(2).jpeg?downsize=773:435)

- Hearing for Vedanta Ltd's proposed demerger deferred to October 8 by Mumbai NCLT

- NCLAT overturned NCLT's earlier rejection of Talwandi Sabo Power Ltd demerger plan

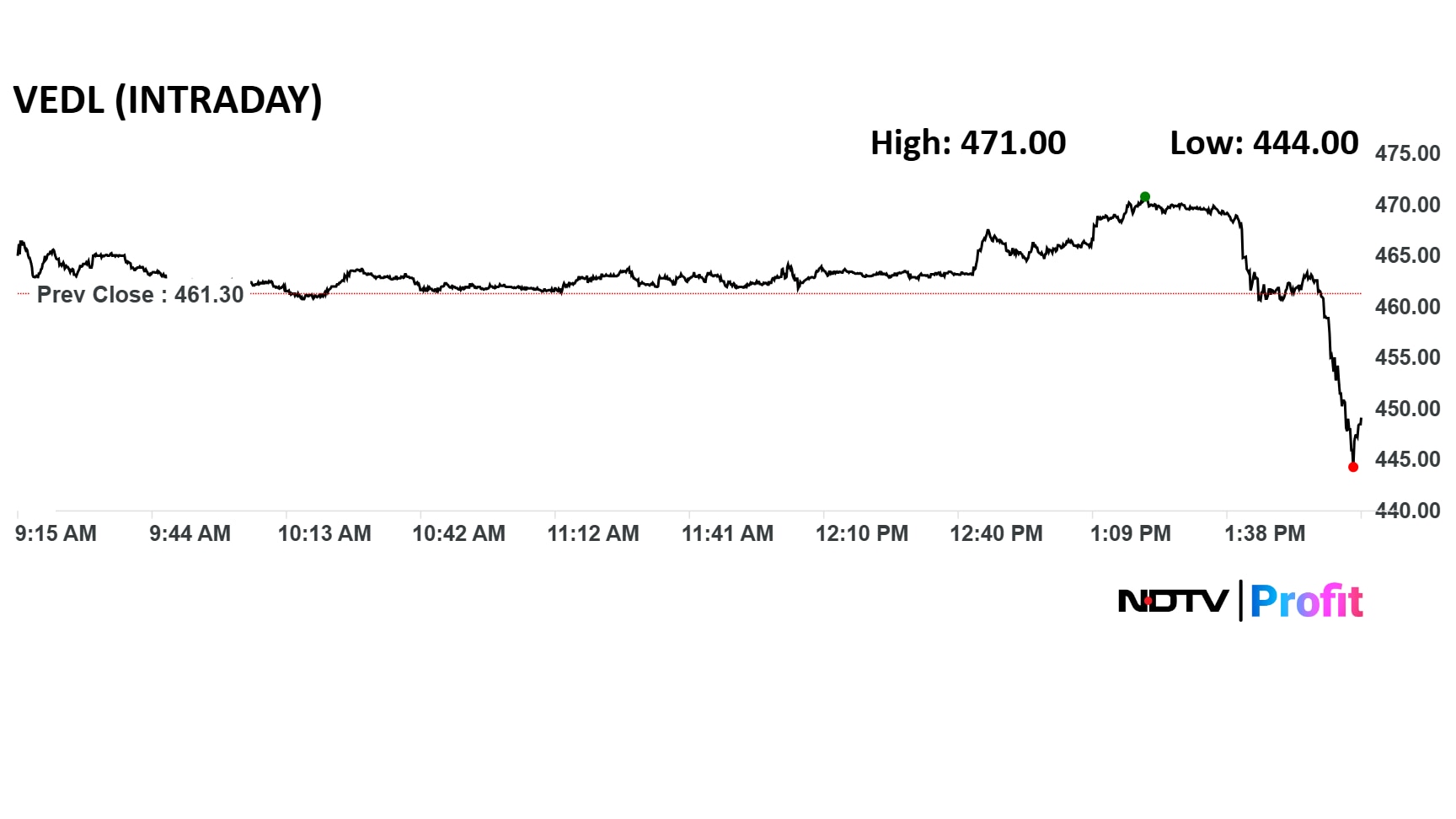

- Vedanta shares fell 3.8% to Rs 444 on NSE following the news, while Nifty 50 rose 0.24%

The Mumbai branch of the National Company Law Tribunal on Wednesday deferred the hearing for Vedanta Ltd.'s proposed demerger. The matter will now be heard on Oct. 8, according to sources.

This comes two days after an appellate tribunal set aside NCLT's previous order rejecting the demerger plan presented by Talwandi Sabo Power Ltd.

Chinese construction and engineering firm Sepco Electric Power Construction Corp. (SEPCO) had challenged the scheme in a long-standing dispute over Vedanta's power business. The two companies later settled the matter and SEPCO withdrew its arbitration claims in the National Company Law Appelate Tribunal. Thereafter, the NCLAT dismissed the NCLT's rejection order. on Sept. 15.

Vedanta Group is currently undergoing proceedings to get the regulatory approvals to demerge into four listed entities. These are to focus on aluminium (Vedanta Aluminium Metal Ltd.), power (Talwandi Sabo Power), gas and oil (Malco Energy Ltd.) and base metals (Vedanta Iron and Steel Ltd.). These plans were first announced in September 2023.

Shares of Vedanta dropped as much as 3.8% to Rs 444 on the NSE after the news. The benchmark Nifty 50 was up 0.24%.

SEBI, Government Objections

Vedanta's proposed demerger received objections by the Securities and Exchange Board of India and the central government last month.

SEBI informed the NCLT that Vedanta had made changes to the scheme of arrangement without disclosing them to the regulator or getting any prior permission. The market watchdog then issued an administrative warning letter dated Aug. 13 to the company.

Vedanta spokesperson, however, mentioned in a media statement, that SEBI has confirmed it has no further comments on the merits of the scheme, and it had issued an administrative cautionary letter over a procedural lapse. This letter carries no financial or operational restrictions, and the matter has already been disclosed by the company. The company has received NOCs from stock exchanges on the modified scheme.

The government also flagged concerns, stating that Vedanta had allegedly concealed certain liabilities in connection with the demerger proposal. These submissions prompted the tribunal to adjourn the matter for further consideration.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.