(Bloomberg) -- A widening gap between equity markets and interest-rate expectations is a worrying sign, according to strategists at JPMorgan Chase & Co.

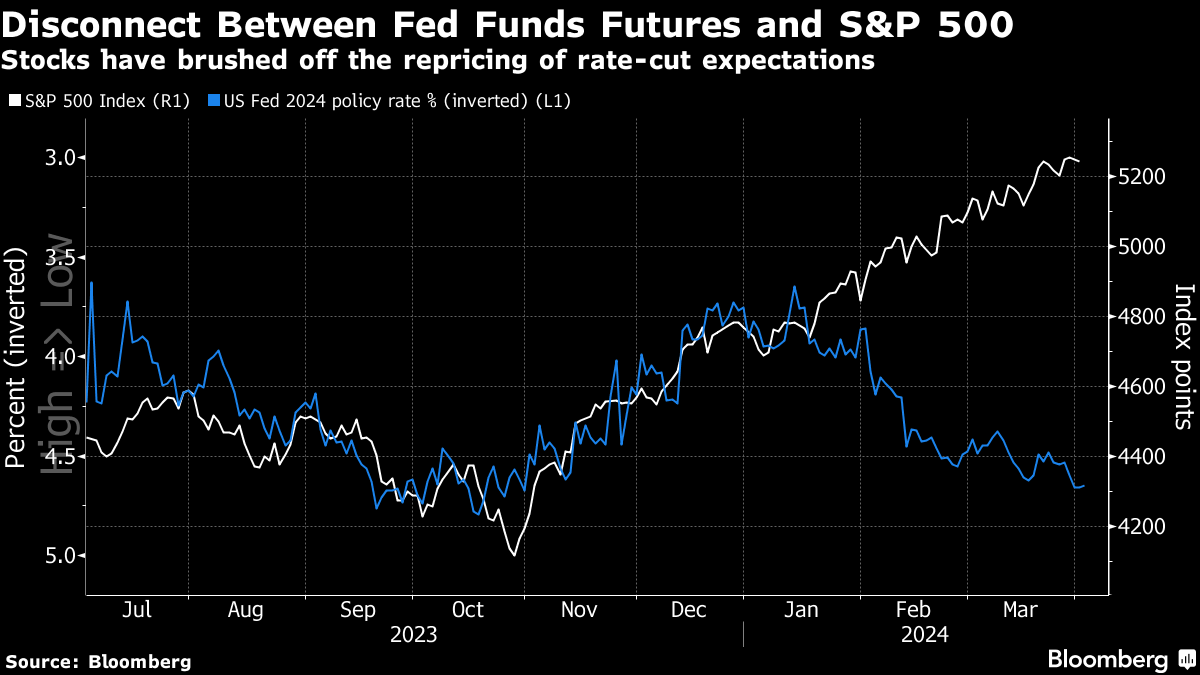

US stocks have gained about 30% from October lows, and continue to rise even as projections for Federal Reserve interest-rate cuts are repeatedly pushed back. “Equities are ignoring the most recent pivot of a pivot, which might be a mistake,” strategists led by Mislav Matejka wrote in a note on Tuesday, adding that earnings will need to accelerate in order to plug the gap.

JPMorgan's fixed income strategists expect bond yields to move lower in the second half of the year, and Matejka says that there is also a “lot of complacency in the bond market” about inflation risks. A pickup in inflation swaps could push out rate cuts further, while the S&P 500 Index keeps rising despite the recent surge in bond yields, creating a wide gap.

The US benchmark has continued rallying this year, powered by megacap and technology stocks, as the economy has stayed resilient while inflation has been trending down, underpinning the case that rate cuts will come this year. Still, expectations for the first Fed cut has been pushed back from March to June, and odds that the central bank will lower rates at the June meeting are only just above 50%.

Read: June Rate-Cut Odds Dip Below 50% as Strong ISM Data Sinks In

According to Matejka, the market is making the assumption that economic growth will come to the rescue, yet earnings estimates for 2024 are still not moving up. In addition, they see equities as too complacent about downside risks, with recession odds seen as extremely low and the ratio of cyclicals versus defensives at 2009-2010 highs, a time when a synchronized global recovery was underway.

“That is unlikely to be the template this time around, and could act as a headwind,” they said.

--With assistance from Jan-Patrick Barnert.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.