The ongoing Hunger Games-like competition in the Indian telecom sector may lead to a bottoming out of revenue and margins over the next one year, according to an S&P Global Research report.

Industry revenue is expected to fall by 5-10 percent in financial year 2017-18 with bigger players such as Idea Cellular Ltd., Vodafone India and Bharti Airtel Ltd. seeing a decline at the lower end of that range. Smaller players such as Reliance Communications Ltd. and Tata Teleservices Ltd. will see a sharper hit, the report said.

Airtel's profitability margin is expected to contract 300 basis points, while that of Idea-Vodafone and the Anil Ambani-led Reliance Communications could contract by 500 basis points. Synergies from Idea Cellular Ltd.'s merger with Vodafone, however, could limit the margin contraction, S&P Global said.

The Indian telecom industry, which was already facing intense competition, saw further disruption when Mukesh Ambani-led Reliance Jio Infocomm Ltd.'s entered the segment with its free services and promotional offers. While the company has started charging for data, its launch in September last year spurred consolidation in the sector. Jio's latest offering - an effectively free intelligent handset - is another blow to the already disrupted telecom industry, the report said.

Also Read: Reliance Jio May Now Disrupt Handset Market With 4G Feature Phone, CLSA Says

Once Jio begins prioitising revenue and profitability over customer base over the next 12-18 months, the industry's revenue should begin to recover again with a stabilising average revenue per user.

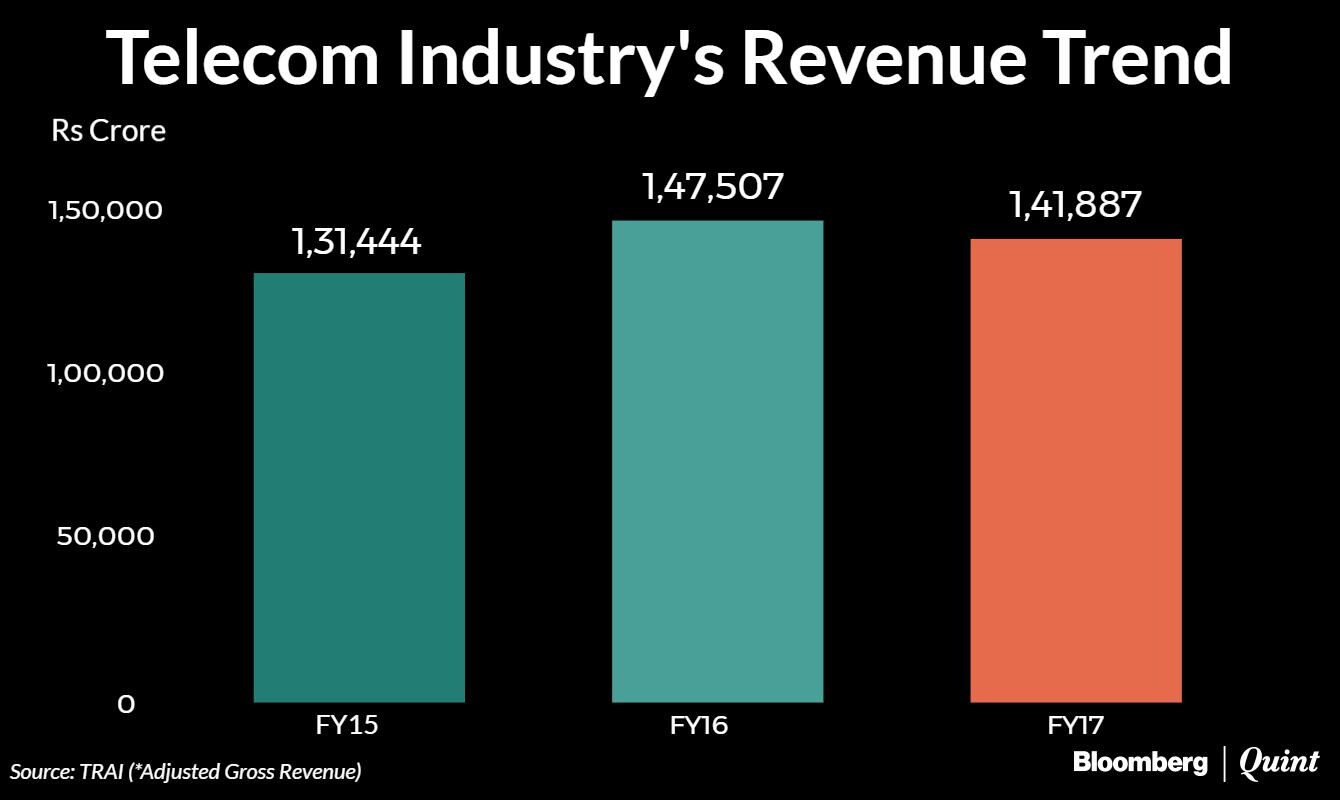

We expect the recovery to be gradual because the protracted competition won't let ARPUs quickly reclaim previous highs of Rs 126 achieved before Jio's entry in 2016.S&P Global Report

Once that happens, bigger companies such as Idea-Vodafone and Airtel are expected to form the top tier of the telecom industry along with Reliance Jio. Government-owned Bharat Sanchar Nigam Ltd. and Mahanagar Telephone Nigam Ltd. will stand at a distant fourth, the report said.

Also Read: How ‘Smart' Is Mukesh Ambani's JioPhone?

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.