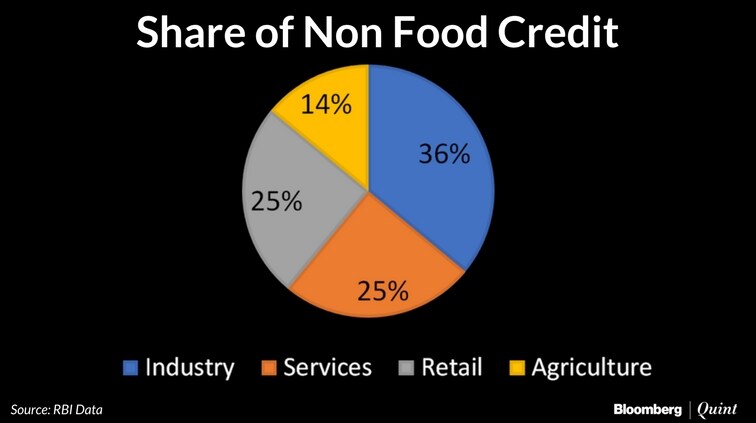

Retail loans, given to individuals for purchase of items from fridges to cars and credit cards, now make up a quarter of all loans given by banks.

Indian lenders have focussed on individual loans as corporate defaults remained high and demand for investment credit weak. The result is that the share of retail loans has reached a new high, shows Reserve Bank of India data highlighted by Kotak Institutional Equities in a report on Wednesday.

Retail loans have reached a new high at 25 percent of overall loans as of February 2018, shows the RBI data. The data also shows that retail loans grew at 20 percent between February 2017 and February 2018. This is double the 9.8 percent in overall non-good credit. Loans to industry grew at just 1 percent over this period, leading to an increase in the share of retail loans.

The trend is expected to continue, according to the Kotak report.

This higher-than-expected increase in the share of retail lending is driven by a lack of demand by corporates. In keeping with the trend we expect retail loans to grow at 16 percent CAGR over FY2018-22 and its contribution to overall loans to increase to ~28 percent of loans from ~18 percent in FY14.Kotak Institutional Equities Report

A bulk of the growth is coming from small ticket loans like credit cards or unsecured loans. Credit card outstandings rose 31 percent between February last year and this year. The ‘other personal loans' category which includes unsecured loans grew 17 percent.

Also Read: Loans To Self-Employed Are Rising. That Calls For Caution

In the past, rapid growth in retail loans has raised concerns about asset quality. Kotak, however, said that asset quality indicators have held up so far.

“Our recent interactions with market participants suggest that the underlying trends on asset quality continue to hold up quite well across products. Default curves across various vintages are broadly showing similar trends. Unsecured-loan delinquency rate continues to remain at historic low levels,” said the report. It, however, added that the drivers for continued rapid growth in retail loan are not easy to identify and appear to be linked to increased penetration of loan products rather than traditional economic variables.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.