Lower crude oil prices and falling refining margins are likely to hurt state-run oil retailers' earnings in the quarter ended December.

Brent crude—the Asian benchmark—averaged 9 percent lower and the Singapore gross refining margin fell to its lowest in five years at the end of December, according to data compiled by BloombergQuint.

With a fall in oil prices and a weaker refining margin, there is a high probability that fuel retailers could suffer a loss in the third quarter, according to Nitin Tiwari, oil and gas analyst at Antique Stock Broking.

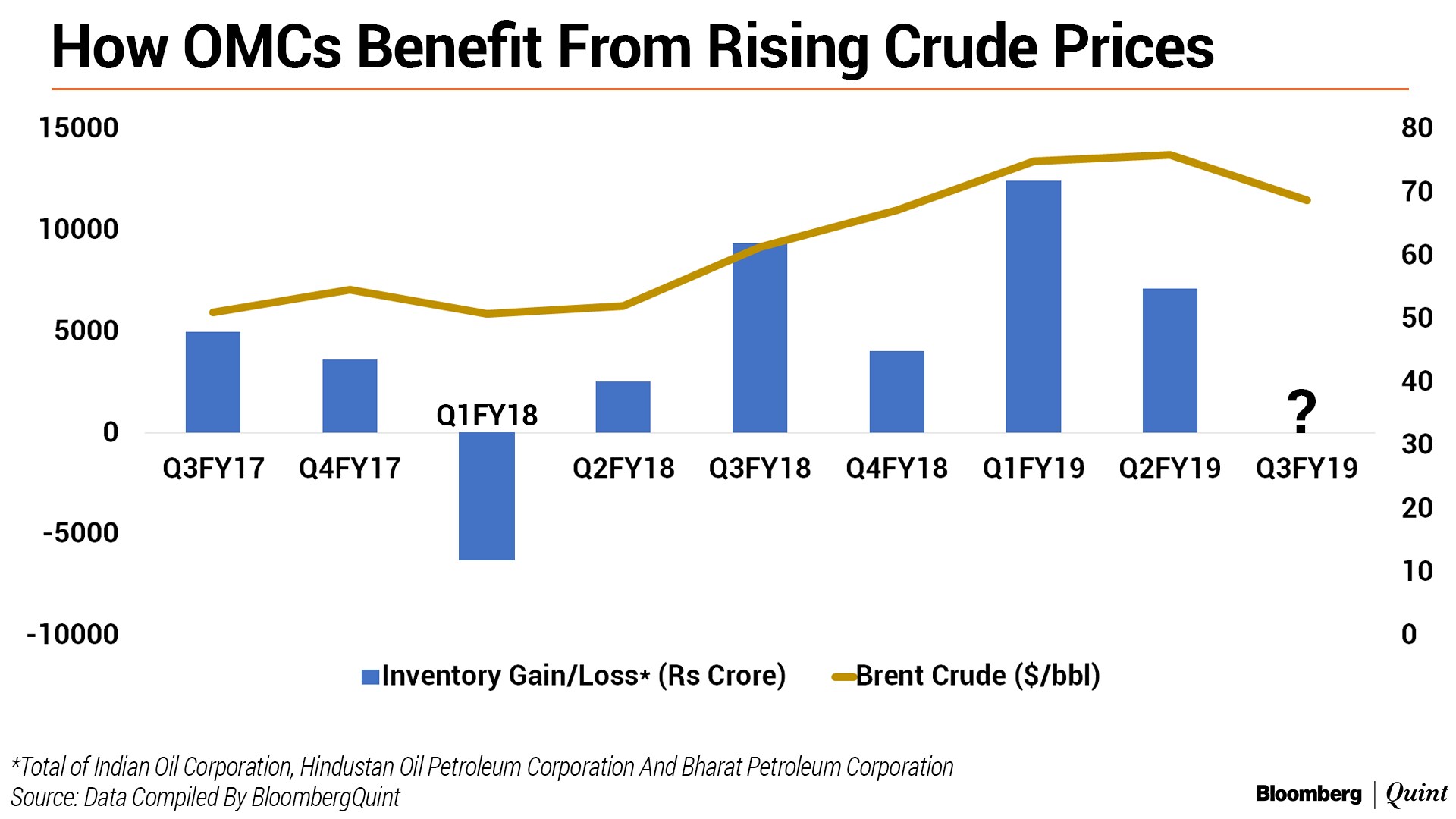

If the market price falls, refiners who bought the existing stock at a higher rate end up selling it cheaper and vice-versa. Brent crude averaged lower at $68.81 a barrel in the quarter ended December over excess supply and tepid demand growth. This may lead to the first inventory loss in six quarters for the three listed oil retailers—Indian Oil Corporation Ltd., Bharat Petroleum Corporation Ltd. and Hindustan Petroleum Corporation Ltd.

Concerns over excess supply also lowered the gross refining margin—the amount a company earns for converting a barrel of crude oil into fuel—by nearly 30 percent compared with the previous three months. Singapore gross refining margin, the Asian benchmark, averaged around $4.3 a barrel as of December. A lower gross refining margin means refiners would earn less.

All's Not Bad For OMCs

The fall in oil prices, however, helped fuel retailers earn higher gross marketing margin in the December quarter.

Gross marketing margin is the mark-up earned by oil marketing companies on sale of every litre of petrol and diesel. On an average, gross marketing margin stood at Rs 3.6 a litre for petrol and Rs 3.2 a litre for diesel at the end of December, according to data compiled by BloombergQuint. That's despite the government asking fuel retailers to absorb up to Re 1 on every litre of petrol and diesel to cushion consumers from rising crude prices at the start of the quarter.

The mark-up retailers earn on every litre of fuel rose in the quarter ended December. The higher gross marketing margin is expected to benefit HPCL and BPCL the most as retail sale of fuel, according to BloombergQuint's calculations, contributes nearly 60 percent and 40 percent, respectively, of their operational profit.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.