- Indian banks are set for a 17% annual profit growth from FY26 to FY28 according to JPMorgan

- Net Interest Margins stopped shrinking in Q2, ending a two-year squeeze on bank earnings

- RoA is expected to improve by 24 basis points, aided by slower deposit repricing and loan growth

Indian banks are poised for what analysts at multinational brokerage JPMorgan calls a “tsunami of profit" after margins bottomed out in the second quarter, setting the stage for a sharp acceleration in earnings over the next three years.

Profits are expected to grow at an annual rate of 17% during FY26–FY28, more than double the 8% CAGR recorded in FY24-FY26. Return on Assets (RoA) is projected to improve by 24 basis points over the same period, analysts said.

For nearly two years, banks struggled with shrinking Net Interest Margins (NIMs) as deposit costs rose faster than loan yields. However, JPMorgan notes that the squeeze ended in Q2 this fiscal when margins stopped falling. With funding costs stabilising, banks now have a clearer path to improve returns without the drag of rising liabilities.

The report highlights that slower deposit repricing and sustained loan growth will support RoA improvement, giving banks a more dependable earnings base through FY26-FY28, especially those with stronger liability profiles.

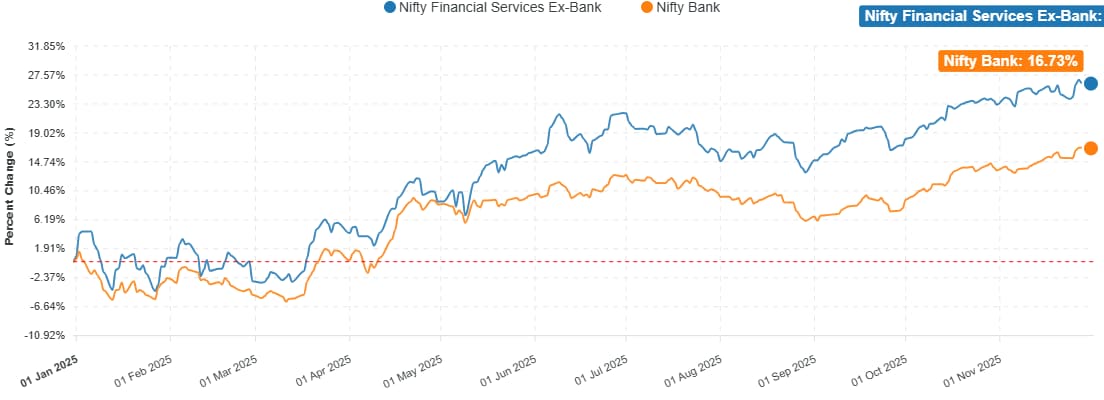

Analysts further noted that Non-Banking Financial Companies (NBFCs) have outperformed banks significantly, pushing their valuation premium to a three-year high. This was driven by faster declines in borrowing costs for NBFCs during the rate-cut cycle, while banks faced rising deposit costs. JPMorgan expects this gap to narrow as bank earnings accelerate.

NBFC Vs Banks In 2025.

Key Focus

Public-sector lenders like State Bank of India, Bank of Baroda, and Punjab National Bank are expected to maintain RoAs in the 0.8-1.1% range through the next three years, a level that was once difficult when they were still cleaning up legacy stress.

These banks now have steadier deposit franchises, stable credit costs, and growing mortgage portfolios.

Additionally, years of investment in technology and branch upgrades are now translating into higher productivity without a proportional rise in expenses, JPMorgan said.

In the private bank space, analysts expect AU Small Finance Bank Ltd.'s RoA to improve by 37 bps through FY26–FY28 as asset quality strengthens.

IDFC First Bank Ltd.'s RoA could rise by 54 bps, supported by lower credit costs and better operating leverage.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.