Do you recall the time how things were last year? Remember how the Covid-19 outbreak wreaked havoc on the world?

Now, owing to omicron, we're back, asking many of the same questions and feeling a heightened sense of foreboding about the future.

However, the pandemic or the new variant has not only brought together its problems, but also various possibilities for India's pharma sector. Medicines are essential for life and the pharmaceutical industry has taken the centre stage.

Do you know that India is hailed as the ‘pharmacy of the world'?

According to data available, India is the largest provider of generic drugs globally. Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the US, and 25% of all medicines in the UK.

Globally, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value.

Adding to that, India exported 58.4 million doses of Covid vaccines to 70 countries as of March 2021.

With low-cost trained labour and a well-established manufacturing base, India is poised to play an even larger role in global drug security. India will remain one of the world's most popular pharmaceutical markets in the coming years.

Many pharma stocks, specifically those addressing the Omicron variant has aroused investor interest recently, resulting in soaring stock prices.

With the help of Equitymaster's powerful stock screener, we have shortlisted the top listed pharma companies to look out for.

These are the stocks that came up when we ran the screener for top pharma companies in India.

1. Aarti Drugs

Aarti Drugs was established in the year 1984 and forms part of $900 million Aarti Group of Industries with robust research and development (R&D) division at Tarapur, Maharashtra Industrial Development Corporation (MIDC).

The company is engaged into manufacturing and selling active pharmaceutical ingredients (API's), pharma intermediates, specialty chemicals as well as formulations.

It's also one of the world's largest producers of Metformin, Fluroquinolones, Tinidazole, Metronidazole Benzoate, Ketoconazole, and Nimesulide.

The company exports its products to more than 100 countries in Europe, Australia, Africa, Asia, Latin & North America.

Aarti Drugs reported flat revenues on a yearly and sequential basis while margins remained under pressure during the September 2022 quarter.

The company's profit after tax (PAT) declined 43.4% year on year (YoY).

Continued upwards momentum in the raw material prices, disruption in the supply chain due to unexpected power outages in China, a sudden spike in the coal prices, elevated freight costs due to shortage of shipping containers, and a one-off employee expense, related to revision in the remuneration, all impacted the margins.

However, the company has delivered good profit growth of 32.5% compound annual growth rate (CAGR) over last 5 years.

In the past one year, the stock has declined 26.7%. Over the last 30 days, the stock of Aarti Drugs is trading up 3.5%.

2. J.B. Chemicals

J. B. Chemicals & Pharmaceuticals (JBC), established in 1976, is one of the fastest growing pharmaceutical companies in India. It's a leading player in the hypertension segment.

The company is also engaged in the business of manufacturing and marketing a diverse range of pharmaceuticals formulations, herbal remedies, and APIs.

Its strong presence in India accounts for majority of its revenue. It two s other major markets are Russia and South Africa.

In India, J. B. Chemicals has five brands among the top 300 brands in the country. The company exports its finished formulations to over 30 countries including the USA.

Besides supplying branded generic formulations to several countries, it's also a leader in the manufacturing of medicated lozenges. The company ranks among the top 5 manufacturers globally in medicated and herbal lozenges.

Globally lozenges are a well-accepted therapeutic option. But, in India it's still in an early stage. This may be because there are very few players in this space. The ecosystem in India is yet to be built and most lozenges are OTC products.

The prescription market for lozenges in India is estimated at around Rs 150 crore. The company expects its new therapeutic options to expand the market.

During the September 2022 quarter, the company reported a 32.4% rise in its consolidated net profit on the back of strong operational performance in India and international business despite pandemic related issues and supply chain uncertainties.

The company earns 47% of its revenues from its domestic business and 53% of revenue from the international business.

In a report, the company said,

During the past one year, several initiatives including the re- aligned Go-To-Market model, diversification into complimentary therapies and new launches have helped the company sustain its growth momentum in India leading to market share gains and rank improvement.

Shares of JB Chemicals & Pharmaceuticals have rallied up to 63% in the last one year. The counter is up 2.1% in the last 30 days.

3. Aurobindo Pharma

Aurobindo Pharma is an Indian pharmaceutical manufacturing company headquartered in HITEC City, Hyderabad, India.

The company started operations in 1988-89 with a single unit manufacturing Semi-Synthetic Penicillin at Pondicherry.

It's also present in six major therapeutic areas - antibiotics, anti-retrovirals, cardiovascular products, central nervous system, gastroenterological, and anti-allergics.

The company markets its products in over 150 countries. Its marketing partners include AstraZeneca and Pfizer.

Aurobindo Pharma consolidated profit declined 2.1% at Rs 700 crore in the second quarter ended 30 September 2021 against Rs 700 crore in the same quarter of the previous financial year.

Profitability was impacted by cost pressure on some of the key raw materials as well as higher logistic costs.

However, the majority of the segments performed well, backed by a modest increase in demand and increases in market share.

It's R&D spend was at Rs 400 crore amounting to 6.7% of revenues during the quarter.

The company has aggressive plans to scale up its injectables business. It aims to reach $650-$700 m of global injectable revenues by the financial year 2025.

Over the last three months, the company's stock price is trading down 2%.

4. IPCA Labs

IPCA Laboratories is an Indian multinational pharmaceutical company based in Mumbai.

It produces Theo bromine, Acetylthiophene, and P-Bromo Toluene as APIs. IPCA sells these APIs and their intermediates all over the world. It produces more than 150 formulations including oral liquids, tablets, dry powders, and capsules.

IPCA reported a 6.3% decline in its consolidated net profit to Rs 250 crore for the second quarter ended 30 September. It reported sales of Rs 1,530 crore in the quarter ended September, up 14% YoY.

Over the last 5 years, the company's revenue has grown at a yearly rate of 13.6%. Its market share increased from 1.6% to 2.1% for the same period.

Last month in November, IPCA Laboratories acquired a 26.57% stake in Lyka Labs for Rs 978.9 m. The management of IPCA sees the formulations segment as one of the key growth drivers, with the domestic market providing the lion's share. This acquisition will also aid management's aspirations to join a new worldwide market for new product lines, allowing for more market access.

IPCA has lined up ambitious capital expenditure of about Rs 400 crore over the next 3-4 years. The company is adding a new plant in Dewas to increase its API production, This is likely to come online by the first quarter of the next financial year and would increase capacity by 25%.

Over the last 30 days, IPCA's stock price is down 1.7%. Over the last one year, it's down 6.2%.

For more details, check out IPCA Laboratories' 2020-21 annual report analysis.

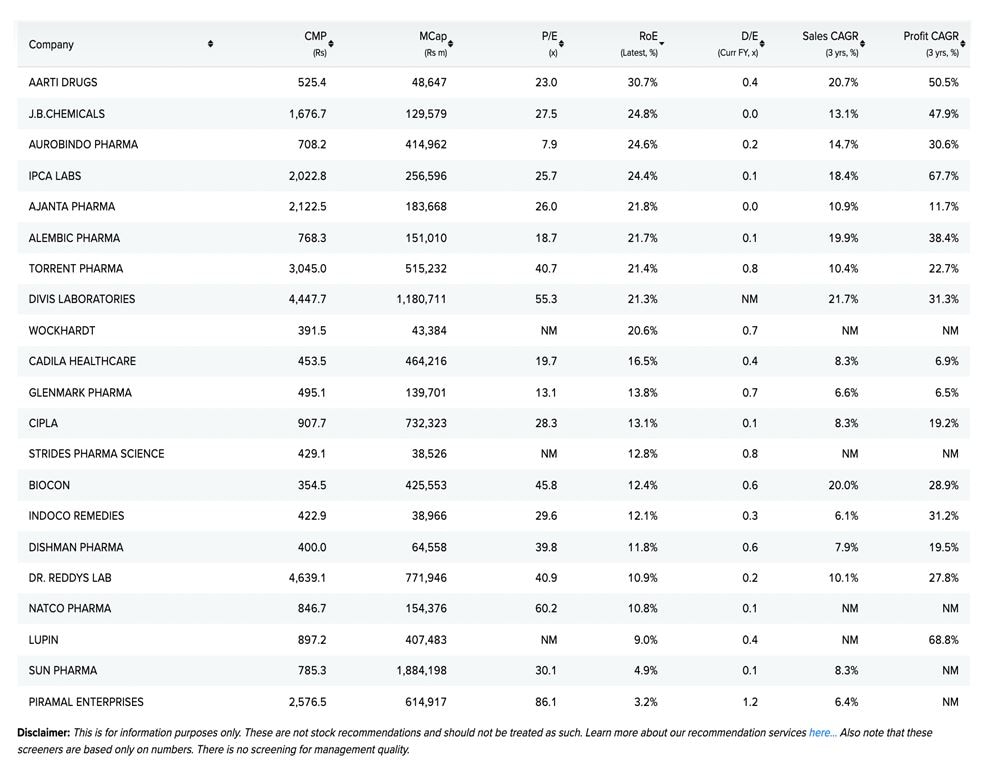

Snapshot of top pharma stocks in India from Equitymaster's stock screener

Here's a quick overview of these companies based on some crucial financials.

pharmacy

Photo Credit: Bloomberg

These parameters can be changed according to your selection criteria. This will help you identify and eliminate stocks not meeting your criteria. It will also emphasise the stocks meeting these metrics.

To conclude …

Over the last year, the Indian pharma industry played a crucial role in developing diagnostic tests and manufacturing drugs for Covid-19 treatment.

The pandemic may as well turn out to be a blessing in disguise for pharma companies as it pushed them to expedite focus on various pharma segments.

Further, pharma companies' efforts have been supplemented by the government's production-linked incentive (PLI) scheme.

The department of pharmaceuticals has initiated a PLI scheme to promote domestic manufacturing by setting up greenfield plants with a cumulative outlay of Rs 6,940 crore from fiscal 2021 to fiscal 2030.

As the third-largest producer of pharma products in the world, India has received global attention with expectations to meet global demand.

However, for a brighter future, pharma companies will need to embrace the right opportunities and spend as much as possible on manufacturing facilities and R&D.

Identifying fundamentally solid pharma stocks is both art and science and a game of large numbers.

One should always try to put money into a solid pharma company with a long track record of successful operations. If there isn't enough confidence in the stock, in the market, it could fall before the market realises its true potential.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

(This article is syndicated from Equitymaster.com)

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.