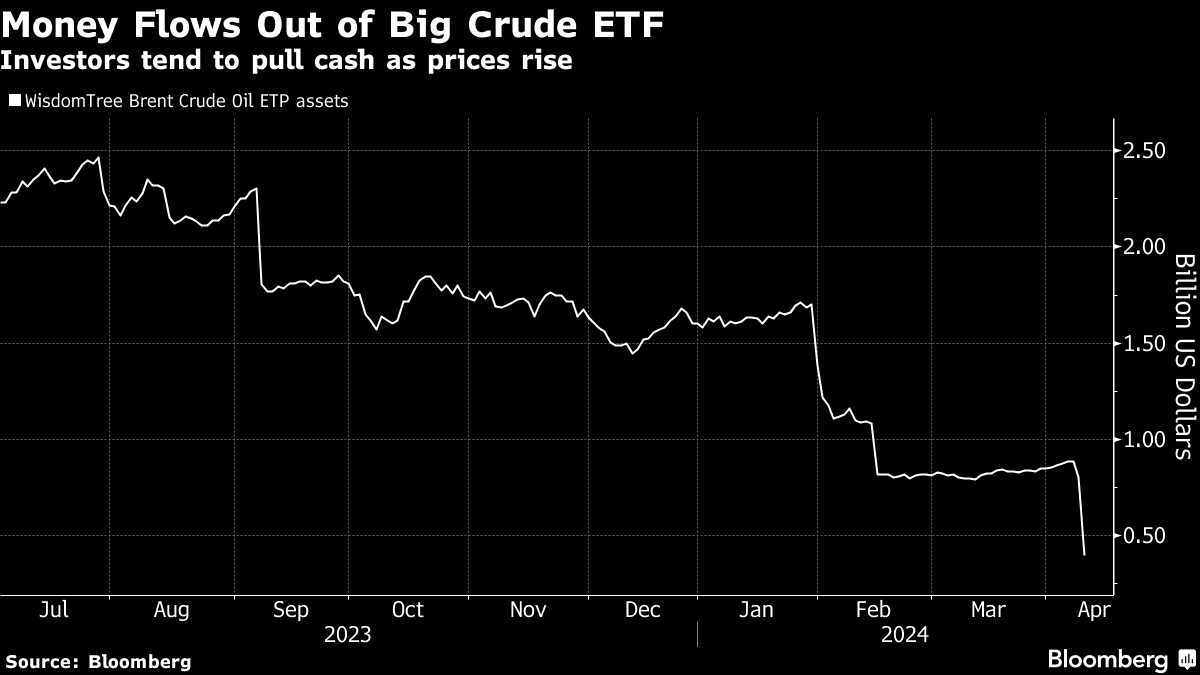

(Bloomberg) -- Investors pulled about $2 billion from what was once the largest oil exchange-traded fund over the last ten months as the rally in crude futures shows no sign of ending.

WisdomTree Brent Crude Oil's assets under management are now approximately $396 million, down from almost $2.5 billion last July, according to data compiled by Bloomberg. Clients have escalated withdrawals, including an outflow of almost $400 million in the past few days.

Investors in commodity-linked exchange traded products tend to pull cash out when prices rise and pile into them when prices are extremely low. Brent crude futures topped $90 a barrel last week for the first time in months as tight supplies, strong demand and elevated geopolitical risks propel prices higher.

For much of last year, the Brent crude oil fund was the largest in the oil market, with assets consistently exceeding $2 billion. It surpassed the US Oil Fund, or USO, which has historically been, and is now again, the largest oil exchange traded fund. USO's assets are now about $1.3 billion, down significantly from a peak of about $5 billion during the pandemic.

WisdomTree declined to comment.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.