "taken for a ride" and served a contempt notice to Patanjali Ayurved and Managing Director Acharya Balkrishna for publicly disobeying its orders as the company had continued to run its false ads even after giving an undertaking to it.

In an exchange filing on Tuesday evening, Patanjali Foods said its business operations and financial performance would not be impacted because of the observations on ads related to ayurvedic medicines sold by the promoter group firm.

On the NSE, Patanjali Foods' stock fell as much as 4.14% during the day to Rs 1,555.55 apiece, the lowest since Feb. 14. It was trading 2.61% lower at Rs 1,580.35 per share, compared to a 0.02% decline in the benchmark Nifty 50 at 9:29 a.m.

The share price has risen 71.07% in the last 12 months. The total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 46.26.

Two analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.