As a large part of the real estate sector's financing needs remain "unbanked", the market has become fertile ground for private credit deals.

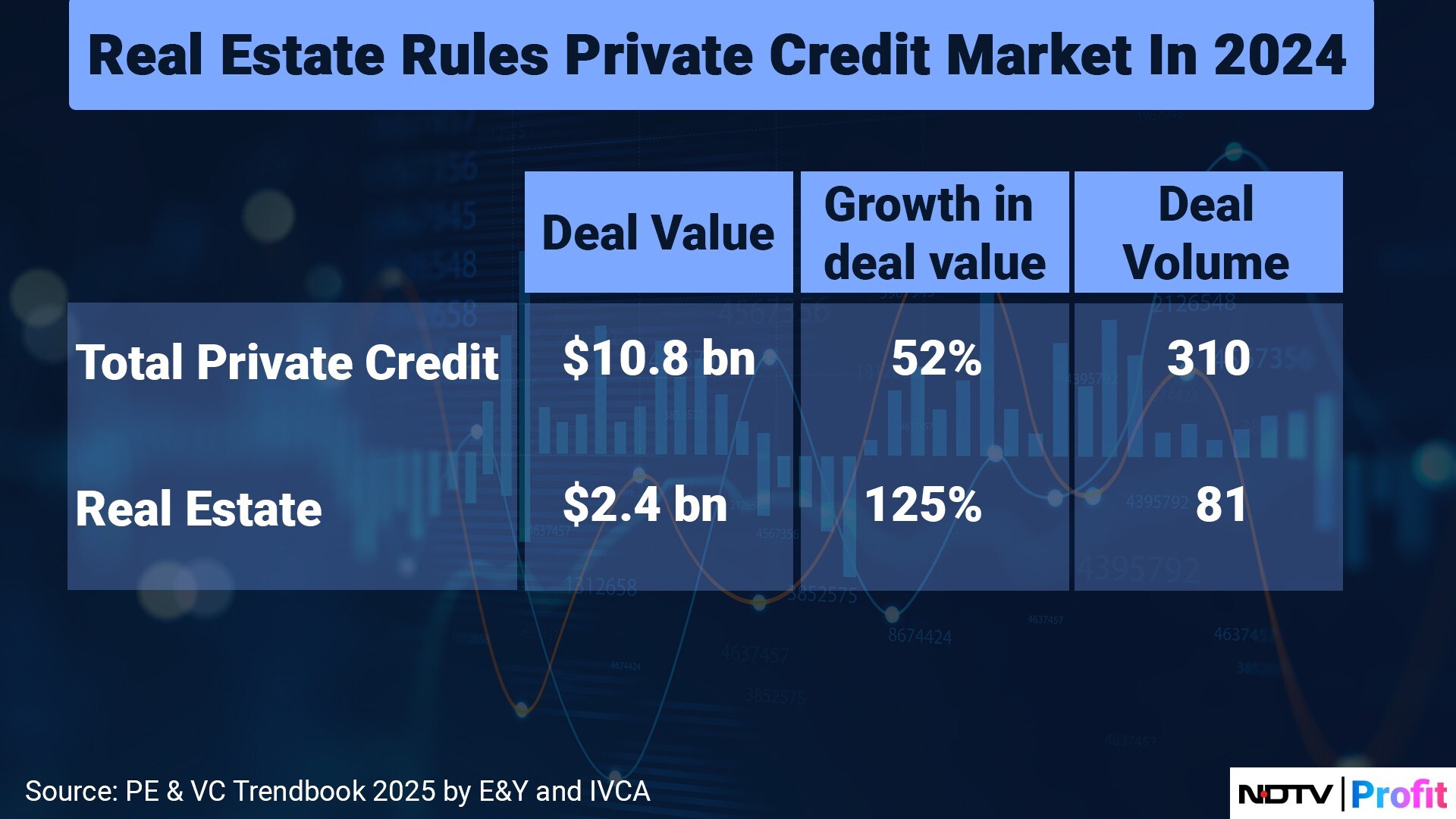

The sector's rapid growth is the tailwind that's pushed the private credit market in the country to record highs in 2024. In 2024, the sector accounted for over a fifth of total deal value at $2.4 billion and around two-thirds of the total deal volume.

Apart from the fact that the real estate sector's mid-upcycle, the inability of regulated entities like banks and non-banking financial companies to fund them at the land acquisition stage has led to spurt in private credit deals.

"To kickstart a project, we need funds other than our equity," Prashant Khandelwal, chief executive officer of Agami Realty, said. "In a typical real estate project, the cost of acquiring land and getting approvals for the project accounts to 25% of the total cost."

"This is considered risky by banks, NBFCs as approval-related delays and the associated costs can eat up the entire project. So, private credit is used at initial stages of a project," Khandelwal said.

Landing Troubles Of Realty

Time is money in real estate and financing goes a long way. Typically, land acquisition takes at least 18 months. After land is purchased, conversion and approvals, and a nod by the Real Estate Regulatory Authority is required.

After acquiring land, developers need to secure multiple regulatory approvals before they can start monetising the property. This approval process can be time-consuming and uncertain, adding to the overall risk.

The speculative nature of some land acquisitions also contributes to the perception of risk. As a result, the Reserve Bank of India has placed restrictions on the use of bank credit for land purchases to mitigate these risks, according to Shobhit Agarwal, CEO of Anarock Capital.

Banks and NBFCs can enter a project only after the RERA approval, by which time sales receivables kick in for the developer to get the project off the ground. In the case of a redevelopment project, it can be much more complicated. Apart from society approvals, which are time consuming, relocation and rental expenses of homeowners add to developers' burden.

Regulated lenders mostly finance the construction needs of a real estate project. But a lot of risk capital keeps the project going long before sales receivables kick in. "What developers need is structured debt as opposed to the cookie cutter debt by banks and NBFCs. Funds are able to fulfill this gap," said Sharad Mittal, founder of Arnya RealEstates Fund Advisors.

Regulated entities require them to pay interest regularly but in initial stages, which is difficult for realty players. The funds also have a deep understanding of the real estate market and are able to price risks with their customised capital stack. "Private lenders build specialised teams and processes to assess risks more accurately," says Agarwal. They also offer a moratorium period for coupon payments, a much-needed relief for developers.

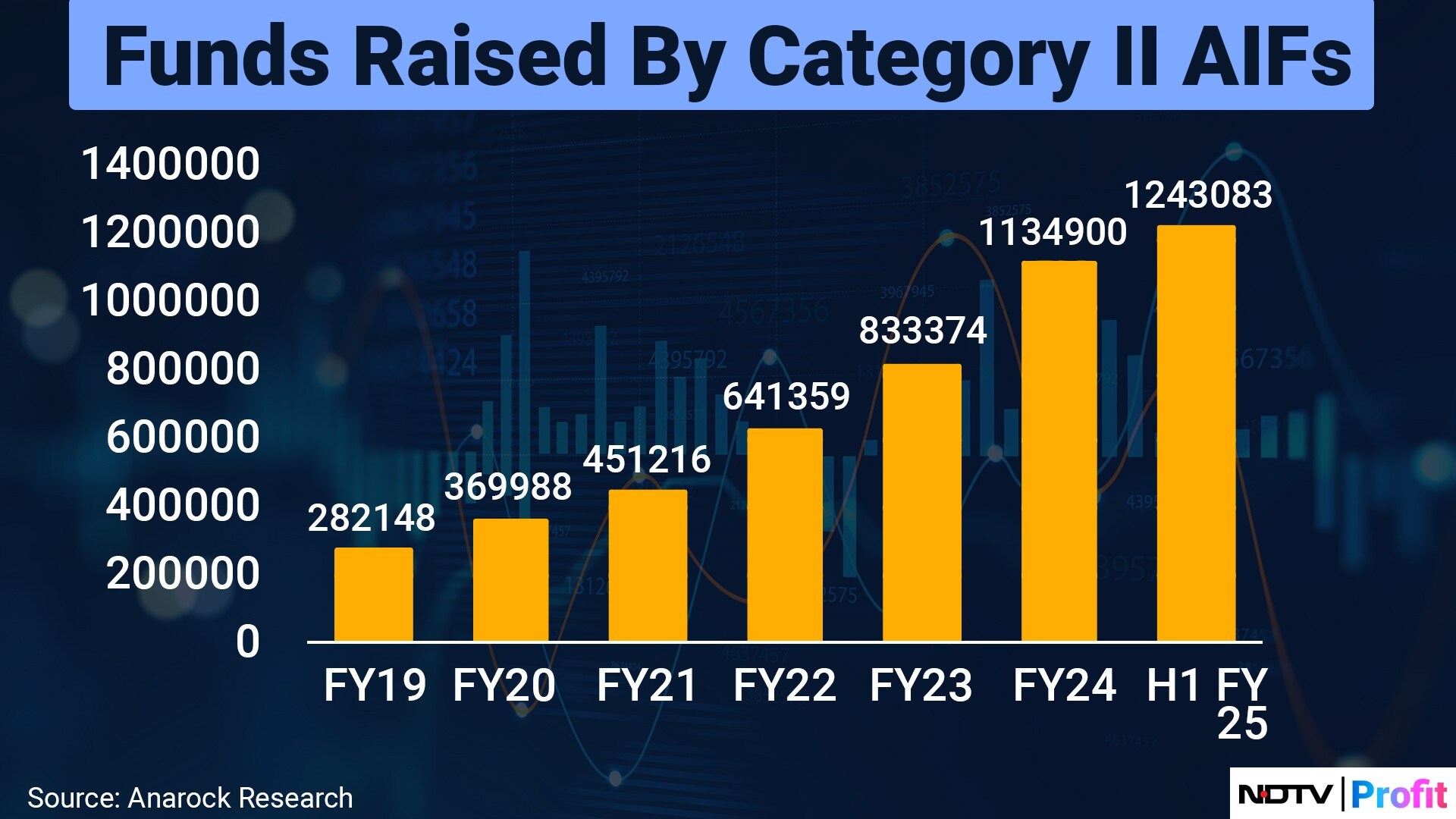

Thanks to the Securities and Exchange Board of India's regulations, the National Company Law Tribunal processes speeding up and more. Category II alternative investment funds, which cater to real estate among other things, have been on a fundraising spree. Both demand and supply has been growing in this area with a lot of them concentrating on residential real estate.

Mother Of High Returns

Private-credit deals do not come cheap for developers. In fact, most deals are executed in the range of 18–24% interest rate, says Khandelwal, quipping that financiers end up generating better returns than developers. The AIF fund managers, however, insist that it's only fair to price them so.

"We can price ourselves to get superior returns, as we provide funds that are not otherwise available," says Bamasish Paul, CEO of Etonhurst Capital Partners, which has recently raised its first AIF, which looks at funding Mumbai's redevelopment projects.

Paul, however, says that the interest rate charged for these loans could be anywhere in the range of 16–24% depending on developer profits, counterparty risks and more such.

Due to the high cost of the funds, most developers refinance the debt after the initial stage is passed, which is around 2–2.5 years. If they hold onto such costly debt, it would eat into a project's returns.

Bank loan interest rates range between 10% and 12% and the NBFCs charge 13–14%, which is cheaper for them. As cash flows and receivables kick in, most developers choose to pay off private loans, with fees, if such a deal exists.

Right To Take Over

Apart from pricing risk, private credit funds also zealously guard their investments, with both usual and unusual covenants in case of a default or more such. Apart from converting debt to equity, a few funds even seek access to developers' share of bank accounts, first exclusive charge over receivables and more such. There have been cases or covenants that allow private lenders to take over a project in case a developer is unable to finish it.

"These controls are necessary," insists Paul adding: "Typically, banks have a higher protection from a litigation standpoint as they hold depositors' money."

"While we have recourse like the NCLT, in the event of default, it makes sense to step in and infuse more funds if needed and complete projects, which is good for the homebuyers as well Also, control over bank accounts ensures that funds are being correctly utilised," Paul said.

Real estate-focussed private lenders bring in depth and girth into the way this sector works. A lot of ground knowledge also helps. "If you look at real estate, it's a very localised market. The city of Pune itself has over 100 relevant local developers," says Mittal.

Private credit is a boon for the number of mushrooming real estate developers, and a large chunk of new launches in the sector. The top seven cities — Mumbai, National Capital Region, Kolkata, Bengaluru, Pune, Hyderabad and Chennai — launched 4.12 lakh units in 2024. While it saw a 7% decline on an overall basis, cities like NCR and Bengaluru are seeing strong double-digit growth which might continue as the upcycle continues.

The demand for real estate is also rising since the pandemic, as inventory levels have been falling, pushing the sector towards more launches. Most experts peg the annual financing needs of the sector anywhere from Rs 1.5–2 lakh crore, which needs various new classes of investors to jump into the ring.

Katya Naidu is a senior business journalist who writes about equity markets, startups, energy, infrastructure, real estate and healthcare.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.