The restrictions placed by the RBI on IIFL Finance Ltd.'s gold-loan disbursement can impact the company's earnings and lower the co-lending income, according to Jefferies India Pvt.

The Reserve Bank of India's restriction on disbursing gold loans due to material supervisory concerns should dent earnings due to rapid unwinding of the profitable gold-loan book, the brokerage said in a note.

Jefferies has downgraded the gold-loan provider to 'hold' with a target price of Rs 435 apiece.

The timing of the lifting of the ban is uncertain, but assuming the ban stays for nine months, the brokerage cut the estimates for the FY25 earnings per share by 26–27% and the return on equity by 460–480 basis points.

The RBI barred IIFL Finance on Monday from disbursing gold loans with immediate effect. The regulator has asked the company to stop sanctioning any new gold loans. It has also been barred from assigning, securitising and selling any of its gold loans. However, the central bank has said that the company can continue servicing its existing loans.

"We expect subdued earnings and uncertainty around the timing of removal of the ban on gold loans would weigh on valuation multiples till clarity emerges," Jefferies said. Faster resolution of the gold-loan ban could aid earnings, it said.

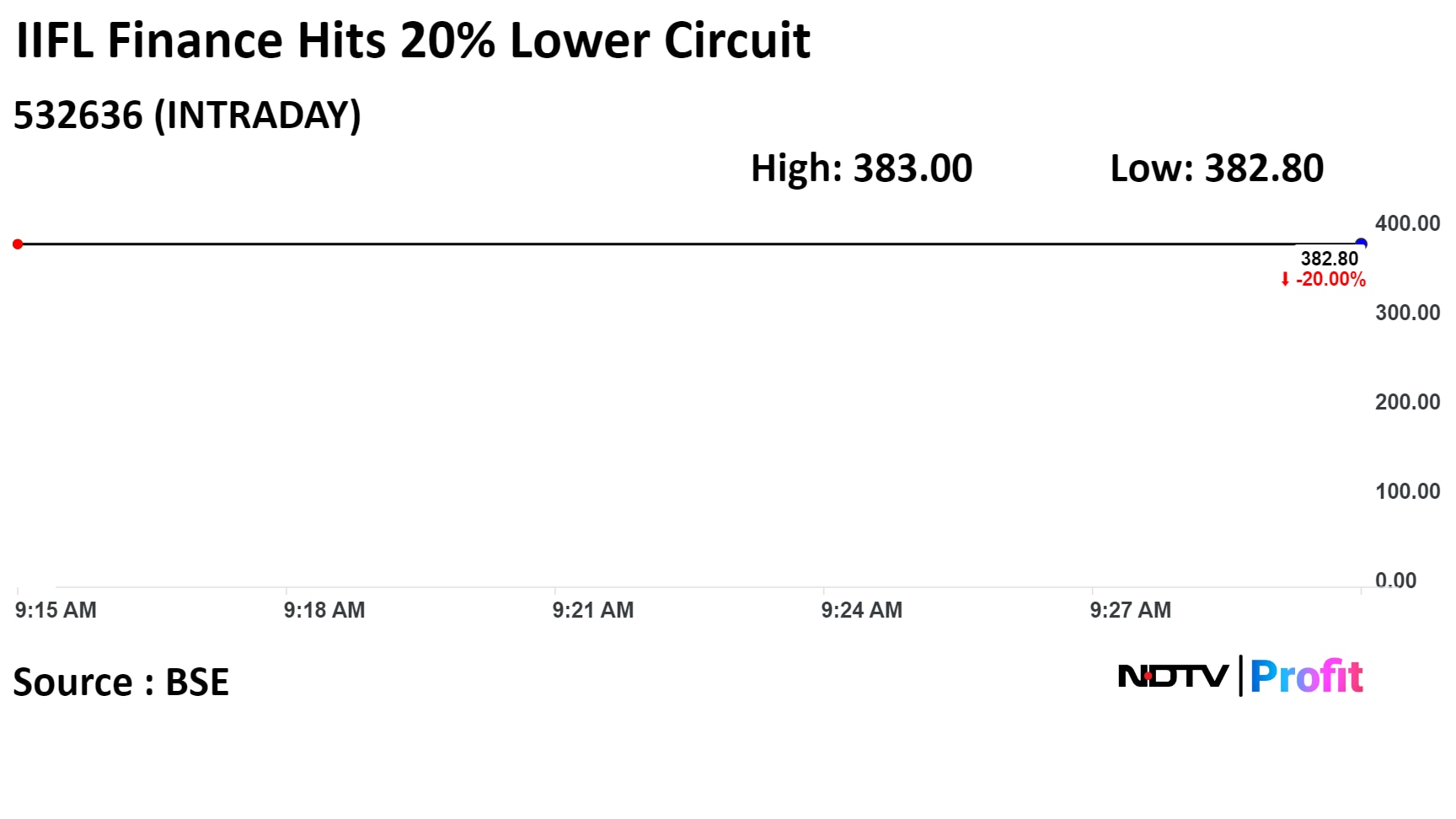

IIFL Finance's stock fell as much as 20% during the day to a 52-week low of Rs 382.20 apiece on the NSE, compared to a 0.10% decline in the benchmark Nifty 50 as of 9:27 a.m.

The share price has fallen 15.8% in the last 12 months. The total traded volume so far in the day stood at 410 times its 30-day average. The relative strength index was at 19.2.

Six out of the seven analysts tracking the company have a 'buy' rating on the stock, while one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 88.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.