Indian aluminium producers stand to gain as U.S. sanctions on United Co. Rusal, the world's biggest producer of the base metal outside China, will tighten the supply globally.

Integrated domestic aluminium producers — with presence from raw materials to the final product — like Hindalco Ltd. and National Aluminium Company Ltd. stand to gain more than Vedanta Ltd., said Goutam Chakraborty, analyst-institutional research at brokerage Emkay Global Financial Services.

Aluminium prices on the London Metal Exchange jumped about 8 percent in the past two days after sanctions on 12 Russian companies, including billionaire Oleg Deripaska-led Rusal, for Russia's intervention in Ukraine and its meddling in the U.S. elections. Rusal accounts for about 13 percent of the global output outside China. It produced 3.71 metric tonnes of primary aluminum in 2017 and earned about 14 percent of its revenue from the U.S., its largest importer, according to a report by Edelweiss Securities.

Shares of Hindalco gained 7.4 percent since the U.S. announced fresh sanctions. In comparison, Nalco rose 2.48 percent and Vedanta declined 0.3 percent.

Vedanta Ltd. Chairman Anil Agarwal told BloombergQuint that the prices of aluminium could rise up to 50 percent if sanctions on Rusal continue. He expects prices to vary between $2,500 and $3,000 a metric tonne from the current minimum average of $2,000-2,200.

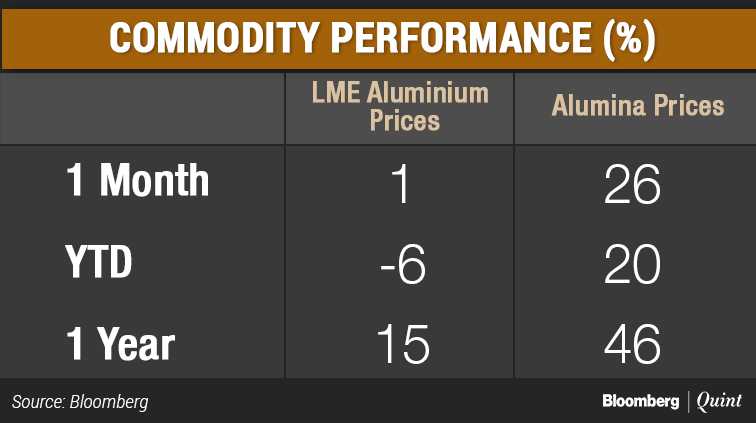

The U.S. action against Russia is not the only reason aluminium prices could go up. Prices of alumina, a key raw material, also rose 26 percent in the past one month due to a partial shutdown at Alunorte, the world's largest alumina refinery located in Brazil. That's expected to further impact the aluminium supply chain.

In fact, aluminium prices have fallen 6 percent so far this year compared to a 20 percent rise in alumina.

Aluminium prices are expected to hold strong due to supply disruption, alumina woes and a lower inventory, Edelweiss Securities said. Higher alumina and aluminium prices will benefit Hindalco due to its integrated operations and Vedanta for its ability to pass on the higher aluminium costs, said the brokerage. It sees some near-term headwinds for Hindalco's subsidiary Novelis as it may struggle to pass on higher costs.

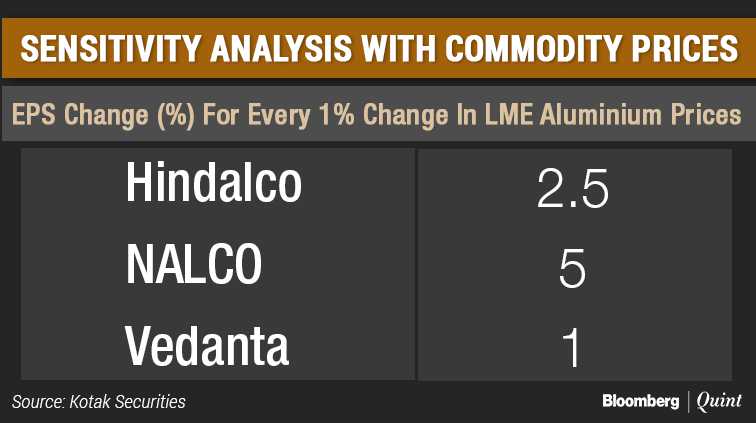

Aluminium has the best demand outlook among base metals, Kotak Securities said. The brokerage has a positive view of the non-ferrous segment. It expects Nalco's earnings to benefit the most from the rise in prices.

The state-run company derives 80 percent of its earnings before interest, depreciation and amortisation from alumina sales. In an earlier interview with BloombergQuint, the company management said every $10 rise in alumina prices boosts its Ebitda by Rs 85 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.