.png?downsize=773:435)

IndusInd Bank Ltd.'s stock rose over 3% on Monday after the bank released the shareholding data for the quarter that ended December 2024.

As per the stock exchanges, the foreign holding limit at the end of December quarter stood at 46.63%, compared to 59.62% at the end of second quarter. Foreign holding stood at 63.49% at the end of March 2024 quarter. The private sector bank has seen its foreign holding decline for the last five quarters from September 2023.

Foreign portfolio investors held 24.74% of IndusInd's total shares at the end of December 2024 compared to 39.79% at the end of March 2024. Foreign investors have gradually reduced their exposure to the private lender after asset quality issues emerged with respect to its microfinance subsidiary, Bharat Financial Inclusion Ltd., impacting the bank's balance sheet.

IndusInd Bank Share Price

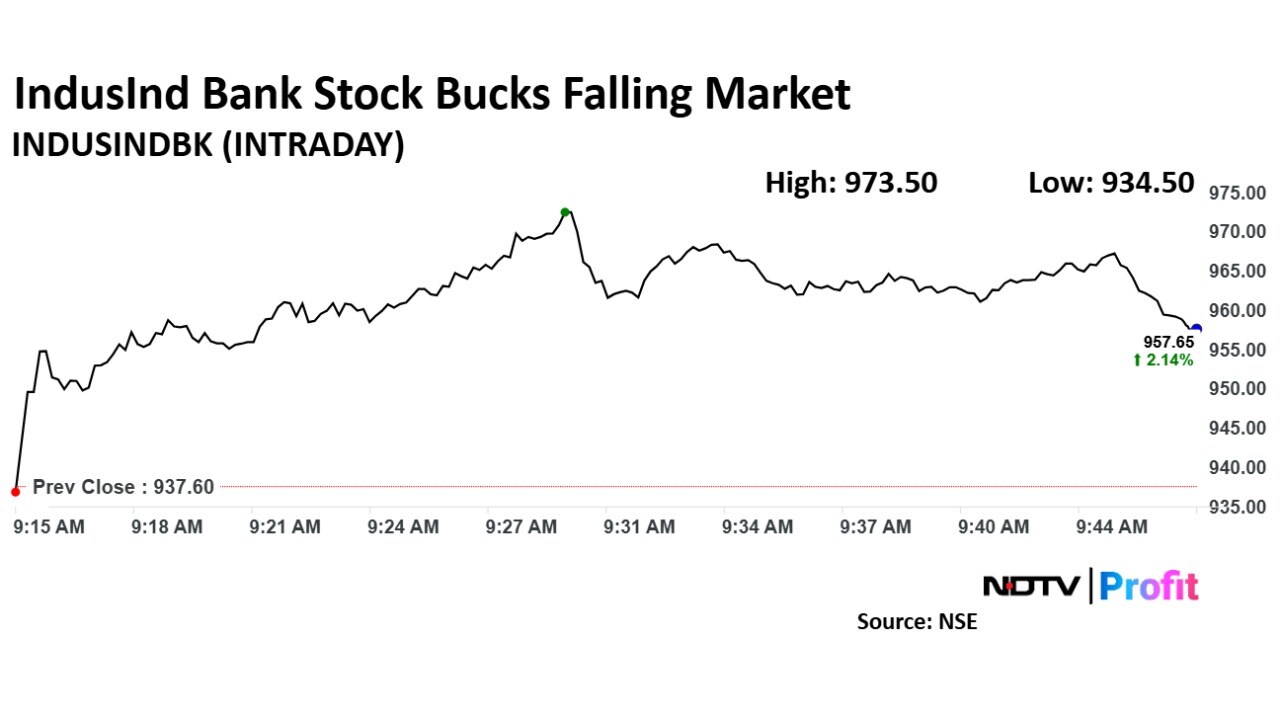

IndusInd Bank stock rose as much as 3.83% during the day to Rs 973.5 apiece on the NSE. It was trading 2.77% higher at Rs 963.55 apiece, compared to an 0.77% decline in the benchmark Nifty 50 as of 10:09 a.m.

It has fallen 43.06% in the last 12 months. The total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 45.11.

36 out of the 50 analysts tracking the bank have a 'buy' rating on the stock, 12 recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 958.55, implying an upside of 41.0%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.