The Reserve Bank of India will conduct simultaneously sales and purchases of government securities under its open market operation programme.

Dubbed as ‘operation twist', the move is intended to push up shorter-term interest rates, while pushing down long-term rates.

The RBI will buy Rs 10,000 crore in longer-dated government bonds, while selling an equivalent amount in shorter-dated treasury bills, the central bank said on Monday. The auction will be conducted on July 2.

The RBI will buy:

- 6.79% GS 2027

- 7.26% GS 2029

- 6.68% GS 2031

- 6.57% GS 2033

The RBI will sell:

- 182-day t-bills due Oct. 15,2020

- 182-day t-bills due Oct. 22, 2020

- 364-day t-bills due April 22, 2021

- 364-day t-bills due April 29, 2021

Flattening The Yield Curve

The RBI has used simultaneous sales and purchases of government securities as a way to manage yields in the market.

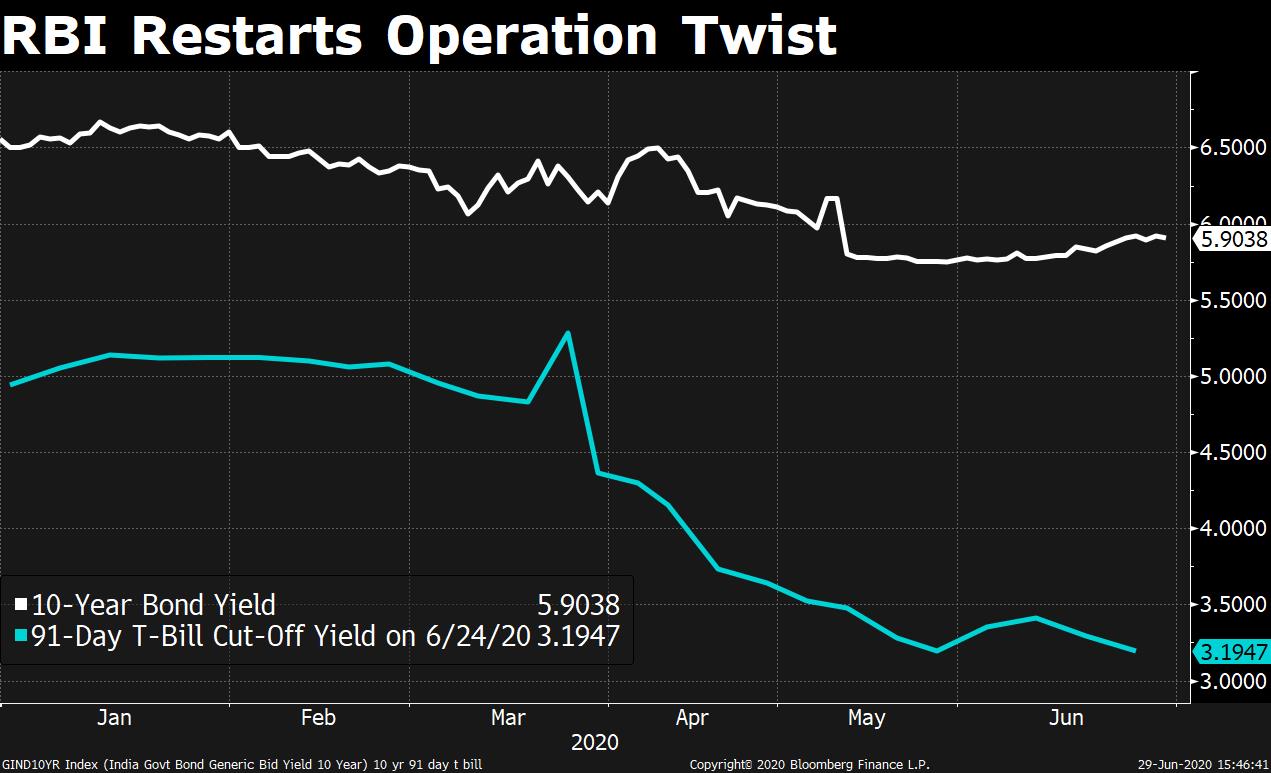

At present, short-term rates are very low as a surplus of liquidity has been chasing shorter-dated assets. Last week, yields on 182-day and 365-day treasury bills fell to record lows, while 91-day t-bill yields came within a whisker of all-time lows. In some cases, these rates have moved even below the RBI's reverse repo rate of 3.35%, which the markets see as the operative policy rate.

Apart from rates on shorter-dated central government bonds, state governments and corporates have also seen short-term interest rates fall sharply. Over the past few weeks, Maharashtra has borrowed two-year and three-year funds at record lows. PSUs are also borrowing short-term funds at very low rates. On Monday, NTPC Ltd. issued commercial papers at 3.24%.

In contrast, long-term rates have remained stubbornly high. The 10-year government bond yield has remained close to 5.90% as investors fear volatility in longer-dated assets.

The 'Operation Twist' will help push up shorter-term rates, while bringing down longer-term rates.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.