India's Monetary Policy Committee on Thursday decided to cut its benchmark repo rate by 25 basis points to 6.25 percent in response to lower-than-expected retail inflation. The committee also changed the policy stance to ‘neutral' from ‘calibrated tightening' and indicated that there may be scope of more rate cuts.

RBI Governor Shatikanta Das, who chaired his first MPC meet this time, said that the RBI Act mandates that the committee focus on growth after meeting its objective of inflation. With headline inflation expected to remain below the mid-point of the MPC's target of 4 (+/-2) percent, the committee believes that room has opened up for lower rates.

The MPC voted 4:2 in favor of the repo rate cut. MPC members Viral Acharya and Chetan Ghate voted against a rate cut. All six members voted in favor of a change in stance.

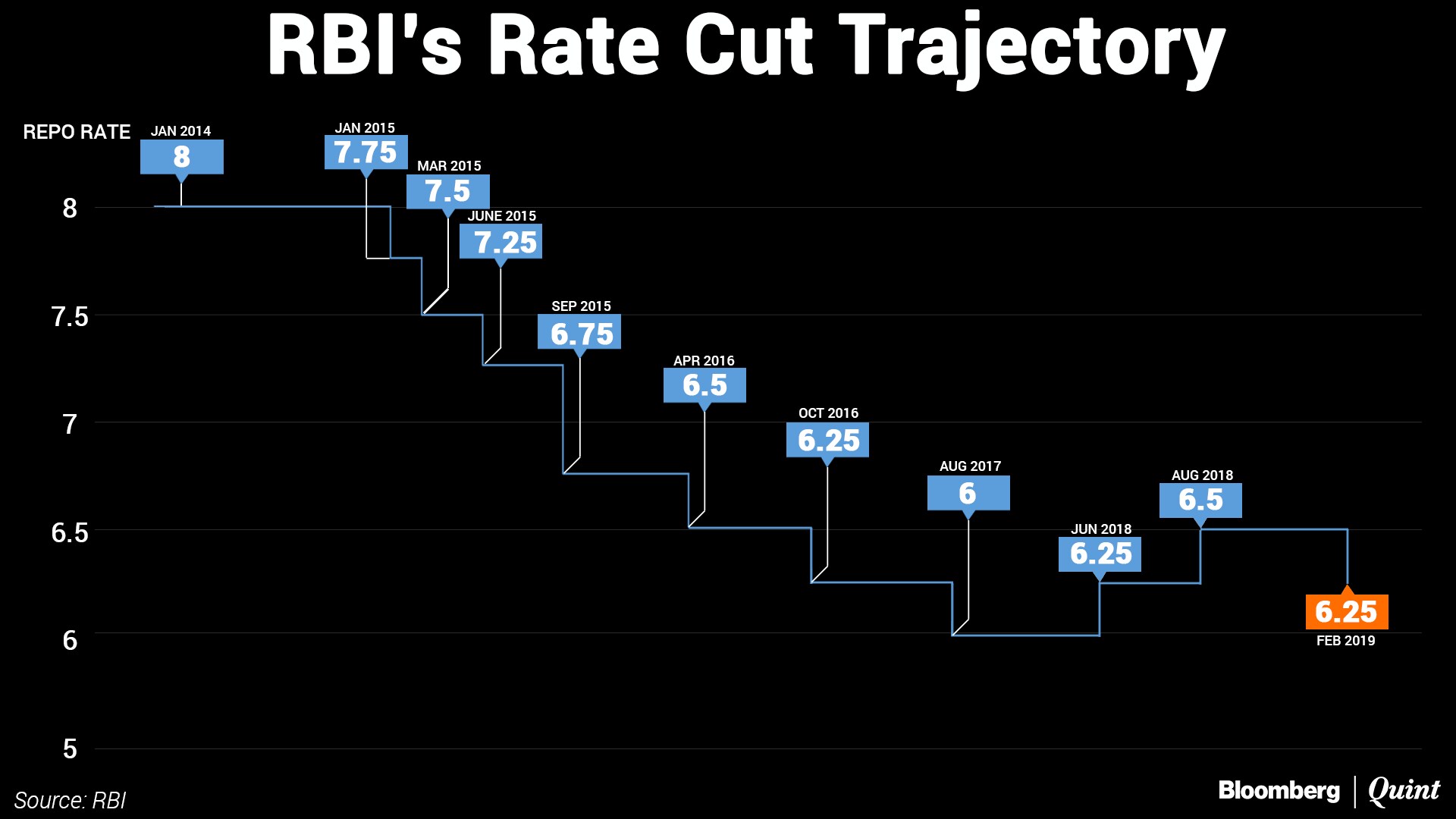

This is the first rate cut announced by the MPC since August 2017 and marks a reversal in the rate cycle. Over the course of 2018, the MPC had raised rates twice by a total of 50 basis points to 6.5 percent. In October, it changed the policy stance to ‘calibrated tightening' from neutral fearing that elevated core inflation poses upside risks to headline inflation.

This stance now stands changed.

Das said with headline inflation contained below or at 4 percent target for the next one year, space had opened up for policy action. He added that there is need to strengthen investment activity and that stressed macro economic indicators called for decisive action.

The shift in stance of monetary policy from calibrated tightening to neutral also provides flexibility and the room to address the challenges to sustain growth of the Indian economy over the coming months, as long as the inflation outlook remains benign. The decisions of the MPC in this regard will be data driven and in consonance with the primary objective of monetary policy to maintain price stability while keeping in mind the objective of growth.Shakitkanta Das, Governor, RBI

Finance Minister Piyush Goyal welcomed the interest rate cut.

RBI's decision to reduce the repo rate by 25 basis point from 6.5% to 6.25% and change of stance to ‘Neutral' will give a boost to the economy, lead to affordable credit for small businesses, homebuyers etc. and further boost employment opportunities

February 7, 2019MPC: Outlook On Inflation

Supporting the decision to cut interest rates, the MPC pared its inflation forecasts for the remainder of FY19 and first half of FY20.

- It now sees inflation at 2.8 percent in Q4 FY19.

- For FY20, inflation is pegged at 3.2-3.4 percent in the first half and at 3.0 percent in the third quarter.

- Risks to this forecast are broadly balanced around the central trajectory.

Headline inflation fell to 2.2 percent in December while core inflation remained elevated at close to 5.7 percent.

“Headline inflation is projected to remain soft in the near term reflecting the current low level of inflation and the benign food inflation outlook. Beyond the near term, some uncertainties warrant careful monitoring,” said the committee. Some of the risks the committee is watching include volatile vegetable prices, uncertain oil prices, the “unusual” spike in prices of health and education and the recent budget proposals.

While flagging off the government's proposals, the committee felt that these won't have a bearing on near-term inflation projections.

Several proposals in the union budget for 2019-20 are likely to boost aggregate demand by raising disposable incomes, but the full effect of some of the measures is likely to materialise over a period of time.MPC StatementMPC: Outlook On Growth

The MPC expects GDP growth in FY20 at 7.4 percent compared to the 7.2 percent projected by the central statistical office for FY19.

The MPC statement reflected on the several factors that will influence growth.

- Aggregate bank credit and overall financial flows to the commercial sector continue to be strong, but are yet to be broad-based.

- In spite of soft crude oil prices and the lagged impact of the recent depreciation of the Indian rupee on net exports, slowing global demand could pose headwinds.

- Trade tensions and associated uncertainties appear to be moderating global grow

While keeping the growth outlook broadly unchanged, the committee suggested that the gap between actual output and potential output has widened, leaving room for lower interest rates.

The MPC notes that the output gap has opened up modestly as actual output has inched lower than potential. Investment activity is recovering but supported mainly by public spending on infrastructure. The need is to strengthen private investment activity and buttress private consumption.MPC StatementMarkets, Bankers, Economists

Sovereign bonds in India rallied after the central bank cut its key rate, providing some relief to traders concerned about a record government borrowing program. The rupee fell. Benchmark equity indices, the NSE Nifty and BSE Sensex rose after the policy announcement but have since flattened out. The Nifty Bank index rallied briefly and then dipped lower.

Going into the policy, 11 of 43 economists polled had forecast a rate cut. A majority had expected a change in stance to neutral, before any rate action was announced.

“We expected a rate cut later this year, but the front-ended delivery was a surprise, even relative to our expectations,” said Nomura Research in a note after the policy. “The RBI has seen through the expansionary budget, as well as sticky core inflation, and viewed the recent softness in inflation prints as “open[ing] up space for policy action,” said the brokerage house.

It certainly does feel like growth has slightly crept back into the discussion and once that discussion changes then we are looking at a more dovish position from the governor and the rest of the MPC.Neeraj Gambhir, Market ExpertThe change in stance, along with the lower inflation projections and the focus on the legal mandate of targeting headline inflation, will allow for more rate cuts.

“Purely based on these projections, it opens up the room for another rate cut. The extent to which the RBI could do OMOs would be constrained by the size of the balance sheet,” Abheek Barua, chief economist at HDFC Bank told BloombergQuint.

"It was more an unexpected cut, we were only expecting change in stance from calibrated tightening to neutral,” said Ashutosh Khajuria, CFO of Federal Bank. "There could be another cut going forward,” he added.

Jaideep Iyer, head of strategy at RBL Bank, agreed there is room for one more rate cut as real interest rates are still quite high. Iyer, however, added that the repo rate cut won't necessarily translate into lower lending rates.

More than policy rate, I think there is an issue on deposit growth, from a banking system stand point, continuously lagging credit growth. That's clearly not sustainable beyond a point. The other interesting challenge is two buckets of liquidity here. Private bank deposit rates have been significantly higher than PSU banks - I don't think in the last 25 years historically the gap could've been as much. Therefore from a transnational standpoint from a borrower lender relationship, the transmission is going to be slower than what one would like it to be.Jaideep Iyer, Head of Strategy, RBL BankWatch the RBI press conference and expert reactions:

Also Read: RBI Eases Risk Weight Norms, Allows Banks To Lend More To NBFCs

Also Read: RBI Eases Overseas Borrowing Norms For Bidders Of Insolvent Companies

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.