Samhi Hotels Ltd. said on Friday its board has approved the acquisition of Innmar Tourism and Hotels Pvt., a Bengaluru-based hotel operator, for Rs 205 crore.

The company will use its funds to buy 100% share capital of Inmar Tourism, according to an exchange filing. A total of 84,37,500 shares with a face value of Rs 10 each would be acquired as part of the transaction.

The shares would be picked up "for an enterprise value of circa Rs 205 crore adjusted for net working capital, including cash, from the existing shareholders", it said. The transaction is expected to be completed on Oct. 4.

The acquisition allows Samhi Hotels to gain a foothold in the upscale hotel segment of Bengaluru.

Innmar Tourism currently owns an operating hotel with 142 rooms in Whitefield, Bangalore, along with surplus land for development of an additional 200-220 rooms in the upper upscale segment, as per the regulatory filing.

Innmar Tourism was incorporated in 2003. Its consolidated turnover increased from Rs 2.9 crore in fiscal 2022 to Rs 24.2 crore in fiscal 2023 and Rs 24.7 crore in fiscal 2024.

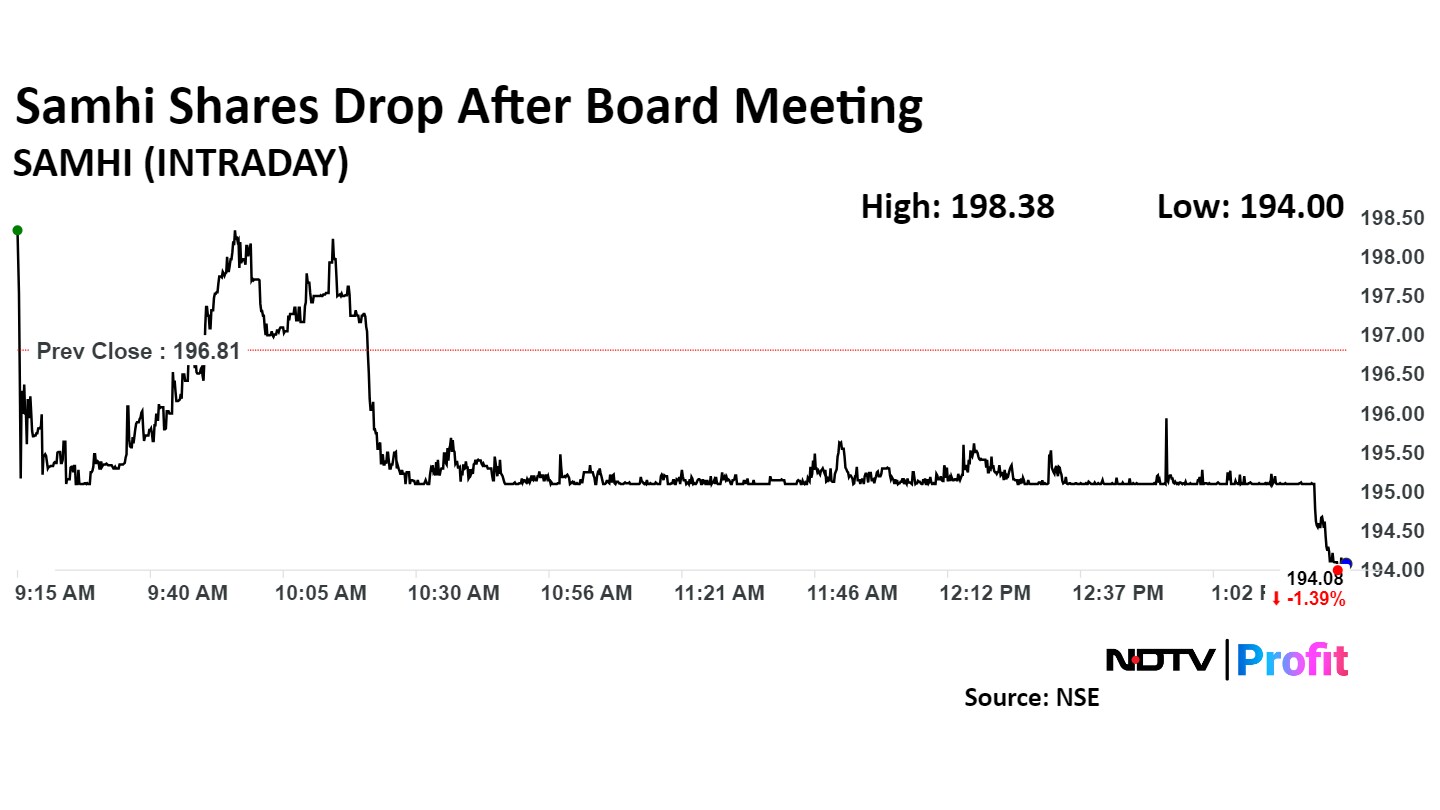

Shares of Samhi Hotels were trading 1.39% lower at Rs 194.08 apiece on the NSE, compared to a 0.57% decline in the benchmark Nifty 50 at 1:29 p.m.

Samhi Hotels, which was listed on the bourses last year, has risen by 31.7% over the past 12 months. On a year-to-date basis, the stock has climbed by 17.2%.

The stock's total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index stood at 63.5.

All the four analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 39%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.