India accounts for half of all international real-time transactions, the government said this week, citing a report. The Unified Payments Interface (UPI) has been recognised by the International Monetary Fund as the world's largest retail fast-payment system (FPS) by transaction volume, Minister of State for Finance Pankaj Chaudhary said in a written reply to a question in Lok Sabha.

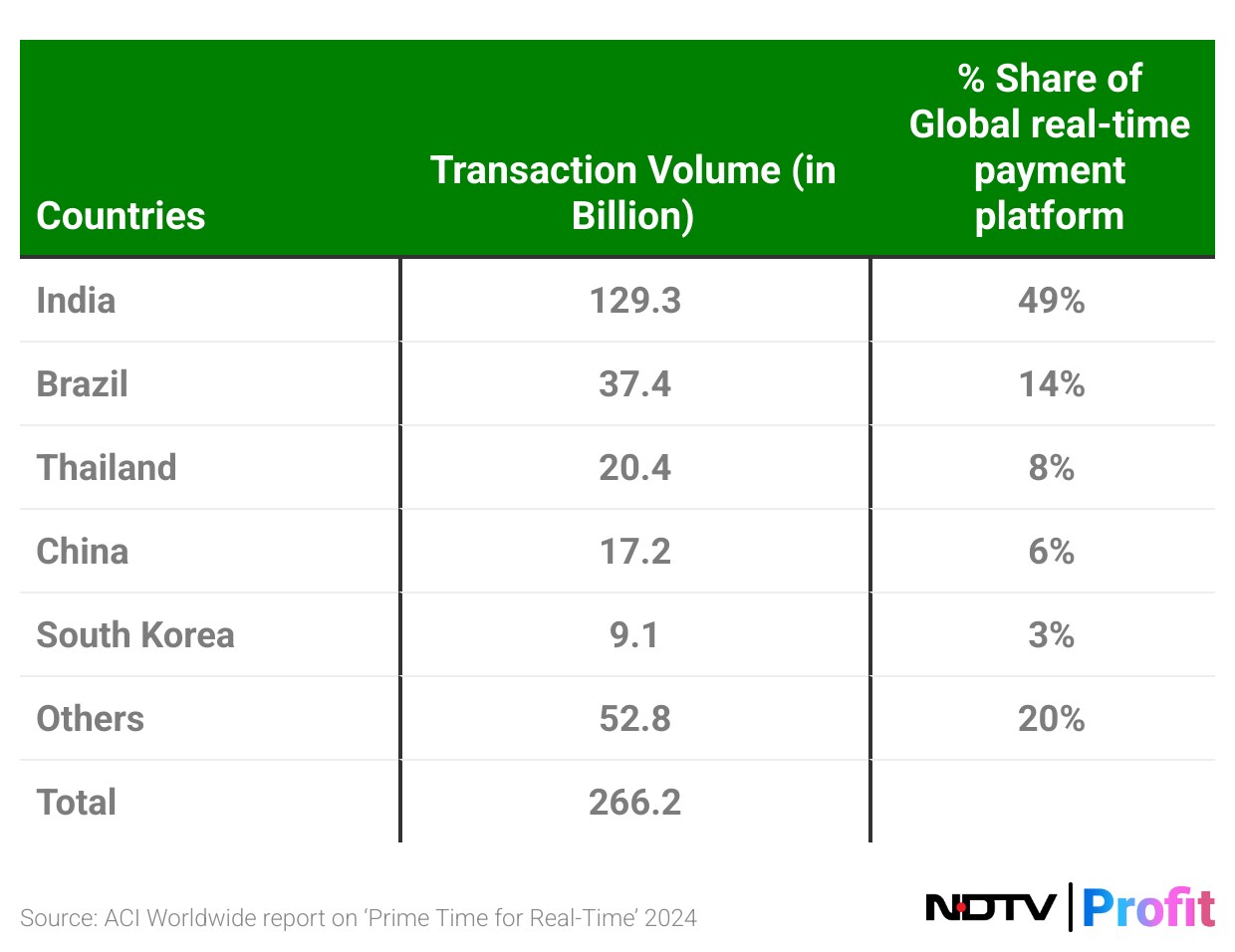

As per a report from the global digital payments software company ACI Worldwide, UPI has around 49% share in the global real-time payment system transaction volume as of 2024. India's share dwarfs that of China and South Korea.

According to the Finance Ministry, various initiatives have been taken up by the Government, Reserve Bank of India and National Payments Corporation of India (NPCI) in order to support small scale merchants in adopting digital payment systems including UPI.

These include incentive scheme for promotion of low value BHIM-UPI transactions, and the Payments Infrastructure Development Fund (PIDF) which provides grant support to the banks and fintechs for deployment of digital payment infrastructure (such as POS Terminals and QR codes) in tier-3 to 6 centers.

As of October 2025, approximately 5.45 crore digital touch points have been deployed through PIDF in tier-3 to 6 centers. Further, as of FY25, a total of 56.86 crore QR were deployed to approximately 6.5 crore merchants.

Domestically, UPI accounts for 85% of all digital transactions.

UPI is already live in eight countries, including the UAE, France, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius. This allows Indians travelling or living there to pay seamlessly without the usual hassles of foreign transactions.

NPCI, an initiative of the RBI and the Indian Banks' Association, is an umbrella organisation for operating retail payments and settlement systems in India (IBA). It runs the UPI used for real-time payments between peers or at merchants' end while making purchases.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.