At first glance there seems to be little difference between any of India's eight ESG-themed mutual fund schemes and the multitude of large-, multi- or flexi-cap ones.

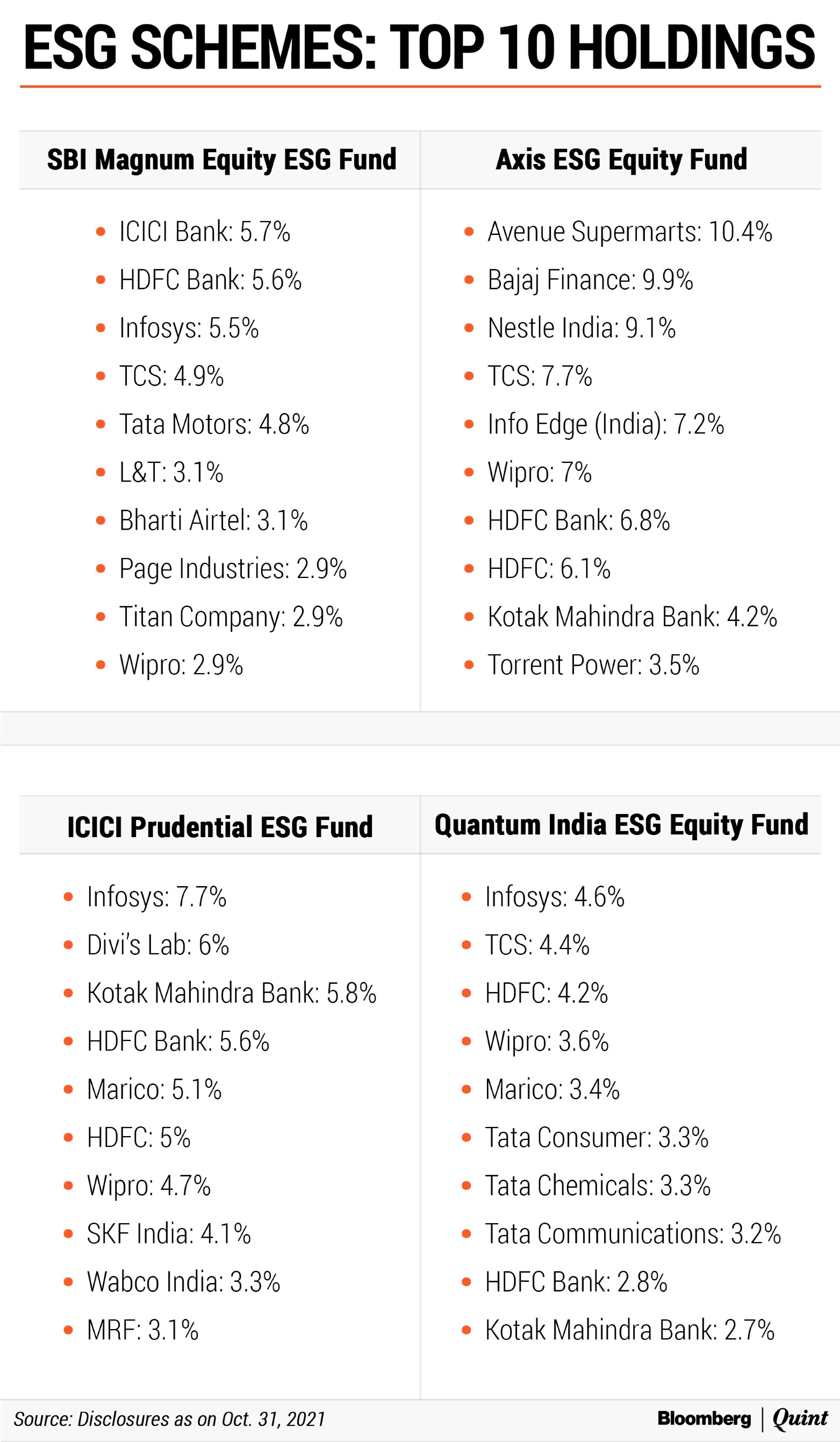

The top three schemes focused on environment, social and governance objectives—SBI Magnum Equity ESG Fund with Rs 4,528 crore in assets under management as on Oct. 31, Axis ESG Equity Fund with Rs 2,176 crore AUM and ICICI Prudential ESG Fund with Rs 1,826 crore AUM—all count mostly IT and finance companies as their top investments. Namely, Tata Consultancy Services Ltd., Infosys Ltd., Wipro Ltd., HDFC Bank Ltd., ICICI Bank Ltd. and Kotak Mahindra Bank Ltd., among others.

Select retail, consumer goods and pharmaceutical businesses offer marginal variation in the top five holdings.

The schemes sector allocation data underscores this. At SBI, financial services and IT constitute 50% of the scheme portfolio in value, at Axis the two sectors amount to 60%, and at ICICI over 35%.

The story repeats itself at Quantum India ESG Equity Fund, where a much smaller play at Rs 54 crore means more frugal allocations but software, and finance constitute over 35% of the scheme's holdings.

The size and liquidity of top IT and finance shares may offer some valid justification. But the likeness must make it hard for investors to tell ESG schemes apart from non-ESG ones?

Is that why ESG-related assets under management barely top Rs 12,000 crore, as per SEBI data. That's under 1% of total equity mutual fund AUMs.

In an interview to BloombergQuint, Chirag Mehta, senior fund manager of alternative investments at Quantum Mutual Fund, says ESG is a new concept and investors aren't yet familiar with the terminology. Besides, many ESG schemes are new and don't offer a long-enough track record to draw faith.

Mehta says top companies and sectors have better disclosures, hence the sameness among schemes' top holdings. "If you look at the next five (stocks) they are very different exposures that you will not see in a typical equity scheme."

Mehta points to Tata Communications Ltd., the eighth largest investment of his scheme. About 20-25% of the exposure of the Quantum scheme is to mid-cap companies as well, he adds.

Readers can draw their own conclusions from the data below.

Why's An ESG Scheme Invested In Petroleum Products?

Curiously, the Quantum scheme has exposure to carbon-intense industries such as cement, chemicals, gas, pesticides and petroleum products. Indian companies in these sectors are more "sustainable" than their global counterparts, Mehta counters. Maybe, but it only further obfuscates what ESG schemes seek to offer investors.

It doesn't help that most scheme descriptions are generic and offer little insight on how funds select companies except to say they score them on ESG parameters. Quantum has a proprietary method that scores E, S and G separately with a higher emphasis on governance, without which it's tough to achieve environmental or social goals.

"For each company we weigh 200-250 factors," Mehta says, also factoring in net zero carbon goals and collaborating with international agencies to finetune the process.

And yet, none of this is in the scheme literature in any detail. For most schemes.

The SEBI Push

To fix this and to safeguard against "greenwashing", the market regulator recently published a consultation paper on disclosure norms for ESG mutual fund schemes.

The key proposals are:

Minimum 80% of total assets of scheme to be invested in ESG-related securities.

Transparency on nature/extent of ESG-related investment objectives.

Investments to be designed to generate beneficial ESG/sustainability impact alongside financial return.

Asset management companies should clearly state the intended "real world" outcome in qualitative terms.

AMCs shall only invest in securities which have BRSR disclosures.

Earlier, the Securities and Exchange Board of India mandated large listed companies to make more extensive disclosures via a Business Responsibility and Sustainability Report (BRSR) next fiscal year onwards.

Together, more granular disclosures by companies and more transparency by funds could help attract more institutional and retail flows to ESG funds.

Mehta believes India is on the cusp of that.

Watch the interview with Chirag Mehta here.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.