- Charges on RTGS, NEFT transactions reduced by up to 75 percent

- Charges to be effective from July 15

- Bank says move in line to push digital transactions

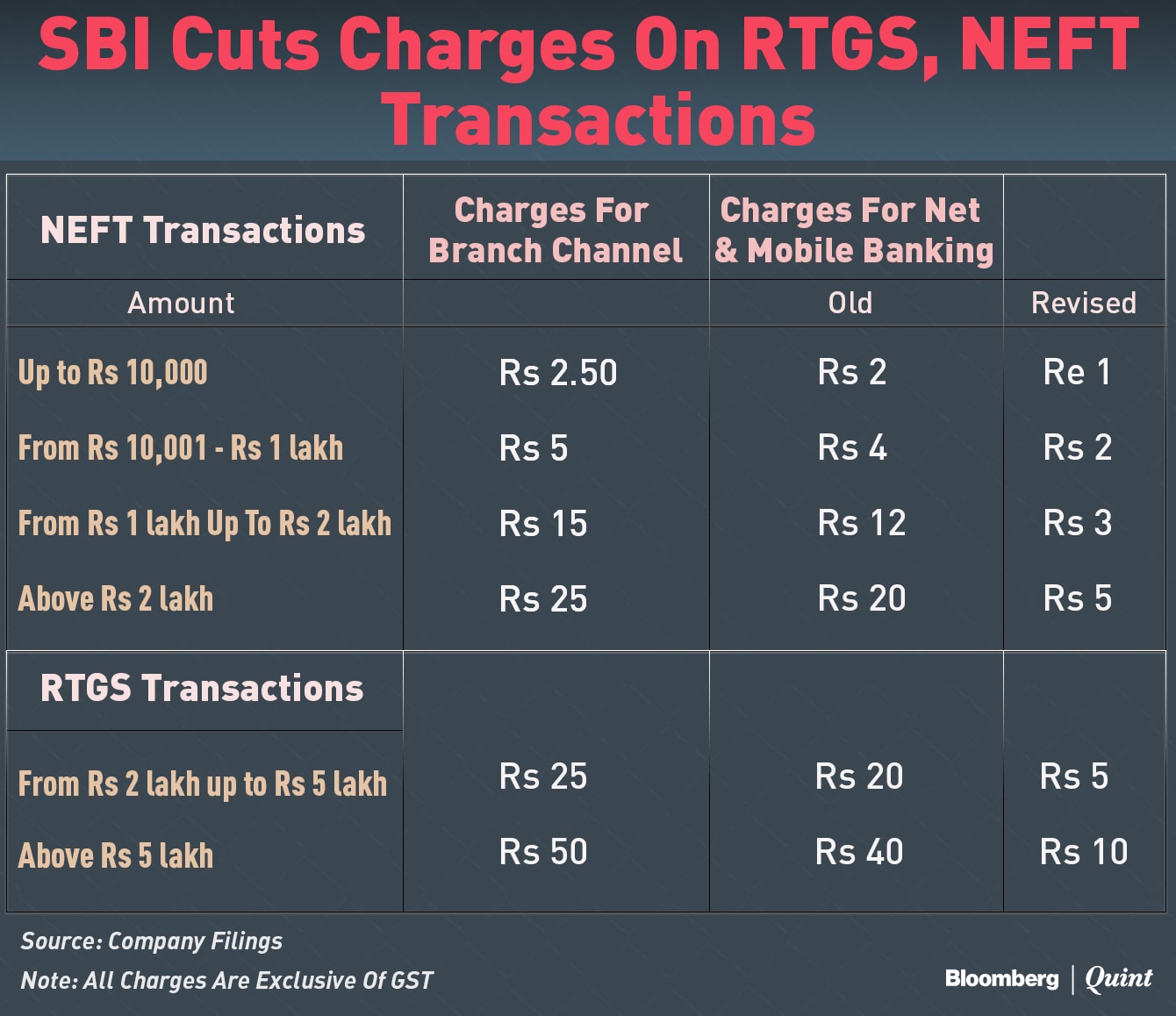

State Bank of India reduced charges on National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS) transactions by up to 75 percent.

The charges will be applicable on transactions done through internet banking and mobile banking and will take effect from July 15, it said in a release.

For RTGS transactions between Rs 2 lakh and Rs 5 lakh, consumers will be charged Rs 5 compared to Rs 20 earlier, while for transactions above Rs 5 lakh, the charge has been reduced to Rs 10 from Rs 40 earlier. The charges are exclusive of the Goods and Services Tax.

Similarly, charges on NEFT transactions from Rs 10,000 up to those above Rs 2 lakh will be charged between Re 1 and Rs 5.

As of March 31, the India's largest lender had 3.27 crore internet banking customers and nearly 2 crore mobile banking customers. The bank said that the move is in sync with its strategy to promote the use of internet and mobile banking.

We are committed towards increasing the share of digital initiatives in products, services and transactions, supported by technologically advanced back-end operations.Rajnish Kumar, Managing Director, State Bank of India

The stock was trading largely unchanged at Rs 287.7 as of 2:00 p.m. It has underperformed the S&P BSE Sensex Index in 2017, gaining 15.37 percent during the period compared to 20.22 percent returns of the benchmark index.

Also Read: SBI To Add More Retail Products Online

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.